The ACNC Annual Report 2023-24 provides an overview of the Commission's work in the 2023-24 financial year.

You can download a copy of our Annual Report as a PDF file, or you can read it here in full.

Our year in review

ACNC Commissioner

I am pleased to present the 2023–24 Australian Charities and Not-for-profits Commission (ACNC) Annual Report.

At the start of the financial year, the Assistant Minister announced a refresh of the ACNC’s Advisory Board. The new board, led by Sarah Davies AM, is experienced, diverse and dynamic, and I have appreciated their advice.

In 2023–24, we continued to focus on work that helped charities understand their obligations and operate more effectively.

Charities report spotlights sector size, breadth and challenges

The data we collate and publish in the Australian Charities Report is key to understanding the issues affecting the sector. This data provides important context for us, but is also of importance to the sector and to policy makers.

We published the 10th edition of our Australian Charities Report in June. It revealed that cost-of-living pressures are having a significant impact, with charity expenses increasing at twice the rate of revenue.

Extra small charities comprise nearly a third of the sector and have been more affected than other charities by these pressures.

Helping charity applicants with several new initiatives

In 2023–24, we continued to focus on work that helped charities understand their obligations and operate more effectively.

After extensive work – including incorporating wide-ranging feedback from the sector and advisers – our new charity online registration application was launched in June.

This new application features a greater level of embedded guidance to help applicants, and is designed to help streamline the application process.

It is hoped the new application will ensure applicants include all required information, which should prevent delays in their application being processed.

As part of our Secrecy Reforms Project – funded in the 2023–24 federal budget – we began publishing a series of de-identified registration decision summaries. These summaries are based on actual cases and highlight common issues that arise when organisations apply for registration.

A significant part of our work this year relates to changes that affect not-for-profit organisations that self-assess as income tax exempt.

If an existing not-for-profit has charitable purposes, it will need to register with the ACNC to retain income tax exemption. As a result, thousands of mostly small organisations have been prompted to consider charity registration.

We are working closely with the ATO and peak bodies to make the process as smooth and efficient as possible.

We have also instituted a range of measures to ensure the details of newly registered charities appear on the Charity Register in a timely manner.

Protecting vulnerable people and charity assets

In 2024–25 we will place a specific focus on the emerging risk of the misuse of complex structures to conceal fraud or non‑compliance.

In March, we announced our compliance and enforcement focus for the 2024–25 financial year.

Our overarching priorities continue to include:

- protecting vulnerable people, particularly children

- preventing the misuse of charities for terrorism purposes

- stopping financial mismanagement in charities, including issues of fraud and private benefit, and

- preventing charities from carrying out activities that put them at risk of a disqualifying purpose.

Additionally in 2024–25 we will place a focus on other areas. One relates to the emerging risk of the misuse of complex structures to conceal fraud or non‑compliance.

Consistent with our conversations with other Australian-based regulators and international colleagues, we are concerned about the use of complex structures to either hide what charitable funds are being used for, or to conceal significant private benefit or other serious non-compliance.

By analysing our data, considering concerns raised with us from the public and others, working with other agencies, and monitoring the media, we are able to identify charities that could fall into this category. Using our risk-based approach, we will investigate to ensure charity assets are protected and used for charitable purposes.

Another focus area will be charity cyber security. As part of this, we completed 26 charity cyber security compliance reviews.

Charities of all sizes hold sensitive and personal information, so we believe it is important to share with the sector examples of good and poor practice to aid better understanding.

To provide charities with current advice, we worked with the Australian Signals Directorate to update the cyber security guidance in our Governance Toolkit, and to produce a joint podcast on cyber security.

Testing the definition of Public Benevolent Institution

Public Benevolent Institution (PBI) is a sought‑after subtype of charity registration as it is a gateway to additional tax concessions.

The term is not defined in legislation so, in August, we sought to provide clarity about how we apply case law by publishing our updated Commissioner’s Interpretation Statement: Public Benevolent Institutions. We thank all those who provided detailed feedback.

There may be further clarification of this concept following Equality Australia Ltd’s challenge to our decision to refuse it PBI status.

Although the Administrative Appeals Tribunal confirmed the ACNC’s decision, Equality Australia appealed to the full Federal Court. The case was heard in May and we await a final decision.

Given the lack of legal definition of PBI, we welcome any clarification of the law.

The Charity Register as a source of truth

The Charity Register is a source of truth for the public, the sector and government. We keep working to confirm information on the Register is accurate by:

- ensuring timely reporting

- removing charities that are no longer operating, or no longer entitled to charity registration and

- working with charities to ensure their details on the Register are correct, including that they are correctly classified, and have updated details about their Responsible People and governing documents.

I am pleased to report that on-time reporting improved this year, with 73% of charities reporting on time.

Register visits also continue to grow. Figures show 19 million interactions took place in the last financial year, and this year I have spoken regularly in the media on the benefits of using the Register.

Charity advocacy and humanitarian action

Many charities play key roles in responding to international events through the provision of humanitarian and disaster relief.

This year we issued guidance for charities providing humanitarian relief in conflict zones. The guidance aimed to help charities support those most in need while avoiding the potential pitfalls associated with working in areas where it can be difficult to manage and monitor funding and resources.

We work with, and rely on, the expertise of key government agencies working in these areas and have liaised with relevant sector peak bodies.

To finish, I want to acknowledge the contributions of our outgoing Advisory Board members, our current sector representatives and advisers on our forums, and our consultation group who have all provided expertise and input to numerous ACNC projects.

Praise is due to the ACNC’s staff, who have risen to challenges over the year, particularly a sustained increase in the number of registration applications we have received. I admire the way they have worked innovatively and collegially across teams to ensure the best customer service and the most accurate register.

I invite you to read the report for more detail on the work and achievements of ACNC staff in the past year. We remain committed to transparency and accountability to the public, the government, and the sector we regulate.

Sue Woodward AM

ACNC Commissioner

Chair, ACNC Advisory Board

I’m really pleased to provide a short introduction to the 2023-2024 ACNC Annual Report on behalf of the Advisory Board.

The current Advisory Board met for the first time in September 2023, and while three members had served on the Advisory Board before, for the rest of us it was a new experience.

Our first concern was to properly understand how the board could best fulfil its advisory role to the Commissioner in the context of an 11-year-old ACNC with a strong track record – but with clear work still to be done, and with the realities of an ever-dynamic and challenging environment in the not-for-profit sector.

Needless to say, all the board members are strongly committed to the sector. With such a range and depth of experience, we had a bit of ‘storming and forming’ to do to fully grasp the nuances of the advisory role, as opposed to the more common governance roles.

As we ‘normed’, the following three priorities were reinforced:

- the need to ensure the ACNC’s core business as a regulator operates expertly, efficiently, fairly and transparently

- the need to continue to focus on, and work with, state, territory and commonwealth governments and agencies to build an improved, nationally-consistent regulatory framework, and

- the importance of collecting and sharing useful and accessible sector data to help inform policy and add value to the sector.

There are several issues and initiatives that are affecting our not-for-profit organisations and communities. These include:

- the NFP Blueprint

- the Productivity Commission review into Philanthropy

- the Australian Taxation Office changes to reporting by self-assessing not-for-profits

- the changes under Fair Work to employee contract terms

- government budget hangovers brought about by COVID

- cost of living pressures

- rising demand for services, and

- multi-jurisdictional demands.

The Advisory Board has spent a lot of time examining and discussing these issues.

And through these discussions it has been really interesting to see how we as practitioners are responding – while at the same time coming back to our job as an Advisory Board with the three priorities listed above, and thinking about how these priorities are impeded or advanced as a result of this ever-swirly context.

The ACNC has recently released its 10th Annual Charities Report, which is packed full of data and patterns ripe for exploration. The data points that have resonated with me are the 5.6% overall increase in charities’ revenue, coupled with the 12.6% overall increase in expenditure.

As a regulator, shining a light on these realities is so critical if we want an impactful, effective, inclusive and engaged community sector to underpin our society.

One final reflection from me on the first nine months of this Advisory Board’s service – I have been energised, inspired, educated (and at times highly entertained) by the wisdom, curiosity, expertise, dedication and honesty of my fellow board members. It’s a real pleasure getting to know you and working with you.

And I can say the same for the Commissioner and her team – totally dedicated and talented, and here for a strong, effective and relevant national regulator for our critical and precious sector and all its constituents.

Sarah Davies

Chair, ACNC Advisory Board

Our organisation

The ACNC is the national regulator of charities.

We are responsible for administering the Australian Charities and Not-for-profits Commission Act 2012 (Cth) (the ACNC Act) and the Australian Charities and Not-for-profits Commission Regulations 2022 (Cth), our primary legislation and legislative instrument.

The ACNC was established by the ACNC Act, which has the following three objects:

- maintain, protect and enhance public trust and confidence in the Australian not-for-profit sector

- support and sustain a robust, vibrant, independent and innovative Australian not-for-profit sector

- promote the reduction of unnecessary regulatory obligations on the Australian not-for-profit sector.

Although the ACNC Act refers to not-for-profits and the not-for-profit sector, the ACNC only regulates registered charities – organisations that meet the definition of charity as set out in the Charities Act 2013 (Cth) (the Charities Act).

The ACNC Commissioner

The ACNC Commissioner is a statutory office holder. Sue Woodward AM was appointed to the role of Commissioner on 12 December 2022.

The ACNC Act (Part 5-2) provides for the establishment of the Commissioner’s position, functions and powers, including terms and conditions of appointment.

The Commissioner sets the ACNC’s direction and priorities.

Our key activity is to maintain a free and accurate register of Australian charities (the Charity Register). Timely registration of new charities ensures the Charity Register remains accurate.

We also:

- maintain the integrity of the Charity Register through our reviews of charity entitlement of deductible gift recipient (DGR) endorsed charities, monitoring and enforcement activities and data integrity work (such as removing those who persistently fail to meet their reporting obligations via our double defaulter process)

- help charities to understand and meet their obligations through information, guidance, advice and other support

- inform public policy makers, researchers, and the media about the work of the charity sector through submissions, reports, advice and other support

- work with all levels of government to share our data to reduce regulatory burden and highlight the impact that reforms will have on charities.

Our values are fairness, accountability, independence, integrity and respect. These values align with the Australian Public Service values and underpin the way we perform our work.

Vision: Charities that inspire confidence and respect.

Mission: Promote confidence in charities; help charities to understand their obligations; support the health of the sector; streamline reporting and reduce red tape.

Priorities: Priority 1: The Charity Register; Priority 2: Supporting charities and building capability; Priority 3: Using our data to maximum effect; Priority 4: Organisational capability

Sue Woodward AM, ACNC Commissioner

Sue Woodward AM started as ACNC Commissioner on 12 December 2022.

Previously, she was Chief Adviser for Not‑for‑profit Law with the charity Justice Connect.

Sue was awarded a Member of the Order of Australia in 2021 for ‘significant service to the not-for-profit sector, fundraising and the law.’

She played an instrumental role in the formation of the ACNC, serving as the inaugural Director of Policy and Education during the early years of the Commission.

As an academic at Melbourne Law School, she made a seminal contribution to reforming charity and not-for-profit sector regulation with her 2004 research report: ‘A Better Framework: reforming not-for-profit regulation.’

Sue also has extensive experience as a volunteer charity board member, most recently sitting on the boards of the Victorian Council of Social Service (VCOSS), the Human Rights Law Centre and the Australian Communities Foundation. Previously Sue sat on the boards of SANE Australia and Social Firms Australia.

Additionally, Sue is a staunch supporter of reducing unnecessary regulatory obligations on the sector. She has worked with an alliance of peak bodies and federal and state governments to make modernised and harmonised fundraising laws a priority.

Natasha Sekulic, Assistant Commissioner, General Counsel

Natasha is the senior legal adviser to the ACNC Commissioner and Advisory Board and contributes to corporate and strategic leadership as a member of the Executive team.

At the Australian Taxation Office, Natasha has worked in a range of leadership roles including most recently as Service Delivery Director. Taxation law, charity law and government administration have been central to a range of executive level roles.

Previously at the ACNC, Natasha served as a lawyer and later as Acting Director Legal and Policy. She has been a volunteer and board member for several charities.

She is admitted to practice law and holds a Bachelor of Laws, a Bachelor of Arts, a Graduate Diploma of Legal Practice and a Master of Taxation.

Mel Yates, Acting Assistant Commissioner

Mel Yates was the acting Assistant Commissioner as at 30 June.

Mel has broad experience in public administration and joined the ACNC in 2016 to lead the collection of reporting from charities with a focus on reducing unnecessary regulatory obligations. Since 2018, Mel also ensured the ACNC had sound corporate governance arrangements.

Prior to joining the ACNC, he worked at the Australian Taxation Office for over a decade. Mel has also worked for the Victorian Government in a finance role.

Mel is a Fellow of CPA Australia.

The ACNC has six directorates, each of which plays a crucial role in helping us achieve the objects of the ACNC Act.

Assistant Commissioner: Advice Services, Education and Public Affairs; Corporate Services, Reporting and Red Tape Reduction; Information Technology

Assistant Commissioner General Counsel: Compliance, Legal and Policy, Registration

Advice Services, Education and Public Affairs

Our Advice Services team provides information to charities and members of the public about charity governance and obligations, responding to written and phone enquiries.

Analysis of enquiries to Advice Services identifies information gaps and helps improve our services to charities, their advisers and the public.

Our Education and Public Affairs team manages internal and external communications, including delivering the latest regulatory news, managing the ACNC website, social media, and government and media relations.

The team is responsible for developing guidance and resources to help charities meet their obligations to the ACNC, promoting awareness of the work of the ACNC and our Charity Register and delivering accessible information about Australia’s charity sector.

Compliance

Our Compliance team works to address risks that pose a threat to trust and confidence in the charity sector. The team uses data analytics and intelligence to identify risks and decide on appropriate action.

The team responds proportionately when addressing a charity’s non-compliance. It considers several factors in determining appropriate action, including the severity and persistence of the non-compliance, the risk of harm to the sector and community, and the willingness and ability of the charity to address the non-compliance.

The team uses a combination of guidance and investigative methods to address non-compliance and support charities in meeting their obligations. When the team finds that a charity has been involved in serious or deliberate non-compliance, it may use its enforcement powers or revoke the charity’s registration.

The ACNC’s compliance work is integrated with state, territory, federal and international regulators and law enforcement agencies, to ensure information is exchanged and actions are taken in a coordinated manner. Doing so ensures the team takes the most appropriate response to charity non-compliance.

Information Technology

Our Information Technology (IT) team manages the implementation, maintenance, support and improvements of the ACNC’s IT services, platforms and solutions. The team also supports the ACNC’s use of data analytics, manages cyber security risks and supports IT innovation (including Artificial Intelligence and other emerging technologies).

The team manages system configuration and architecture as well as information governance. It also provides data to support ACNC operations and inform strategic decisions, as well as facilitating data exchanges with other government agencies.

Legal and Policy

Our Legal and Policy team provides legal advice on interpretation and application of the ACNC Act, the Charities Act and other applicable legislation and regulations. The team manages legal review and appeal proceedings of ACNC administrative decisions. It also manages obligations under the Freedom of Information Act 1982 (Cth) (the FOI Act) and the Privacy Act 1988 (Cth) (the Privacy Act).

The team undertakes strategic policy work, including coordinating submissions to parliamentary inquiries and consultative bodies on policy and legislative initiatives that are of relevance to charities, and the not-for-profit sector more broadly. The team support engagement with the ACNC’s Adviser and Sector Forums and Consultation Group, and coordinates our annual Regulators Day and updates to overseas charity regulators.

Reporting, Red Tape Reduction and Corporate Services

Our Reporting and Red Tape Reduction team administers our reporting framework and works with other government agencies to reduce red tape for charities.

The team administers reporting obligations set out in ACNC legislation, manages the Charity Passport, oversees the design of the Annual Information Statement and works to ensure the integrity of the data we collect from charities. It also undertakes analysis of ACNC data, including the analysis for our annual Australian Charities Report.

Our Corporate Services team oversees resource management and supports the ACNC in meeting financial, governance and risk obligations.

The team is responsible for implementing key strategic workforce, culture and people initiatives, including our Census Action Plan and Learning and Development strategy.

Registration

Our Registration team is responsible for assessing charity registration applications and reviewing charities’ continued entitlement to registration.

The team also assesses requests from charities to have information withheld from the Charity Register, to have new charity subtypes added to their registration, and to have their registration voluntarily revoked.

The team helps streamline the process through which charities get access to Commonwealth charity tax concessions (such as deductible gift recipient status) by collecting necessary information and passing it onto the ATO.

The ACNC Advisory Board meets quarterly. It supports and advises the ACNC Commissioner.

Under the ACNC Act, the Board is appointed by the Minister and consists of:

- up to eight general members with expertise in the not-for-profit sector, law, taxation or accounting, and specified office holders

- ex officio members.

General members are appointed for a term of up to three years. Ex officio members remain on the Board for as long as they hold the specified office.

In 2023–24, the Assistant Minister announced a refresh of the ACNC’s Advisory Board.

In February 2024, Dini Soulio (an ex officio member) resigned as the Commissioner of Consumer Affairs and Liquor and Gambling with Consumer and Business Services (CBS) in South Australia. Martyn Campbell was appointed as the new Commissioner of CBS in June 2024.

General members

Sarah Davies AM (Chair)

Sarah has had a wide-ranging career from executive roles in tertiary education to private sector consulting in Australia and overseas. For the last 18 years she has held leadership and executive positions in the charity and for-purpose sector. In 2021 Sarah joined the Alannah & Madeline Foundation as the CEO. The Foundation works to make sure children can grow up happy, safe and strong – in both their online and offline worlds – free from violence, and with the support and strategies they need to thrive.

Sarah also serves on a range of boards and committees. Her current community board roles include Chair of the Australian Charities and Not-for-profits Commission Advisory Board, and non-executive director of Teach for Australia, and Social Ventures Australia.

Heather Watson (Deputy Chair)

Heather Watson is a specialist charity lawyer with experience across the not-for-profit sector. She has held non-executive appointments with several charities.

Currently her charitable roles include serving as Chair of Uniting NSW.ACT and the SpArc Foundation (formerly Epic Good Foundation), and as director of Australian Regional and Remote Community Services. She is a member of the Governance Committee for Royal Flying Doctor Service (Qld Division) and a member of the State Council (Qld) for the Australian Institute of Company Directors.

Heather also serves as the independent chair of the ACNC’s Performance, Audit and Risk Committee.

Emeritus Professor Myles McGregor-Lowndes OAM

Emeritus Professor Myles McGregor-Lowndes OAM is the former Director of The Australian Centre of Philanthropy and Nonprofit Studies at the Queensland University of Technology.

He is an internationally recognised charity law academic and has written extensively about not-for-profit tax and regulation, not-for-profit legal entities, government grants and standard charts of accounts as a means of reducing the compliance burden. He is a practising lawyer in Queensland.

Myles was a founding member of the ATO Charities Consultative Committee and the ACNC Advisory Board.

Ian Hamm

A Yorta Yorta man, Ian has extensive government and community sector experience, particularly at executive and governance levels. Ian has overseen major policy and strategic reforms for government and community organisations.

He works with people from a vast array of backgrounds, managing complex and sensitive relationships to achieve mutually beneficial outcomes.

Ian chairs and is a member of several boards, including the Indigenous Land & Sea Corporation, the Community Broadcast Foundation, Connecting Home, the Koorie Heritage Trust, Holmesglen TAFE and the Australian Institute of Company Directors.

Rosa Loria

Rosa’s passion is helping culturally and linguistically diverse communities, including seniors, newly arrived migrants, refugees, people with a disability and other community members.

For more than 40 years, Rosa has advocated for disadvantaged refugees and residents from multicultural backgrounds at a policy level.

A community innovator, she has helped establish many organisations and services including Sydney Multicultural Community Services, Youth Employment Support Scheme, Skill Share, Killara Women’s Refuge, Settlement Services International, The Settlement Engagement and Transition Support Program in Northern Sydney.

Anna Bacik

Anna has held leadership and senior roles in not-for-profits and state government agencies and membership on a range of committees and advisory boards throughout her career.

Her experience includes developing and implementing policy and programs in health, community services, sector development and regulation.

She has had the privilege to work with and for communities and people from diverse backgrounds, identities and lived experiences.

David Crosbie

David is CEO of the Community Council for Australia, a role he has held for 10 years.

He has spent more than 25 years as CEO of significant not-for-profit organisations, including the Mental Health Council of Australia, the Alcohol and other Drugs Council of Australia, and Odyssey House Victoria.

He has served on many national advisory groups and boards including the first Advisory Board for the ACNC, the Not-for-Profit Sector Reform Council and the Chair of the National Compact Expert Advisory Group.

Sara Harrup

Sara is a seasoned governance leader with a career in steering organisations through complex transitions and growth, particularly within the not-for-profit sector.

She has played a pivotal role in enhancing board composition, risk management, and strategic governance across various organisations, including charities in the transport and logistics, community and health space.

Sara is also an independent member of the ACNC’s Performance, Audit and Risk Committee.

2023–24 snapshot

Key statistics

Charity registration

Charities can be registered with multiple or no charity subtypes.

Maintaining the accuracy of the Charity Register

Supporting charities and the public

Our regulatory approach

Australian charities make a valuable contribution to our communities, and their work reaches into every corner of our lives. To help them carry out this important work, charities need a regulator that listens, understands and communicates appropriately.

In January 2024, the ACNC received a Statement of Expectations from the Assistant Minister for Competition, Charities and Treasury.

This statement outlines the Australian Government’s expectations of how the ACNC Commissioner will ensure the ACNC achieves its objectives, carries out its functions and exercises its powers, while acknowledging the ACNC Commissioner’s statutory independence.

The ACNC’s response – a Statement of Intent – articulates how the ACNC will meet these expectations.

Collaboration and engagement with the charity and not-for-profit sector helps us to gain greater understanding of charities’ points of view and ensures we can make informed decisions about how we meet our purposes.

The ACNC continued to meet with our Adviser (professional advisers such as legal and accounting professionals) and Sector (representatives from registered charities) Forums to seek views on charity regulation and insights into emerging issues that affect the sector. In 2023–24, we convened each of the forums twice, as well as hosting a combined Regulators Day. Minutes of these meetings are published on our website. We thank the members of these Forums for their expertise and time.

We have also continued to use and grow our Consultation Group, seeking feedback on our guidance such as the Commissioner’s Interpretation Statement on Withholding and Removing Commercially Sensitive Information from the ACNC Charity Register. The group includes charities, advisers to the charity sector, and people with relevant experience in the sector.

We supported the sector in other ways, including testing and providing feedback on the new Volunteering Gateway that includes links to relevant ACNC website content. We participated in several webinars, including webinars with:

- Landcare to discuss the impact of SAITE reforms on their member groups

- Justice Connect to discuss the impact of SAITE reforms on community sheds

- the ATO to discuss the broad impacts of SAITE reforms.

In May, we released a podcast on cyber security, aimed at providing simple tips on how charities could improve their cyber awareness (downloaded 407 times to 30 June). We also hosted a webinar focusing on related party transactions and the Annual Information Statement (167 attendees).

The Commissioner and senior leadership team had 48 speaking engagements and attended 96 meetings or forums that included charities, sector representatives or peak bodies.

We are a data-driven regulator, and we continue to refine our understanding of risk based on:

- working with government agencies to receive intelligence and insight

- analysing trends or concerns that emerge through our regulatory activities

- sector engagement

- evaluating thousands of concerns from a range of sources, including the public.

All concerns we receive are assessed to determine the significance of the matter and whether it falls within our jurisdiction. We have a risk-based triage process.

This allows us to assess intelligence in a holistic manner so that we can concentrate on issues that are most likely to result in a risk to public trust and confidence.

We received 2,309 concerns about charities, a 10% increase compared to 2022-23. We received 77 concerns from other government agencies (compared to 52 the previous year). More than 1,000 concerns (or 45%) originated from the public.

Of these concerns, 26% related to private benefit (using a charity’s money for personal gain, and in a fashion that goes beyond the appropriate payment for services), and 21% related to the mismanagement of charity funds.

In 2023–24, we:

- chaired two forums with state, territory and Australian Government regulators to share insights and discuss emerging risks within the sector

- hosted two forums with international charity regulators in which we discussed common compliance risks across the sector

- chaired two commissioner-level charity regulation meetings with international colleagues.

We also signed a new memorandum of understanding with the Australian Federal Police.

Our compliance reviews

Cyber security risks can present challenges for charities. Charities can hold sensitive personal information, and it is important for charities to have appropriate governance arrangements in place.

Charities also need to have appropriate governance arrangements to safeguard beneficiaries.

In 2023–24, we completed 52 compliance reviews. Of these, 26 reviews were focused on cyber security and 24 were focused on safeguarding. A further two reviews unrelated to cyber security and safeguarding were also completed in 2023–24.

Of the 26 charities whose reviews were focused on cyber security, 12 received regulatory advice that identified areas where they could improve their cyber security governance.

Of the 24 charities whose reviews focused on safeguarding, nine received regulatory advice that identified areas where they could improve their safeguarding governance.

While most of our efforts are focused on education and support, we will use the other compliance powers outlined in our regulatory pyramid based on the level of risk presented to public trust and confidence.

This ensures that we:

- effectively target key issues that have the greatest impact on public trust and confidence

- maximise charities’ voluntary compliance with our obligations.

Priorities

Key performance indicators

| Key performance indicators (as outlined in the ACNC’s 2023–24 Corporate Plan) | Target | Result |

| 1.1 Percentage of new eligible charities registered within 15 business days of ACNC receiving all information necessary to make a decision | 90% | 74% |

| 1.2 Percentage of Annual Information Statements submitted by the due date | 75% | 73% |

| 1.3 Percentage of investigations finalised within 90 business days of ACNC receiving all information necessary to make a decision | 75% | 88% |

| 1.4 When a charity is notified of an investigation, the percentage of investigations that result in a regulatory action | 90% | 97% |

| 1.5 Percentage of self-audits that result in regulatory advice | Establish | 75% |

| 1.6 Percentage of DGR endorsed charities reviewed to confirm eligibility of subtype and registration | 2% of DGR | 2% (492) |

| 1.7 Percentage of time that the Charity Register and Charity Portal are available (excluding scheduled maintenance) | 95% | 99.99% |

| Result | Description |

| Met | Target met or exceeded |

| Partially met | 80% or more of the target was achieved |

| Not met | Less than 80% of the target was achieved |

1.1 Percentage of new eligible charities registered within 15 business days of ACNC receiving all information necessary to make a decision

In 2023–24, we registered 3,014 new charities.

The target was partially met, with 2,243 charities (74%) registered within 15 business days of receiving all information necessary to make a decision.

This performance can be attributed to:

- a significant increase in the number of registration applications received

- the time it has taken for new staff to be recruited and trained.

The 2022–23 ACNC annual report highlighted an unexpected increase in registration applications received during May and June 2023 (the average application rate for May and June 2023 was 31.5% higher than the average application rate for the 2021–22 year).

Many of these applications were unable to be assessed during 2022–23 and were ‘carried over’ into 2023–24, affecting our ability to meet this measure during the first few months of 2023–24.

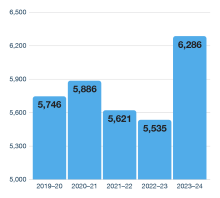

2019–20: 5,746; 2020–21: 5,886; 2021–22: 5,621; 2022–23: 5,535; 2023–24: 6,286

From the early months of 2024, registration applications increased due to the impact of the Self-Assessing Income Tax Exempt (SAITE) reforms introduced in the 2021–22 Federal Budget, which are being administered by the ATO. The data shows that from April to June 2024, at least 44% of applications received were due to SAITE. We received 931 applications in May 2024, the highest number ever received in a month.

For the 2023–24 year, we received 6,286 registration applications, an increase of 751 (14%) compared to 2022–23 and the highest number received since our establishment in 2012.

To help address the significant number of registration applications ‘carried over’ into 2023–24, and to prepare for the increase in registration applications due to SAITE, we:

- reviewed and refined existing processes to improve efficiency

- employed more staff, with extra support from the ATO in May 2024

- met with several NFP peak bodies to ensure new applications were ‘grouped’ via a bulk registration application process to help streamline their assessment

- developed guidance and tools to help NFPs identify if they were charitable.

The tight labour market and staff recruitment timeframes impacted our ability to quickly employ staff.

Staff were progressively brought onboard between November 2023 and April 2024. It takes about six months for a registration analyst to be fully trained in the complexities of charity law.

While we cannot control the number of applications we receive, we are confident that the strategies we have employed will help us improve our performance in 2024–25.

1.2 Percentage of Annual Information Statements submitted by the due date

Each year, charities must submit an Annual Information Statement (except charities that are also registered with the Office of the Registrar of Indigenous Corporations (ORIC)).

The Annual Information Statement asks for information about a charity’s programs, beneficiaries, human resources and finances. Medium and large charities must provide reviewed or audited annual financial reports with their Annual Information Statement.

Data from the Annual Information Statement updates the Charity Register, ensuring that the Register remains accurate and is a useful resource for the public.

The Annual Information Statement is due within six months of the end of a charity’s reporting period, although this deadline can be extended at the Commissioner’s discretion.

The 10th edition of the Australian Charities Report reaffirms that more than half of Australia’s registered charities operate without any paid staff. In many volunteer-run organisations there is a more frequent turnover of roles. We support charities by sending them multiple reminders through different channels (letter and email).

In 2023–24, we trialled a new approach to support charities in submitting their Annual Information Statements on time by sending first reminders by both letter and email.

As of 30 June 2024, 73% of charities had submitted their 2023 Annual Information Statement on time. This was an improvement on the 72% submitted in the previous year.

In 2024–25, we will work with the Behavioural Economics team of the Australian Government and the Australian Centre for Evaluation to investigate different approaches that may improve our on-time submission rates.

1.3 Percentage of investigations finalised within 90 business days of ACNC receiving all information necessary to make a decision

Investigating a charity is our most significant response to suspected non-compliance. In line with our regulatory approach, we will begin an investigation when we identify a risk of serious and/or deliberate non-compliance.

We are committed to finalising investigations in a timely manner. The timeliness of an investigation is affected by multiple factors, such as the complexity of the matter being investigated and the level of co-operation from the charity – or others – in providing the information we need.

We define ‘receiving all information’ as the point where we receive a response from a charity that:

- provides sufficient evidence to demonstrate its compliance

- shows it has undertaken governance reforms in consultation with or as required by the ACNC, or

- responds to our show cause notice in full.

In 2023–24, we completed 59 investigations. Of the investigations completed, 88% were completed within 90 business days of the ACNC receiving all information necessary to make a decision.

We also continued to work on several joint investigations and other activities with Australian and state agencies which improved all agencies’ understanding of risks in the charity sector. In 2023–24, we referred 36 charities to other government agencies when we thought that other agency may be able to act.

1.4 When a charity is notified of an investigation, the percentage of investigations that result in a regulatory action

We are committed to an effective risk-profiling approach that ensures that we only notify charities of investigations where we suspect there is either serious non-compliance, deliberate non-compliance, or both (rather than investigations that result in no outcome as there was no issue).

Regulatory actions can include revocation of charity status, use of our legislative enforcement powers, compliance agreements (for example, an action plan about improving management practices), or education (such as advice on improving record keeping or financial management policies).

Where a charity was notified of an investigation, 97% resulted in regulatory action.

Revoking a charity’s registration is the most serious step that the ACNC can take. Revoking registration may affect a charity’s eligibility for tax concessions as well as other government benefits, concessions or exemptions.

In 2023–24, we revoked the charity status of nine organisations. On average, these organisations had been operating for 11 years. The youngest organisation had been operating for four years, the oldest for 23.

1.5 Percentage of self-audits that result in regulatory advice

The ACNC uses a number of strategies to support charities in meeting their obligations.

A self-audit requires a charity to respond to questions related to their compliance with Governance Standards and, where applicable, External Conduct Standards. Depending on the response, we may provide tailored regulatory advice that supports the charity to comply with their obligations to the ACNC.

We are committed to ensuring that our risk‑based approach identifies charities that require regulatory advice.

In 2023–24, we had to reallocate our resources to other important priorities. This – in combination with staffing vacancies – limited our ability to complete self-audits.

Of the eight self-audits completed in 2023–24, six (75%) resulted in regulatory advice.

1.6 Percentage of DGR endorsed charities reviewed to confirm eligibility of subtype and registration

Each year, we review 2% of DGR endorsed charities to assess their continued eligibility for subtype and charity registration.

Our reviews are completed in two stages:

- Stage 1: We conduct an initial desktop review. If that initial review uncovers any issue, or if we need further information to help us make an assessment, we conduct a more detailed review.

- Stage 2: As part of a more detailed review, we will contact the charity.

For the first time, we included Health Promotion Charities in our reviews. We also continued to review Public Benevolent Institutions and charities with other types of DGR endorsement.

Additional selection criteria for reviews included whether the charity was registered prior to 3 December 2012 (our establishment date) and indicators of heightened risk (such as a lack of Responsible People or a missing governing document).

In situations where a detailed review is not required, but where we notice information is missing from the Charity Register, we will proactively support charities to maintain the accuracy of their information on the Charity Register.

For example, a charity may not have provided the ACNC with the details of its current Responsible People. During our desktop review, we will support the charity to update any remaining details and ensure the Charity Register is current.

In 2023–24, we met our target of reviewing 2% of DGR-endorsed charities by completing 492 desktop reviews.

| Outcomes of desktop reviews for DGR endorsed charities selected for a 2023–24 review | Number |

| No detailed review required. Charity still entitled to registration. Support provided to charity to help them update the Charity Register | 137 |

| Escalated for a detailed review | 253 |

| No further action required – charity entitled to subtype and charity registration | 102 |

1.7 Percentage of time that the Charity Register and Charity Portal are available (excluding scheduled maintenance)

The Charity Register and Charity Portal were online and available to the public 99.99% of the time during the 2023–24 period.

Due to the provision of back-office services by the Tax Office, the Charity Register’s availability can be affected by both ACNC-specific and Tax-Office-specific issues.

In 2023–24, total unexpected downtime was around 56 minutes. This was due to connection timeouts and internal server errors.

From 2024–25, we will simplify the metric to focus on the Charity Register, which is publicly available. While the Charity Portal is important, it is not available to the public. Access is limited to charities and their authorised representatives who use the Charity Portal to update the Charity Register.

Maintaining the integrity of the Charity Register

We have a program of work to ensure the Charity Register remains accurate. Reviews of charity and subtype entitlement for DGR endorsed charities form part of this program. Another element involves our financial reporting reviews.

Our financial reporting reviews

Each year we conduct a review of at least 250 annual financial reports and Annual Information Statements to help us assess compliance with ACNC reporting requirements. As part of our 2023–24 review, we contacted 71 charities to help them fix material errors they had made in their 2022 financial reporting.

Our 2023–24 reviews identified errors associated with paid key management personnel (KMP) reporting. The requirement for certain charities to report on this started from the 2022 reporting period.

As a result of our findings, we worked with key charity and accounting stakeholders to improve awareness of KMP reporting requirements. We also published a Commissioner’s Column on the topic to help charities comply with their financial reporting obligations.

Removing organisations from the Charity Register

We revoke the charity status of organisations that are no longer entitled to be on the Charity Register. In 2023–24, we revoked the charity registration of 190 organisations due to ACNC action. This included nine organisations whose registrations were revoked due to the outcome of an investigation and 181 ‘double defaulters’.

We classify a ‘double defaulter’ as any charity that has not submitted two or more Annual Information Statements. We make numerous attempts to contact ‘double-defaulter’ charities and request they submit any outstanding Annual Information Statements within 28 days. If they fail to do so, we revoke their charity registration.

Organisations can also request voluntarily revocation of their charity registration for a range of reasons. In 2023–24, we processed 1,176 voluntary revocations, of which 149 were due to mergers.

| Reason for voluntary revocation | Number |

| No longer wants to be a registered charity | 34 |

| Merged with another charity | 149 |

| No longer operating | 916 |

| Not entitled to be a charity | 77 |

Key performance indicators

| Key performance indicator (as outlined in the ACNC 2023–24 Corporate Plan) | Target | Result |

| 2.1 Percentage of users that find our guidance useful | Establish baseline | 83% |

| 2.2 Percentage of calls answered within four minutes and percentage of written correspondence responded to within seven business days of receiving all information necessary to respond | 80% | 72% |

| 2.3 Percentage of charity recipients that open The Charitable Purpose newsletter | 44% | 51% |

| 2.4 Percentage of respondents that gained new knowledge or skills after completing a Governing Charities online learning program module | Establish baseline | 95% |

| 2.5 Percentage of users that find the online Annual Information Statement form easy to use | Establish baseline | 57% |

| 2.6 Percentage of applicants that find the online registration form easy to use | Establish baseline | 62% |

| Result | Description |

| Met | Target met or exceeded |

| Partially met | 80% or more of the target was achieved |

| Not met | Less than 80% of the target was achieved |

2.1 Percentage of users that find our guidance useful

The ACNC is committed to publishing new guidance, as well as updating existing guidance to ensure it remains current and fit-for-purpose. On our website users can tell us whether they found our guidance webpages useful. Currently there are 181 guidance pages.

In 2023–24, 6,702 users provided feedback on our guidance pages. 83% (5,530) of these users rated our guidance as useful.

The top three pages (by number of users that provided feedback) were:

- acnc.gov.au/not-profit (432 ratings, 85% useful) – this page outlines the meaning of not-for-profit from a charity perspective

- acnc.gov.au/registrationguide (316 ratings, 96% useful) – this page contains a checklist to help organisations applying for charity registration

- acnc.gov.au/RPs (295 ratings, 75% useful) – this page outlines the duties of Responsible People – those who are responsible for governing a charity.

New or updated guidance published in 2023–24 included:

- updated guidance on private benefit and conflicts of interest

- an updated Commissioner’s Interpretation Statement: Public Benevolent Institutions

- the 2023 Annual Information Statement Guide

- guidance for self-assessing income tax exempt (SAITE) not-for-profits

- de-identified reasons for decision summaries

- advice on donating to humanitarian causes or providing humanitarian relief

- guidance for charities with a proprietary limited (Pty Ltd) company structure

- guidance for charities that looked to spend money or conduct advocacy activities in relation to the Voice referendum

- the Equality Australia Decision Impact Statement

- guidance to help charities complete the new charity registration application

- updated guidance on cyber security.

2.2 Percentage of calls answered within four minutes, and percentage of written correspondence responded to within seven business days of receiving all information necessary to respond

The ACNC is committed to providing excellent service to the public and charities.

In 2023–24, we answered 21,663 calls and responded to 8,695 written enquiries – a total of 30,358 enquiries.

We responded to 21,934 (72%) enquiries within the target timeframe – within four minutes for calls and within seven days of receiving all information necessary for written enquiries.

Each January, we experience an increase in calls because charities with a financial year ending 30 June are required to submit their Annual Information Statement by 31 January. In January 2024, we answered 2,662 calls, the highest number of calls answered in a month since March 2021.

Other factors that affected our performance included:

- additional enquiries received due to SAITE

- difficulties in maintaining full staffing at key times

- the implementation of refined proof-of-identity checks and improved security measures when speaking or writing to customers.

2.3 Percentage of charity recipients that open The Charitable Purpose newsletter

The ACNC monthly email newsletter – The Charitable Purpose – includes important guidance and news that affects the sector. We use The Charitable Purpose’s open rate as a gauge of sector engagement with ACNC content and guidance.

In 2023–24, we published 12 editions of The Charitable Purpose, sending them to all registered charities and to 12,300 other subscribers.

On average, we sent The Charitable Purpose to 57,181 unique email address each month.

Across the year, 51% of our emails were opened. This exceeded our target of 44%.

Our target of 44% was based on our 2022–23 open rate. Our open rates continue to be higher than the average open rate for similar emails sent by government agencies. This figure sits at 41% and is based on data published by Mailchimp.

2.4 Percentage of respondents that gained new knowledge or skills after completing a Governing Charities online learning program module

The ACNC’s Governing Charities online learning program consists of 12 free e-learning courses. The program is designed to support leadership and accountability in the charity sector by boosting the skills and expertise of participants.

In 2023–24, more than 7,500 participants enrolled in our courses, although this figure does not reflect the total number of individual participants. This is because people may enrol for more than one course.

At the end of each course, participants were asked if they had gained new skills from the module.

95% of respondents said they had gained new knowledge or skills after completing a module.

The three most popular courses were:

- Becoming a Charity Board Member

- Governance Standards Part A

- Safeguarding: A Guide for Charities.

In 2024–25, we will be moving the courses – including videos and quizzes – to our existing guidance pages on the ACNC website (see KPI 2.1). By integrating the content onto our website, we aim to create a better user experience and provide users with multiple methods of understanding our content.

Because of this change, the current KPI will be removed from the 2024–25 annual report. We will continue to report on the usage and user experience of these education resources in our annual reports through KPI 2.1.

2.5 Percentage of users that find the online Annual Information Statement form easy to use

We are committed to ensuring that the Annual Information Statement is easy to use, and that it minimises unnecessary burden on charities.

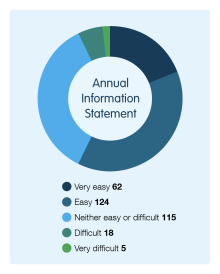

Very easy: 62; Easy: 124; Neither easy or difficult: 115; Difficult: 18; Very difficult 5

After submitting their charity’s 2023 Annual Information Statement, we asked people to complete a survey. This survey included a question on whether the Annual Information Statement was easy to use.

In 2023–24, 324 users provided feedback on the ease of the Annual Information Statement. Of them, 57% found the Annual Information Statement easy or very easy to use.

Only 7% of users found the Annual Information Statement difficult or very difficult.

From 2024–25, the ACNC will report on the percentage of users that found the questions in the Annual Information Statement clear and easy to follow.

People’s level of experience using technology was a key factor affecting whether or not they found the Annual Information Statement easy to use. The spread of abilities among people submitting their AIS makes it difficult for the ACNC to meet the needs of all users.

In comparison, our new 2024–25 measure will allow us to better track our performance and improve on the questions (if necessary).

2.6 Percentage of applicants that find the online registration form easy to use

We also aim for the registration application form to be easy to use, and for it to minimise unnecessary burden on applicants.

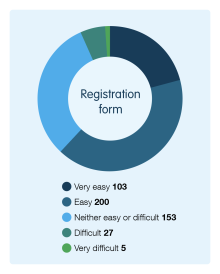

Very easy: 103; Easy: 200; Neither easy or difficult: 153; Difficult: 27; Very difficult: 5

No matter what our decision on an organisation’s registration application may be, all applicants are asked to complete a survey once a decision has been made. This survey includes a question on whether the registration form was easy to use.

In 2023–24, 488 applicants provided feedback on the how easy the application was to use. Of those, 62% found the registration form easy or very easy to use. Only 7% of users found it difficult or very difficult.

From 2024–25, the ACNC will no longer report on this metric. The ACNC developed and launched its new online registration application in 2024, meaning that comparisons to previous metrics will be far more difficult.

The new registration application is designed to gather extra information from applicants that the ACNC requires to make a decision. This will reduce the need for follow-ups with applicants.

Secrecy reforms project

In the 2023–24 Federal Budget, the ACNC received extra funding to allow us to disclose information about certain regulatory activities, including registration decisions.

This work includes the publication of de-identified registration decision (DRD) summaries. These summaries detail the reasons behind ACNC decisions to accept or refuse charity registration applications where these reasons – and our decision-making processes – are of educational benefit to the wider charity sector or the general public.

To ensure that we do not identify the charities whose registration applications are detailed in this work, we have developed a publication framework that contains appropriate checks and balances.

In December 2023, we published our first DRD summary focusing on a registration application from an organisation structured as a proprietary company limited by shares – commonly known as a ‘Pty Ltd’.

We published another de-identified reason for decision in 2024 on the topic of ‘necessitous circumstances’.

We will continue to publish further DRDs on our Secrecy Reforms Project webpage.

Key performance indicators

| Key performance indicator (as outlined in the ACNC 2023–24 Corporate Plan) | Target | Result |

| 3.1 Percentage of datasets delivered to other regulators (as part of data sharing arrangements) on-time | Establish baseline | 97% |

| 3.2 Visits to the ACNC data hub | Establish baseline | 6,805 |

| 3.3 Percentage of datasets on data.gov.au that are updated weekly | 90% | 92% |

| 3.4 Effectiveness of the ACNC in influencing red tape reduction for charities | Endorsement received from all regulators | Met |

| Result | Description |

| Met | Target met or exceeded |

| Partially met | 80% or more of the target was achieved |

| Not met | Less than 80% of the target was achieved |

3.1 Percentage of datasets delivered to other regulators (as part of data sharing arrangements) on-time

As part of our efforts to reduce regulatory burdens across the charity sector, we have several data sharing arrangements with other regulators. This measure captures the data we share through an automated IT process (it does not include ad-hoc or manual datasets).

In 2023–24, we provided 3,393 separate datasets. 3,293 (97%) were provided on-time, in accordance with our agreement with the other regulator.

3.2 Views of the ACNC data hub

We are committed to maximising the use of our data. Our data hub centralises the data we hold and publish, helping the public and government understand the size, diversity and nature of Australia’s charity sector.

In 2023–24, the data hub was viewed 6,805 times.

We will continue to promote the data hub in 2024-25, ensuring that users can easily find ACNC data.

3.3 Percentage of datasets on data.gov.au that are updated weekly

As part of our commitment to sharing data with the public, we publish (and update) different datasets to data.gov.au. As of 30 June 2024, we regularly update 11 datasets.

These datasets include all Annual Information Statements (up to and including the 2022 Annual Information Statement) as well as a list of registered charities.

To ensure our data remains accurate, we aim to update our datasets weekly, with a target of 90%.

In 2023–24, our datasets were updated weekly 92% of the time.

3.4 Effectiveness of the ACNC in influencing red tape reduction for charities

As the national charity regulator, we hold valuable data about the charity sector.

We share our data through the Charity Passport, our Annual Charities Report, the Charity Data Explorer and in our submissions or advice to all levels of government.

As of 30 June 2024, 30 different government agencies were using the Charity Passport. This is in addition to other government agencies that choose to use our datasets on data.gov.au.

In 2023–24, we made 12 submissions to help all levels of government. This work helps both policy makers and decision makers gain a better understanding of the impact of reforms on Australia’s charities. Some examples include our submissions to the:

- Not-for-Profit Sector Development Blueprint Issues Paper

- draft report from the Productivity Commission inquiry into philanthropy

- Department of Social Services on the National Housing and Homelessness Plan Issues Paper

- Parliamentary Joint Committee on Law Enforcement on the capability of law enforcement to respond to cybercrime

- Attorney-General’s Department on Reforming Australia’s anti-money laundering and counter-terrorism financing regime.

We surveyed 10 participants to ask whether our submission or advice was effective in providing them with a better understanding of the impact of the reforms on Australia’s charities.

Participants were sent at least two emails and were given three weeks to complete the survey.

We received three responses. All three respondents agreed that our submission or advice provided them with a better understanding of the impact of the reforms on Australia’s charities.

We also met regularly with different levels of government to discuss how unnecessary regulatory burden can be minimised. Some of these meetings included:

- a forum chaired by the ACNC Commissioner which included representatives of each state and territory consumer affairs regulator (the Northern Territory was unable to attend)

- meetings with the Australian Business Registry Services to ensure that the right people are contacted in relation to Director ID obligations

- meetings with the ASIC Commissioner and attendance at the Business Registry and Inter-Agency Liaison group (chaired by an ASIC Commissioner with ATO, Treasury and other agencies represented) to discuss updates to the ‘Companies Register’ that is maintained by ASIC.

We also worked with states and territories to update the National Standard Chart of Accounts.

Australian Charities Report

The Australian Charities Report helps to showcase the diversity of Australia’s registered charities.

In June, the ACNC published the 10th edition of this report which highlighted the significant impact of cost-of-living issues on charities.

The 10th edition also featured a focus on extra small charities, comparing key indicators between 2017 and 2022.

We upgraded our online Charity Data Explorer which allows users to filter our data based on their own criteria to enable them to search by postcode.

Our media monitoring service shows that the 10th edition of the Australian Charities Report reached an estimated audience of about 865,000. The dollar value of this coverage if it had been paid advertising is estimated at $319,676.

Highlights included:

- dedicated coverage in a ten-minute live interview with the Commissioner on ABC Radio Sydney Afternoons, and an AAP story syndicated on 79 mastheads across Australia

- key message mentions and analysis in major mainstream media stories such as on Nine TV News, The Australian Financial Review, Guardian Australia and ABC TV News

- extensive coverage in sector media – The Community Advocate and Third Sector.

Key performance indicator

| Key performance indicator (as outlined in the ACNC 2023-24 Corporate Plan) | Target | Result |

| 4.1 Level of employee engagement | Top 5 small agencies | Equal top 6 |

| Result | Description |

| Met | Target met or exceeded |

| Partially met | 80% or more of the target was achieved |

| Not met | Less than 80% of the target was achieved |

Analysis of performance

4.1 Level of employee engagement

The annual APS Census collects information from ACNC staff and provides staff with an opportunity to share their experiences and rate their level of engagement. We use the census to identify areas for improvement to ensure we maintain a positive work culture.

Our 2022 census results, provided to the ACNC on 31 July 2023, showed an employee engagement level of 74.

Our score was above both the APS average and small government agency score of 73. The ACNC was equal sixth when comparing our results with other small government agencies (the top five small agencies had an employee engagement score of 75 or above, compared with our score of 74).

We are committed to a range of activities to increase our level of employee engagement. Additional information is provided in Section 11 – Our People.

An update on our 2023–24 Census Action Plan

Following extensive consultation with staff, we developed a 2023–24 Action Plan with three key focus areas:

- managing priorities – helping our people to manage and communicate priorities to maintain a good balance between workload and wellbeing

- capability management – enhancing our capability (including process, systems, and knowledge management) to a level that supports staff retention and provides effective workload management

- communication and empowerment – embedding effective two-way communication and supporting a collaborative approach to our work, where we empower each other to challenge ideas and are comfortable speaking up.

Each of three focus areas included three actions (nine in total).

As of 30 June 2024, the ACNC had fully implemented seven of the nine actions. Only two actions were still in progress and will be finalised in 2024–25.

One action included the development of micro-learning sessions run by subject matter experts within the ACNC. Topics included public speaking, use of artificial intelligence in the workplace and the protocols for using pronouns.

Another action has involved the expansion of the ACNC’s mentoring program.

Service standards

Of our eight service standards, we:

- met (or exceeded) three service standards

- partially met four service standards (service standard 1, 2, 3 and 5)

- did not meet one service standard (service standard 4).

Service standards 5 and 8 are also KPIs 1.1 and 1.3. Service standards 1 and 2 combine to make KPI 2.2.

The challenges outlined in KPIs 1.1 and 2.2 (particularly the challenges associated with SAITE) also impacted on our ability to meet service standards.

While the impact of SAITE on our workload remains uncertain, we have implemented a range of strategies with an aim to improve on our service standards performance in 2024–25.

| Result | Description |

| Met | Target met or exceeded |

| Partially met | 80% or more of the target was achieved |

| Not met | Less than 80% of the target was achieved |

| Service | Our commitment | Target | Result | Result |

| 1 General telephone enquiries | If you call us we aim to answer your call promptly and courteously within four minutes and respond to your queries on the spot. | 80% | 80% | 70% |

| 2 General correspondence | We aim to give you a full response to general correspondence within seven business days of receiving all the information. In some cases, we may request further information before we are able to give you a full response. | 80% | 85% | 77% |

| 3 Approved forms | When you submit any of the following forms to update your charity's details, we aim to process the request (or make a decision) within seven business days of receiving all the information:

| 80% | 89% | 70% |

| 4 Approved forms | When you submit any of the following forms to update your charity's details, we aim to make a decision within 15 business days of receiving all information necessary to make a decision:

| 90% | 67% | 66% |

| 5 Registering a charity | We aim to register your organisation as a charity within 15 business days of receiving all information necessary to make a decision. | 90% | Analysis included | |

| 6 Registering a charity | We aim to deliver a registration service by knowledgeable staff who are courteous, friendly, helpful, can communicate clearly and keep you informed. | 90% | 95% | 90% |

| 7 Complaints about the ACNC | We aim to acknowledge receiving a complaint within three business days and to respond within 20 business days. | 95% | 100% | 100% |

| 8 Investigations | We aim to finalise investigations within 90 business days of receiving all information necessary to make a decision. | 75% | Analysis included | |

Corporate information and governance

Application of the PGPA Act to the ACNC

The ACNC is not a Commonwealth entity for the purposes of the Commonwealth Resource Management Framework or the Public Governance, Performance and Accountability Act 2013 (Cth) (PGPA Act). The Commissioner of Taxation is the Accountable Authority for the ACNC.

Because of this, the ATO’s annual report includes information for the ACNC for the purposes of the PGPA Act. This includes the following information:

- ecologically sustainable development and environment performance

- annual financial statements

- significant non-compliance with financial law

- asset management

- purchasing and consultancies

- procurement including initiatives to support small business

- grants

- advertising campaigns

- Audit and Risk Committee information

- fraud prevention

- Australian National Audit Office

- Access Clauses exempt contracts

- information required by other legislation.

While the ACNC adopts the ATO’s Enterprise Risk Management approach, we manage Enterprise risks independently of the ATO. This reflects our operational independence as well as the different regulated population.

Additionally, the ATO’s Audit and Risk Committee is the relevant audit committee under the PGPA Act. The ACNC attended six meetings (and relevant subcommittees) in 2024–25.

ACNC Performance Audit and Risk Committee

The ACNC is committed to internal governance practices to maintain our high standards of governance and risk management. As a demonstration of our commitment to better practice, we have chosen to establish a Performance, Audit and Risk Committee (PARC).

The PARC provides advice to the ACNC Commissioner and has a role in providing assurance to the ATO Audit and Risk Committee and Accountable Authority.

As of 30 June, the PARC included two independent members from the ACNC Advisory Board. A member of the ATO Audit and Risk Committee also attended the PARC as an observer.

The PARC met four times in 2023–24.

Senate Estimates

In 2023-24, we appeared with the Treasury before three Senate Estimates hearings of the Senate Standing Committee on Economics.

Freedom of Information

Under Part II of the FOI Act, we are required to publish information as part of the Information Publication Scheme (IPS).

Each agency must display on its website a plan showing the information it publishes in accordance with the IPS requirements. The ACNC publishes this information at: acnc.gov.au/IPS.

In 2023-24, we responded to 42 FOI requests. All requests were responded to within the 30 calendar-day statutory timeframe.

Review and Appeal of ACNC decisions

We conduct an internal review of a decision if an affected applicant submits an ‘objection’. The internal review is conducted by a different person to the one who made the original decision.

This is known as an ‘objection decision’ under the ACNC Act.

Administrative Appeals Tribunal review

If a charity is dissatisfied with our objection decision, it can apply for a review by the Administrative Appeals Tribunal (AAT).

In 2023–24:

- one application for AAT review of a decision, commenced in the previous financial year, was withdrawn by the Applicant

- one application for AAT review of a decision was received in this financial year. That application was finalised in December 2023.

Court appeal

If a charity is dissatisfied with an AAT decision, it can appeal to the Federal Court of Australia on questions of law. A charity can also appeal objection decisions directly to the Federal Court.

In 2023–24, one matter was heard in the full court of the Federal Court. As of 30 June 2024, no judgment was delivered.

Financial management

Division 125 of the ACNC Act establishes an ACNC Special Account. This is an appropriation mechanism that sets aside an amount within the Consolidated Revenue Fund to be expended for the purposes of the ACNC Act.

Our Special Account is administered in accordance with the Department of Finance guidelines. The balance of the Special Account does not lapse at the end of the annual appropriation period.

The ACNC is included in the ATO’s annual financial statements in accordance with subsection 43(4) of the PGPA Act. For transparency, we have included some financial information below.

The ATO provides certain financial and taxation management services through a memorandum of understanding.

Our 2023–24 budget was $21.3 million (excluding litigation funds). Our operating expenditure in 2023–24 was $19.6 million.

| Cost centre | Staff costs ($’000) | Supplier costs ($’000) | Total ($’000) |

| Executive | 1,319 | 82 | 1,400 |

| Advisory Board | 19 | 177 | 196 |

| Registration | 2,447 | 3 | 2,450 |

| Corporate Services | 412 | 1,624 | 2,036 |

| Education and Public Affairs | 754 | 120 | 874 |

| Advice Services | 1,562 | -98 | 1,464 |

| Information Technology | 1,327 | 1,880 | 3,207 |

| Reporting and Red Tape Reduction | 794 | 2 | 796 |

| Compliance | 1,729 | 5 | 1,734 |

| Legal and Policy | 1,041 | 67 | 1,108 |

| Deductible Gift Recipient Reform | 2,553 | 462 | 3,015 |

| Litigation | 0 | 173 | 173 |

| Modernising Business Registers* | 35 | 7 | 42 |

| Compliance Review Program | 496 | 106 | 602 |

| Reform of Secrecy Provisions | 414 | 133 | 547 |

| Total | 14,902 | 4,743 | 19,645 |

* Spending ceased on 31 August 2023 in accordance with the Government’s decision to cease work on the Modernising Business Registers program.

Our people

ACNC staff

We are a national regulator based in Melbourne.

We are proud of our staff, who continue to deliver quality services to the charity sector and the Australian public.

Our culture vision, created by ACNC staff, ensures we all come together as One ACNC to deliver on our objects. We do this through our shared purpose in an environment where people belong, are supported and connected, and aspire to continuously evolve.

ACNC staff are engaged as employees of the ATO (under the ATO Enterprise Agreement 2024) and can access flexible working arrangements.

The ATO’s annual report includes details on salary ranges and non-salary benefits.

ACNC staff are included in the ATO’s annual report. For transparency, we have included some staffing information below.

| Classification | Woman/Female | Man/Male | Non-binary | Total |

| APS4 | 25 | 6 | – | 31 |

| APS5 | 16 | 10 | – | 26 |

| APS6 | 27 | 13 | 2 | 42 |

| EL1 | 21 | 21 | – | 30 |

| EL2 | 5 | 4 | – | 9 |

| SES1 | 1 | 2 | – | 3 |

| Commissioner | 1 | – | – | 1 |

| Total | 96 | 44 | 2 | 142 |

* The figures above include staff on leave in addition to acting arrangements (for example, we only have 2 SES positions).

| Employee type | Woman/Female | Man/Male | Non-binary | Headcount |

| Statutory appointee | 1 | – | – | 1 |

| Ongoing full-time | 71 | 40 | 1 | 112 |

| Ongoing part-time | 20 | 1 | 1 | 22 |

| Non-ongoing full-time | 1 | 3 | – | 4 |

| Non-ongoing part-time | 1 | – | – | 1 |

| Secondment from ATO full-time | 2 | – | – | 2 |

| Secondment from ATO part-time | – | – | – | – |

| Total | 96 | 44 | 2 | 142 |

* The figures above include staff on leave and acting arrangements

Diversity and inclusion

The ACNC’s goal is to be representative of the Australian community and a place where all individuals can make a positive impact.

We continue to strive to be a leader in diversity, equity, and inclusion in the Australian Public Service, which includes a focus on:

- Aboriginal and Torres Strait Islander peoples

- employees living with disability

- gender equality

- cultural and linguistic diversity

- lesbian, gay, bisexual, transgender, intersex, queer (LGBTIQ+) staff

- mature-age people.

Because ACNC staff are employees of the ATO, we also follow relevant ATO diversity and inclusion strategies.

Additional information is included in the ATO’s annual report.

We are committed to implementing these strategies in line with our One ACNC Culture.

In 2023–24, we:

- published a Statement of Commitment to outline the actions that we would take as part of the ATO’s 2024 Diversity and Inclusion Strategy

- began work on a Statement of Commitment that outlines the actions we will take to support the ATO’s Reconciliation Action Plan

- conducted three recruitment processes for identified positions (Aboriginal and Torres Strait Islander)