This Australian Charities Report is the annual analysis of the information we receive from charities in their Annual Information Statements. This is the 10th edition.

Foreword

I am pleased to present the Australian Charities Report 10th edition – our annual analysis that helps quantify the contribution of charities to the community and Australian economy.

Charities work across multiple sectors, but the Australian Charities Report is of strategic importance as it aggregates charity data (from 51,536 charities) to provide a holistic picture or ‘sector-wide’ view.

Cost of living increases impact charities

Our data shows that cost of living issues had an impact on charities in 2022, with increases in expenses and liabilities outpacing increases in revenue and assets (in percentage terms).

Total revenue in the sector increased by $11 billion to a record high of just over $200 billion, but expenses increased by $22 billion in the same period.

Employee expenses also rose dramatically. The amount charities spent on employees in 2022 increased nearly 10% when compared to 2021 – the highest annual percentage increase recorded.

Donations grew by 4.4% in 2022. This was lower than the 5.3% increase in donations reported in 2021. For this reporting period, donations and bequests totalled $13.9 billion, an increase of more than $584 million over 2021 figures.

Philanthropy in the form of grant making continues to be important. Charities reported spending $11.7 billion on grants and donations to others, an increase of 21% on the previous reporting period, with most of that increase concentrated on grants within Australia.

Charity people

The report indicates charities remain a major employer, accounting for 10.5% of the Australian workforce. Still, the sector continued to depend on volunteers, with more than half of all charities reporting they operate with no paid staff.

Pleasingly, volunteer numbers increased to 3.5 million, although still below 2018 when the sector had 3.77 million volunteers.

Size analysis provides nuance

We base our analysis on charity size. The charity size thresholds changed in 2022. Data we have gathered since the change to charity size thresholds shows 74% of charities now report as small, compared to the 65% that did so before the shift. This was a proposal that arose from the ACNC legislation review.

This change more appropriately reflects a charity’s size as average annual revenue levels have risen since those set at the ACNC’s inception in 2013.

It is not compulsory for Basic Religious Charities to provide financial information to the ACNC. However, 7% did so in the 2022 reporting period and the information they provided is included.

Focus on extra small charities

Extra small charities – those with annual revenue of $50,000 or less – are a focus for this report because they comprise nearly a third of all Australian charities.

As part of this focus, we look at how extra small charities fared in 2022 in comparison to 2017.

And although extra small charities make up around 31% of the sector, they account for just 0.1% of the sector’s income. In contrast, extra large charities (those with more than $100 million in annual revenue) account for more than 54% of aggregate revenue, even though they only make up 0.5% of Australia’s charity sector.

Nearly 90% of extra small charities operate without paid staff.

The five-year figures show there was a significant drop in the number of volunteers (-17%) and paid staff (-18%) for extra small charities.

The data shows the cost of operating and delivering services has increased but extra small charities haven’t received sufficient revenue or donations to keep pace with these increases.

The differences between the smallest and largest charities could not be starker. When we talk about charities, set obligations or when policy is made, we must be mindful of the difference in resources and capacity. We don’t set policy, but we can highlight that most of the sector operates on low revenue with no paid staff.

In this edition, we have gathered a decade of data, providing both a snapshot and trends over time. And for the first time, using our Charity Data Explorer, people can interrogate the data further by using a new postcode filter.

The report is packed with valuable data that helps us understand some of the challenges affecting charity operations. It demonstrates charities make an enormous contribution to Australia’s social fabric, its economy and employment.

The report also highlights the enormous diversity amongst Australia’s charities. By publishing this report we meet one of our strategic priorities to share data back to the sector.

I invite you to read the report.

Warm regards,

Sue Woodward AM

Commissioner

Australian Charities and Not-for-profits Commission

The Australian Charities Report contains comprehensive information on Australia’s registered charities.

This report demonstrates our commitment to maximising the use of our data to assist the public, charities, researchers and policy makers to better understand the diversity of the charity sector.

This is the tenth edition of this report. Previous editions can be found on our website.

Charity size changes that affect this report

A charity’s size for ACNC purposes is based on its total annual revenue for a reporting period. Although charity size revenue thresholds changed in 2022, we have continued to use the pre-2022 thresholds in this report so that we can track trends over time.

Charity size revenue thresholds

| Size | Pre-2022 thresholds | Post-2022 thresholds |

|---|---|---|

| Small | Annual revenue under $250,000 | Annual revenue under $500,000 |

| Medium | Annual revenue of $250,000 or more, but under $1 million | Annual revenue of $500,000 or more, but under $3 million |

| Large | Annual revenue of $1 million or more | Annual revenue of $3 million or more |

To provide a more detailed overview of the charity sector in this report, we use six different size categories based on revenue:

| Charity size | Total revenue |

|---|---|

| Extra small | Less than $50,000 |

| Small | $50,000 or more but less than $250,000 |

| Medium | $250,000 or more but less than $1 million |

| Large | $1 million or more but less than $10 million |

| Very large | $10 million or more but less than $100 million |

| Extra large | $100 million or more |

Analysis

There are three key sections in this report:

- The size of Australia’s charities uses data submitted by 51,536 charities in the 2022 Annual Information Statement. This in an increase from 49,402 charities analysed as part of the 9th edition.

- Charitable purposes provides charity data by charity subtypes (subtypes reflect a charity’s purpose) using data from the 2022 Annual Information Statement.

- Profile of the charity sector primarily uses data from the 2022–23 financial year and provides information on obligations to other regulators in addition to analysis of newly registered charities and revoked entities.

Detailed information is available in Data sources and methodology.

Our focus areas

Last year we included a focus on giving and philanthropy. This helped to inform our response to the Productivity Commission’s inquiry into philanthropy.

10 years of data

For the 10th edition of this report we have analysed ten years of data to highlight key changes across the charity sector in ten graphs.

Extra small charity focus

This report also focuses on extra small charities (those with revenue less than $50,000) because they comprise nearly a third of all Australian charities. We look at how extra small charities fared in 2022 compared with 2017.

Our Charity Data Explorer

Our interactive Charity Data Explorer allows you to interrogate the data by using filters to run custom searches. This year, we have updated the explorer to allow you to filter by postcode.

For the 10th edition of the Australian Charities Report, we have included some key figures that show trends across the Australian charity sector.

1. Charity registrations and revocations

Since 2021, the number of registered charities has remained relatively stable.

Annual charity registrations vs revocations by financial year

Annual charity revocations by type by financial year

Notes: Reasons that the ACNC may revoke a charity’s status include compliance issues, having a cancelled ABN, or being what is known as a ‘double defaulter’. A double defaulter is a charity that has failed to submit its Annual Information Statement for two years.

A charity can request the ACNC revoke its registration as a charity. This is known as voluntary revocation. The ACNC requires a charity to provide reasons for requesting voluntary revocation. These reasons could be if a charity is no longer operating, has merged, no longer wants to be a charity or is no longer entitled to be a charity.

Annual compliance revocations by financial year

In the most serious cases where a charity does not comply with their obligations, we may revoke a charity’s registration.

2. Charity subtypes

The percentage of charities registered with the subtype of social welfare has increased significantly since 2014.

2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Health | 5.2 | 5.5 | 6.1 | 6.5 | 6.7 | 7.1 | 7.2 | 7.3 | 7.4 | 7.6 |

| Education | 18.7 | 18.5 | 17.8 | 16.3 | 16.1 | 16.0 | 15.9 | 15.6 | 15.2 | 15.0 |

| Social welfare | 9.9 | 10.6 | 11.8 | 12.7 | 13.2 | 13.9 | 14.2 | 14.5 | 15.0 | 15.3 |

| Religion | 27.8 | 27.1 | 25.4 | 24.8 | 24.1 | 23.4 | 22.9 | 22.4 | 21.6 | 21.2 |

| Culture | 4 | 4.2 | 4.6 | 4.9 | 5 | 5.1 | 5.3 | 5.5 | 5.7 | 6 |

| Reconciliation | 1.4 | 1.4 | 1.5 | 1.6 | 1.6 | 1.6 | 1.7 | 1.7 | 1.7 | 1.8 |

| Human rights | 1.2 | 1.2 | 1.2 | 1.2 | 1.2 | 1.1 | 1.1 | 1.1 | 1.1 | 1 |

| Security | 1.3 | 1.3 | 1.3 | 1.3 | 1.3 | 1.4 | 1.4 | 1.4 | 1.4 | 1.3 |

| Animals | 0.8 | 0.9 | 1 | 1.1 | 1.2 | 1.3 | 1.3 | 1.4 | 1.4 | 1.4 |

| Environment | 1.6 | 1.7 | 1.8 | 1.9 | 2 | 2 | 2.2 | 2.2 | 2.4 | 2.5 |

| Other | 9.1 | 9.0 | 9.4 | 9.5 | 9.5 | 9.3 | 9.1 | 9.0 | 9.0 | 8.8 |

| Law | 0.6 | 0.6 | 0.7 | 0.7 | 0.7 | 0.7 | 0.7 | 0.7 | 0.7 | 0.7 |

| PBI1 | 16.0 | 15.5 | 14.8 | 14.8 | 14.7 | 14.3 | 14.2 | 14.3 | 14.4 | 14.4 |

| HPC2 | 2.5 | 2.6 | 2.5 | 2.5 | 2.6 | 2.7 | 2.8 | 2.9 | 3 | 3 |

1. Public Benevolent Institution. 2. Health Promotion Charities

Note: Since 2014, the ACNC has registered charities with one or more of the 14 charity subtypes listed in the table above.

3. Charity activities

Religion remains the most common activity across the sector, but from 2021 Human Services now exceeds Education as the second-most common activity.

Note: Between 2014 and 2019, charities classified their activities based on the International Classification of Not-for-profit Organisations. Since 2020, charities have classified their activities based on the CLASSIE taxonomy developed by Our Community. Further information is available in What charities do.

4. Charity size

The percentage of charities in each size category has remained fairly stable, with the exception of ‘size unknown Basic Religious Charities’ which has decreased over time.

| Charity size | Total revenue |

|---|---|

| Extra small | Less than $50,000 |

| Small | $50,000 or more but less than $250,000 |

| Medium | $250,000 or more but less than $1 million |

| Large | $1 million or more but less than $10 million |

| Very large | $10 million or more but less than $100 million |

| Extra large | $100 million or more |

| Size unknown (Basic Religious Charity) | No financial information provided (exempt from providing) |

5. Growth in charity revenue

Growth in charity revenue has been in excess of GDP since 2018, which is largely due to strong revenue growth among very large and extra large charities. Between 2018 and 2021, the revenue of these charities grew at more than twice the rate of GDP.

Note: The information above was not published in the 2013 to 2017 versions of the Australian Charities Report.

6. The importance of donations to charity operations

Smaller charities are more reliant on donations and bequests to generate revenue than charities of other sizes.

Percentage of donations and bequests to charities as a share of their total revenue

Note: The information above was not published in the 2013 to 2016 editions of the Australian Charities Report.

7. Percentage of Australians that work for charities

Employee numbers have increased over time, which largely mirrors changes in Australia’s employment rate (that is, the proportion of Australians employed by charities has remained constant).

Charities percentage of total workforce

8. Percentage of Australians that volunteer with charities

The percentage of Australians that volunteer with charities has yet to fully recover following the COVID-19 pandemic, but there are signs that volunteering is returning to pre-pandemic levels.

Percentage of population that volunteer

Note: The information above was not published in the 2013 and 2014 editions of the Australian Charities Report.

9. Percentage of charities operated entirely by volunteers

Charities continue to rely heavily on volunteers to deliver their charitable purposes.

Percentage of charities with paid staff

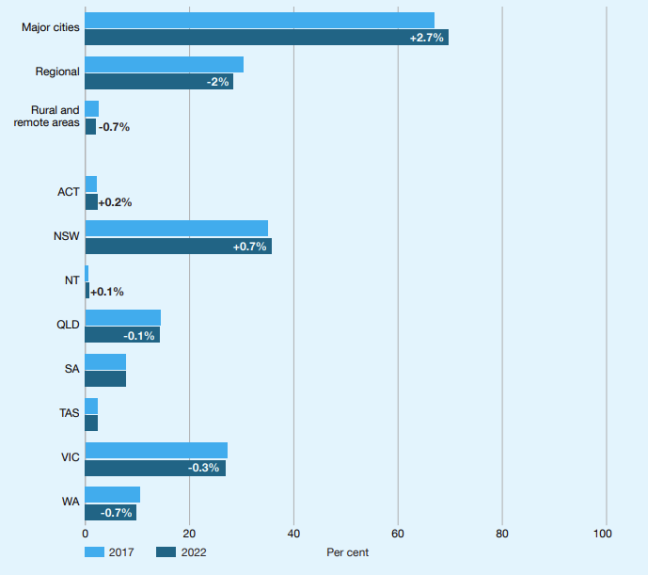

10. Charity locations

When comparing 2022 data with that of 2013, the ACT, NSW and Victoria are the only states and territories to record an increase in the percentage of charities based in them (according to the physical address provided by charities). QLD reported the largest decrease.

Physical locations of charities in Australia

Note: Information on the physical locations of charities was not published in the 2017 to 2019 versions of the Australian Charities Report.

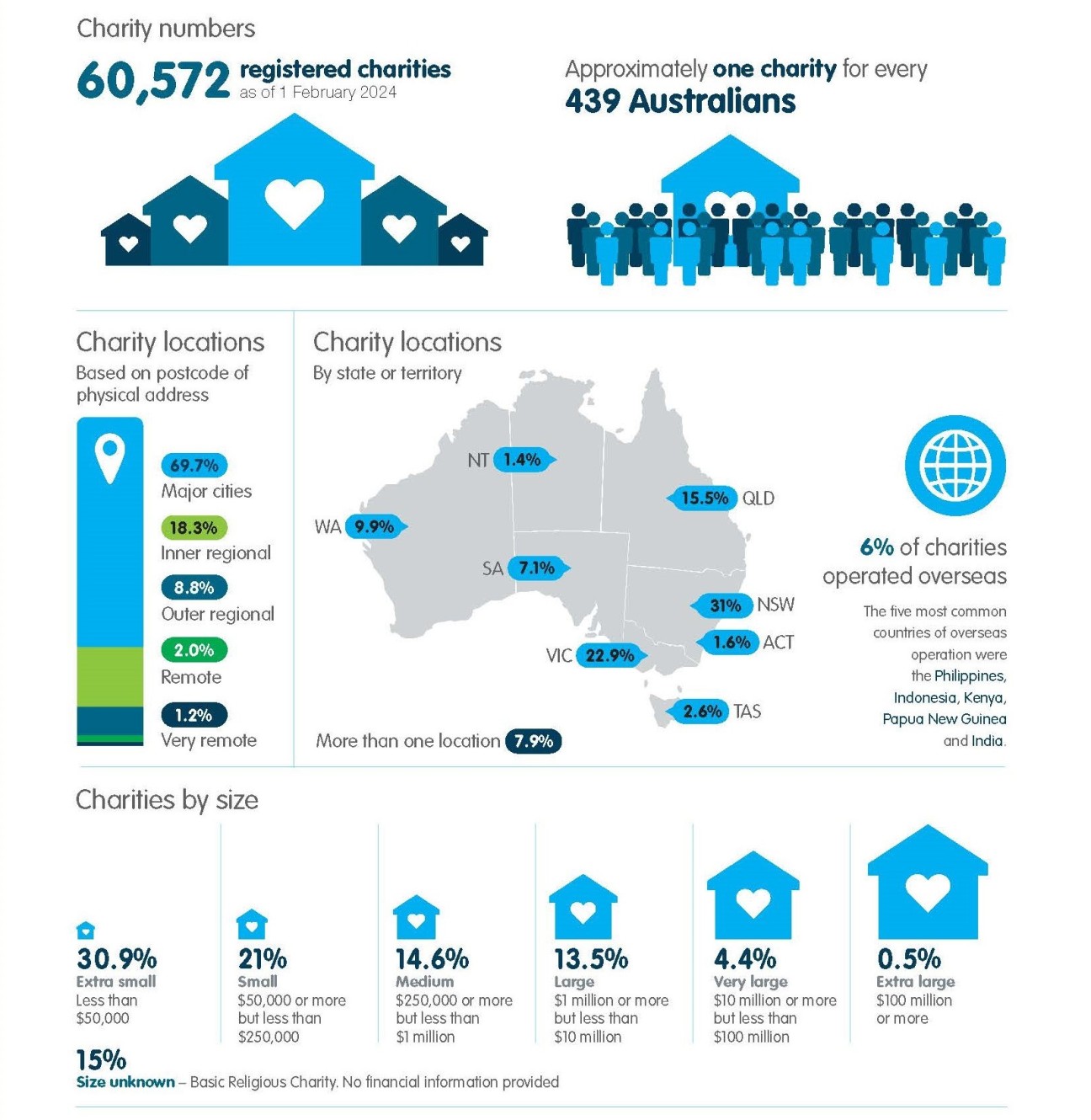

Charity numbers

- 60,572 registered charities as of 1 February 2024

- Approximately one charity for every 439 Australians

Charity locations based on postcode of physical address

- Major cities – 69.7%

- Inner regional – 18.3%

- Outer regional – 8.8%

- Remote – 2.0%

- Very remote – 1.2%

Charity locations by state or territory

- ACT – 1.6%

- NSW – 31%

- NT – 1.4%

- QLD – 15.5%

- SA – 7.1%

- TAS – 2.6%

- VIC – 22.9%

- WA – 9.9%

- More than one location – 7.9%

- 6% of charities operated overseas

- The five most common countries of overseas operation were the Philippines, Indonesia, Kenya, Papua New Guinea and India.

Charities by size

- Extra small (less than $50,000) – 30.9%

- Small ($50,000 or more but less than $250,000) – 21%

- Medium ($250,000 or more but less than $1 million) – 14.6%

- Large ($1 million or more but less than $10 million) – 13.5%

- Very large ($10 million or more but less than $100 million) – 4.4%

- Extra large ($100 million or more) – 0.5%

- Size unknown (Basic Religious Charity, no financial information provided) – 15%

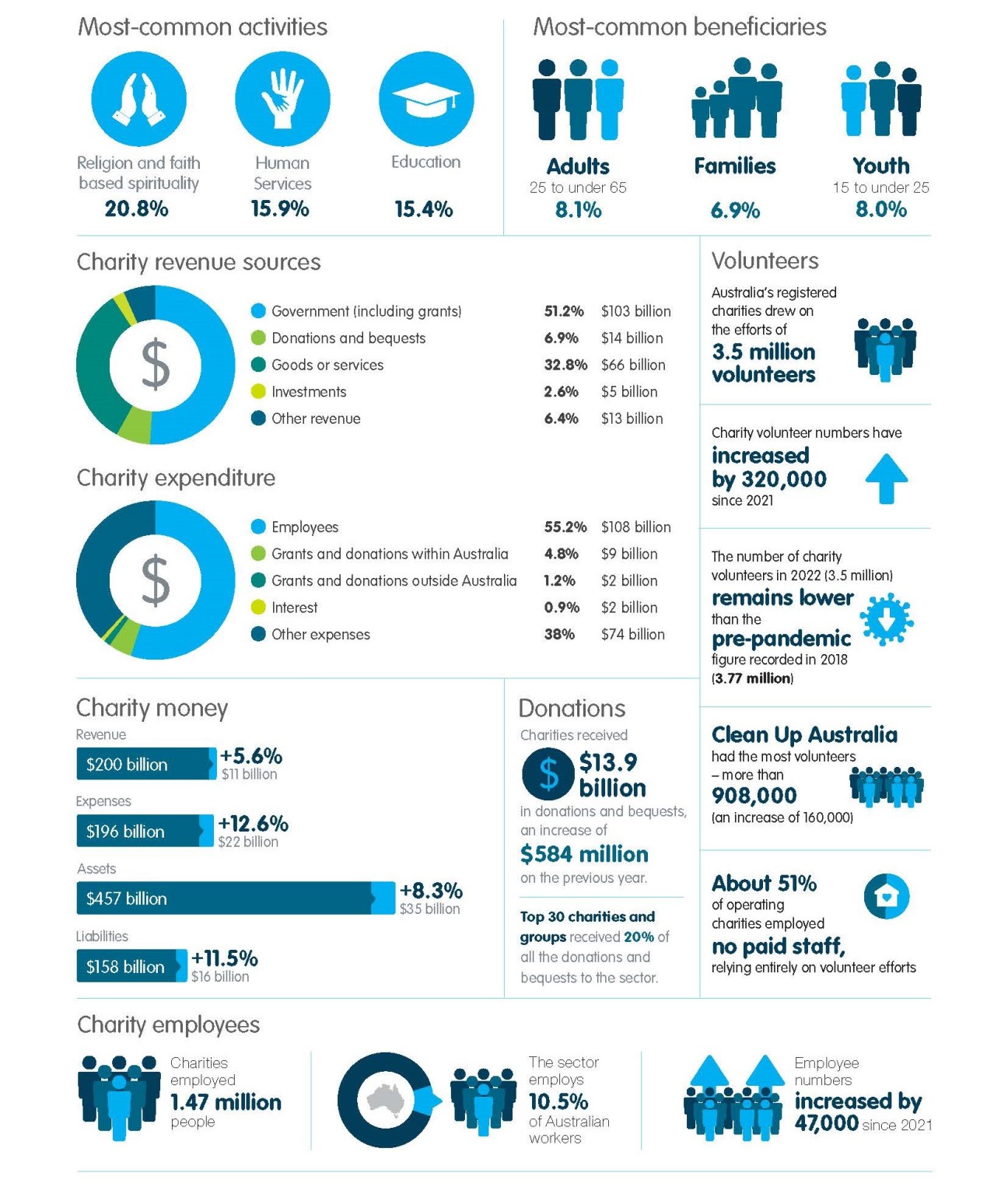

Most-common activities

- Religion and faith based spirituality – 20.8%

- Human Services – 15.9%

- Education – 15.4%

Most-common beneficiaries

- Adults (25 to under 65) – 8.1%

- Families – 6.9%

- Youth (15 to under 25) – 8.0%

Charity revenue sources

- Government (including grants) – 51.2% ($103 billion)

- Donations and bequests – 6.9% ($14 billion)

- Goods or services – 32.8% ($66 billion)

- Investments – 2.6% ($5 billion)

- Other revenue – 6.4% ($13 billion)

Charity expenditure

- Employees – 55.2% ($108 billion)

- Grants and donations within Australia – 4.8% ($9 billion)

- Grants and donations outside Australia – 1.2% ($2 billion)

- Interest – 0.9% ($2 billion)

- Other expenses – 38% ($74 billion)

Volunteers

- Australia’s registered charities drew on the efforts of 3.5 million volunteers

- Charity volunteer numbers have increased by 320,000 since 2021

- The number of charity volunteers in 2022 (3.5 million) remains lower than the pre-pandemic figure recorded in 2018 (3.77 million)

- Clean Up Australia had the most volunteers – more than 908,000 (an increase of 160,000)

- About 51% of operating charities employed no paid staff, relying entirely on volunteer efforts

Charity money

- Revenue – $200 billion (+5.6%, $11 billion)

- Expenses – $196 billion (+12.6%, $22 billion)

- Assets – $457 billion (+8.3%, $35 billion)

- Liabilities – $158 billion (+11.5%, $16 billion)

Donations

- Charities received $13.9 billion in donations and bequests, an increase of $584 million on the previous year

- Top 30 charities and groups received 20% of all the donations and bequests to the sector

Charity employees

- Charities employed 1.47 million people

- The sector employs 10.5% of Australian workers

- Employee numbers increased by 47,000 since 2021

Australia’s charity sector contains organisations of many sizes – from tiny local community groups to large international aid organisations.

This section of the Australian Charities Report examines charity data from 51,536 charities that submitted a 2022 Annual Information Statement.

A charity’s size for ACNC purposes is based on its total annual revenue for a reporting period. Analysing charity size helps us understand the scale on which charities operate and provides an insight into the composition of the sector over time.

Changes to charity size thresholds

Table 1: Charity size revenue thresholds

| Size | Pre-2022 thresholds | Post-2022 thresholds |

|---|---|---|

| Small | Annual revenue under $250,000 | Annual revenue under $500,000 |

| Medium | Annual revenue of $250,000 or more, but under $1 million | Annual revenue of $500,000 or more, but under $3 million |

| Large | Annual revenue of $1 million or more | Annual revenue of $3 million or more |

Charity sizes before and after

As a result of changes to charity size thresholds, the proportion of small charities increased from 64.3% to 73.6%. The proportion of large charities dropped to 10.8%.

| Size | Pre-2022 thresholds | Post-2022 thresholds |

|---|---|---|

| Small | 64.3% | 73.6% |

| Medium | 16.7% | 15.7% |

| Large | 19% | 10.8% |

Basic Religious Charities

More than 7,700 Basic Religious Charities did not provide financial information in the Annual Information Statement.

A Basic Religious Charity (BRC) is a type of religious charity that meets specific requirements. BRCs are not required to:

- answer the financial questions in the Annual Information Statement

- submit annual financial reports

- comply with ACNC Governance Standards.

BRCs are required to nominate whether they are a small, medium or large charity. Using post-2022 thresholds, 90.1% of BRCs reported being small, 8.2% reported being medium and 1.7% reported being large.

Charity sizes used in this report

In this report, we have continued to use pre-2022 size thresholds to allow meaningful comparisons to previous years’ data.

BRCs that voluntarily provided financial information have been categorised to the corresponding charity size based on their revenue. BRCs that did not provide financial information are noted as ‘Size Unknown (BRC)’ where relevant.

Table 2: Charity size thresholds used in this report

| Charity size | Total revenue |

|---|---|

| Extra small | Less than $50,000 |

| Small | $50,000 or more but less than $250,000 |

| Medium | $250,000 or more but less than $1 million |

| Large | $1 million or more but less than $10 million |

| Very large | $10 million or more but less than $100 million |

| Extra large | $100 million or more |

| Size unknown (BRC) | No financial information provided |

While 31% of Australia’s charities were extra small (with annual revenue of less than $50,000) in 2022, the proportion of extra small charities decreased by 0.6% compared to the previous year. In turn, there was a 0.7% increase in the proportion of small charities – from 20.3% to 21% - compared to the previous year.

Table 3: Australian charities by size, with changes from the previous reporting period.

| Charity size | % of charities (2022) | % change from 2021 | % change over past three years |

|---|---|---|---|

| Extra small | 30.9 | -0.6 | 0.9 |

| Small | 21.0 | 0.7 | -0.3 |

| Medium | 14.6 | 0.5 | 0.6 |

| Large | 13.5 | 0.1 | -0.2 |

| Very large | 4.4 | -0.1 | 0.2 |

| Extra large | 0.5 | Unchanged | 0.1 |

| Size unknown (BRC) | 15 | -0.7 | -1.3 |

Charities that were not operating

The number of charities that reported as ‘not operating’ in the 2022 Annual Information Statement decreased. About 4% of charities (just over 1,900 in total) reported that they did not conduct activities during the period.

COVID-19 continued to affect charity operations.

In the 2022 Annual Information Statement, 25% of charities that did not conduct activities cited COVID-19 as the reason why. This, however, represented a decrease from the 43% figure recorded in 2021.

Other non-operational charities reported that they:

- were winding up

- were conducting activities in the name of another charity

- had yet to receive funding

- had insufficient staff or volunteers available, or

- were still in a planning or establishment phase and had yet to begin activities.

Extra small charities represent approximately 31% of the sector, but they generate just 0.1% of the sector’s income.

We compared the latest figures with data from the 2017 Australian Charities Report to provide further context on how extra small charities have fared over the past five years.

The figures showed that since 2017, the number of paid staff at extra small charities had decreased by 18%, while volunteer numbers have fallen by 17%.

Donations and bequests to extra small charities increased by $10 million in the five-year period. However, Australia’s extra small charities attracted only a small percentage of the charity sector’s total reported donations.

Extra small charities total revenue increased slightly but average revenue contracted slightly during the five-year period. The cost of operating and delivering services has increased, but extra small charities are not seeing an increase in revenue or donations to help them keep up with these demands.

Volunteers

Extra small charities by revenue

Note: A significant number of extra small charities reporting zero revenue did not operate during the reporting period.

Sources of revenue

Donations and bequests

Operations

Physical address

Note: This analysis includes 49,425 charities that have provided the ACNC with a physical address.

We base a charity’s location on its physical address. A charity’s physical address is most commonly the physical base for the charity – for example, a head office – and may be distinct from where it conducts its activities.

Based on the Australian Statistical Geography Standard (ASGS): Volume 5 – Remoteness Structure, most charities (nearly 70%) continue to be located in Australia’s major cities.

Our analysis also saw no change in the percentage of charities that are located in the major cities compared to the regions (inner and outer regional areas) compared to the previous year.

Table 4: Charity location (based on postcode of physical address)

| Location in Australia | % of charities |

|---|---|

| Major cities | 69.7 |

| Inner regional | 18.3 |

| Outer regional | 8.8 |

| Remote | 2.0 |

| Very remote | 1.2 |

Operations in Australia

The Northern Territory, Tasmania and South Australia were the only locations where the proportion of charities based there exceeded the proportion of Australia’s population that lived there.

Table 5: Operating locations of registered charities

| State or territory | % of charities | % of Australia’s population at 30 June 2023 |

|---|---|---|

| ACT | 1.6 | 1.8 |

| NSW | 31.0 | 31.2 |

| NT | 1.4 | 0.9 |

| QLD | 15.5 | 20.5 |

| SA | 7.1 | 7.0 |

| TAS | 2.6 | 2.2 |

| VIC | 22.9 | 25.6 |

| WA | 9.9 | 10.8 |

| More than one | 7.9 | – |

To find out more about charities’ locations, visit our Charity Data Explorer.

State and territory breakdown

The state and territory breakdown uses a charity’s physical address (where provided) along with data from the 2022 Annual Information Statement.

About 8% of charities operate in multiple jurisdictions, but this may not be reflected by a charity’s physical address. This is relevant for the analysis of volunteers; although volunteers are attributed to a state based on a charity’s street address, the figures include volunteers across Australia.

- ACT –Total revenue rose by $1.3 billion, with revenue from donations and bequests increasing by 45% from $154 million in 2021 to $223 million in 2022.

- NSW – The number of charities with a physical address in NSW increased by more than 700. Revenue from donations grew by $293 million to $5.4 billion. While the number of volunteers rose by more than 246,000 people, much of this can be attributed to one charity. Clean Up Australia Limited, which has a physical address in NSW but operates throughout Australia, reported an increase of more than 160,000 volunteers in 2022.

- NT – While the number of charities with a physical address in the Northern Territory increased by 21 in 2022, total revenue for these charities decreased by $125 million compared to the previous year.

- QLD – Revenue from donations and bequests decreased by $270 million (16.5%) to $1.4 billion in 2022. However this drop can be explained by a large one-off donation of $590 million that had been made in 2021. Despite the drop in donations and bequests revenue, overall revenue grew by $1.2 billion.

- SA – Although an extra 130 charities were based in SA in 2022 compared to 2021, total revenue fell by $38 million in the same period.

- TAS – Tasmanian charities experienced growth in total revenue, although this growth can be attributed to an increase in both government funding, and goods and services. Revenue derived from donations and bequests fell by more than 3% compared to the previous year.

- VIC – The number of charities based in Victoria grew by more than 500, with these charities reporting the biggest increase in donations and bequests across all of Australia.

- WA – Donations and bequests to charities based in Western Australia increased by nearly 20% to $787 million. Volunteer numbers also increased by more than 25,000.

Operations overseas

In the 2022 Annual Information Statement, 6% of charities reported that they operated overseas.

Australia’s registered charities reported operations in 214 different countries or regions outside Australia. For charities operating overseas:

- 65% operated in just one country or region

- 14% operated in five or more countries or regions

- 5% operated in 10 or more countries or regions

The five most common countries in which charities operated overseas were the Philippines, Indonesia, Kenya, Papua New Guinea and India.

Table 6: Charity revenue sources, volunteers and employees by state or territory

| State or territory | Number of charities | Revenue from government ($ million) | Revenue from donations and bequests ($ million) | Revenue from goods or services ($ million) | Total revenue ($ million) | Volunteers | Employees |

|---|---|---|---|---|---|---|---|

| ACT | 1,126 | 2,461 | 223 | 1,582 | 4,847 | 49,375 | 30,533 |

| NSW | 16,445 | 26,243 | 5,442 | 15,323 | 53,547 | 1,733,612 | 349,585 |

| NT | 457 | 1,131 | 35 | 604 | 1,901 | 11,732 | 13,636 |

| QLD | 7,225 | 12,368 | 1,375 | 8,301 | 23,681 | 398,293 | 185,514 |

| SA | 3,503 | 5,323 | 409 | 3,541 | 10,276 | 144,006 | 97,434 |

| TAS | 1,145 | 2,253 | 103 | 855 | 3,396 | 51,272 | 29,624 |

| VIC | 12,008 | 24,253 | 3,299 | 13,460 | 44,330 | 530,016 | 290,485 |

| WA | 4,454 | 8,295 | 787 | 7,783 | 18,328 | 226,371 | 146,001 |

Note: Charities that report as part of a group have been excluded from this analysis.

Table 7: Charity donations and bequests received, by state and territory with changes from previous reporting periods

| State or territory | $ million | Change compared to previous period ($ million) | % change from previous period |

|---|---|---|---|

| ACT | 223 | 69 | 44.9 |

| NSW | 5,442 | 293 | 5.7 |

| NT | 35 | 8 | 28.1 |

| QLD | 1,375 | -264 | -16.1 |

| SA | 409 | 18 | 4.6 |

| TAS | 103 | -4 | -3.4 |

| VIC | 3,299 | 320 | 10.7 |

| WA | 787 | 130 | 19.8 |

Note: Charities that report as part of a group have been excluded from this analysis

When the ACNC registers an organisation as a charity, we register it with one or more charity ‘subtypes’.

These subtypes are categories that reflect the charity’s charitable purpose – for example ‘advancing education’ or ‘advancing health’. A charity’s purpose is the reason it has been set up, or what its activities work towards achieving.

Charities may have more than one charitable purpose, and charities may conduct a range of activities and services (programs) to achieve their purpose or purposes.

Our activity classification system is based on CLASSIE (Classification system of Australian Social Sector Initiatives and Entities), which was specifically developed by Our Community for the social sector.

By removing some non-charitable classifications, we refined the CLASSIE system to include a taxonomy suitable for the work of charities.

All charities that submitted an Annual Information Statement (and were operating) had the option to provide information on between one and ten programs.

Our analysis is limited to the approximately 91,000 programs that charities detailed in their AISs. This figure will not represent the full number of programs that charities conduct, as some charities may not have provided details on all their programs or may have more than 10 programs (the maximum permitted on the AIS).

Number of programs reported

Charities can select from 864 program classifications when completing their AISs. This is how we obtain information about charities’ activities.

Charities reported 91,450 programs in 2022.

Activity categories

CLASSIE is a nested taxonomy to classify social sector initiatives using four levels of granularity, with Level 1 being the highest or most overall level (for example, arts and culture) and Level 4 being the most granular level (for example, musical theatre).

The following analysis is based on CLASSIE’s level one activity classifications. All classifications can be attributed to a level one classification.

Consistent with the previous year, the most common program classifications were Religion and faith-based spirituality, Human services, and Education.

This corresponds with the second and third most common charities by subtype category being Advancing religion and Advancing education (see the ‘charity subtypes’ section).

There were minor changes in the most common activities by charity size.

For extra small charities, Religion and faith-based spirituality overtook Community development to become the second most common classification. For extra large charities, Health overtook Education as the second most common classification.

Similar to the previous year, the least common categories were Social sciences, Science, and International relations.

Table 8: CLASSIE Level 1 classifications reported by charities

| CLASSIE classification | Number of activities | % |

|---|---|---|

| Agriculture, fisheries and forestry | 755 | 0.8 |

| Animal welfare | 1,671 | 1.8 |

| Arts and culture | 6,975 | 7.6 |

| Community development | 8,652 | 9.5 |

| Economic development | 2,258 | 2.5 |

| Education | 14,112 | 15.4 |

| Environment | 2,751 | 3 |

| Health | 10,340 | 11.3 |

| Human rights | 1,470 | 1.6 |

| Human services | 14,518 | 15.9 |

| Information and communications | 739 | 0.8 |

| International relations | 373 | 0.4 |

| Public affairs | 1,044 | 1.1 |

| Public safety | 2,173 | 2.4 |

| Religion and faith-based spirituality | 19,021 | 20.8 |

| Science | 309 | 0.3 |

| Social sciences | 152 | 0.2 |

| Sport and recreation | 1,459 | 1.6 |

| Unknown or not classified | 2,678 | 2.9 |

| Total | 91,450 | 100.0 |

Table 9: Common classification by charity size

| Charity size | Most common classification | Second most common classification | Third most common classification |

|---|---|---|---|

| Extra small | Education (17.0%) | Religion and faith-based spirituality (13.7%) | Community development (13.5%) |

| Small | Religion and faith-based spirituality (20.4%) | Education (15.3%) | Human services (14.2%) |

| Medium | Education (17.7%) | Human services (17.3%) | Religion and faith-based spirituality (13.3%) |

| Large | Human services (23.8%) | Education (19.7%) | Health (15.4%) |

| Very large | Human services (31.1%) | Education (23.0%) | Health (20.6%) |

| Extra large | Human services (41.3%) | Health (21.3%) | Education (20.4%) |

Charities were able to select multiple beneficiaries for each program they reported. Overall, the most common beneficiaries remain unchanged in 2022:

Across all charity sizes, the most common beneficiaries remained the same – the only exception being extra large charities. For extra large charities, Adults aged 65 and over became the second most common beneficiary group.

Table 10: Common beneficiaries by charity size

| Charity size | Most common beneficiary | Second most common beneficiary | Third most common beneficiary |

|---|---|---|---|

| Extra small | Adults – aged 25 to under 65 (8.8%) | Youth – aged 15 to under 25 (8%) | Families (7.6%) |

| Small | Adults – aged 25 to under 65 (8.4%) | Youth – aged 15 to under 25 (8.1%) | Families (7.6%) |

| Medium | Adults – aged 25 to under 65 (8.1%) | Youth – aged 15 to under 25 (8%) | Families (6.9%) |

| Large | Youth – aged 15 to under 25 (7.7%) | Adults – aged 25 to under 65 (7.5%) | Females (6.4%) |

| Very large | Youth – aged 15 to under 25 (9.3%) | Adults – aged 25 to under 65 (7.1%) | Adults – aged 65 and over and Children – aged 6 to under 15 (6.5%) |

| Extra large | Youth – 15 to under 25 (9.4%) | Adults - aged 65 and over (8.7%) | Adults – aged 25 to under 65 (8.6%) |

Note: Basic Religious Charities were excluded from the table because their sizes are unknown. To meet the requirements of a Basic Religious Charity, a charity must have the sole purpose of ‘Advancing religion’. Charities select from a list of potential beneficiaries.

To find out more about what charities do and who they help, visit our Charity Data Explorer or search the Charity Register.

Volunteers

Volunteers play a vital part in the charity sector. In 2022, charities reported drawing on the efforts of nearly 3.5 million volunteers.

More than half (51%) of all operating charities reported having no paid staff. This was a 1% increase on the previous year.

While volunteer numbers increased by more than 320,000 compared to 2021, half of this increase can be attributed to one charity – Clean Up Australia Limited, which operates nationally.

Volunteer numbers remain lower than in 2018; the year in which charity volunteer numbers peaked at 3.77 million.

It should also be noted that the figure of 3.5 million does not reflect the total number of individual volunteers across Australia. This is because people may volunteer for more than one charity, and many more people volunteer for not-profits that are not charities – for example, local sporting clubs.

Employees

The Annual Information Statement asks each charity to provide a snapshot of its employment figures based on its most recent pay period. These figures showed that the charity sector remained a significant employer in Australia.

Charities reported having 1.47 million paid employees in the 2022 reporting period. Similar to the previous year, charities employed 10.5% of Australia’s workforce (based on Australian Bureau of Statistics data as at 30 June 2023).

In the 2022 reporting period, charities reported an increase of more than 47,000 employees. This compared to an increase of 40,000 in the previous year. About 90% of this increase related to full-time or part-time employment.

Table 11: Number of employees by charity size

| Charity size | Full-time | Part-time | Casual | |||

|---|---|---|---|---|---|---|

Number | Change from previous period | Number | Change from previous period | Number | Change from previous period | |

| Extra small | 3,915 | 666 | 3,746 | 330 | 4,349 | -29 |

| Small | 2,734 | 256 | 5,405 | -74 | 6,272 | -436 |

| Medium | 8,216 | -223 | 18,342 | 490 | 16,205 | 1,637 |

| Large | 65,554 | -7,241 | 83,304 | -602 | 58,908 | -5,430 |

| Very large | 194,019 | 5,982 | 172,264 | -502 | 114,618 | 3,935 |

| Extra large | 281,724 | 26,125 | 253,405 | 17,529 | 160,214 | 5,441 |

| Unknown – BRC | 5,448 | -17 | 7,316 | -286 | 3,011 | -458 |

| All charities | 561,610 | 25,548 | 543,782 | 16,885 | 363,577 | 4,660 |

Table 12: Type of employment by charity size

| Charity size | Full-time | Part-time | Casual | |||

|---|---|---|---|---|---|---|

% of total staff | % change | % of total staff | % change | % of total staff | % change | |

| Extra small | 32.6 | 3.2 | 31.2 | 0.3 | 36.2 | -3.4 |

| Small | 19 | 2.1 | 37.5 | 0.1 | 43.5 | -2.2 |

| Medium | 19.2 | -1.4 | 42.9 | -0.8 | 37.9 | 2.2 |

| Large | 31.6 | -1.4 | 40.1 | 2.1 | 28.4 | -0.8 |

| Very large | 40.3 | 0.5 | 35.8 | -0.8 | 23.8 | 0.4 |

| Extra large | 40.5 | 1 | 36.4 | -0.1 | 23 | -0.9 |

| BRC size unknown | 34.5 | 1.5 | 46.4 | 0.4 | 19 | -1.9 |

| All charities | 38.2 | 0.5 | 37.0 | 0 | 24.8 | -0.5 |

Employee and volunteer breakdown

Smaller charities and Basic Religious Charities remain more reliant on volunteers, while larger charities were more likely to engage employees to deliver their services.

Only small and large charities reported an increase in volunteer numbers. Very large charities reported the biggest drop in volunteer numbers, with about 30,000 fewer volunteers compared to 2021.

Extra small, medium, very large and extra large charities reported an increase in employees.

Extra large charities continued to add the most employees – in 2021, these charities reported an additional 43,000 employees, and in 2022 they reported a further increase of 49,000.

In comparison, large charities reported a decrease of more than 13,000 employees.

Table 13: Employee and volunteer numbers by charity size with changes from previous reporting periods

| Charity size | Volunteers | Employees | Volunteers per employee | ||||||

|---|---|---|---|---|---|---|---|---|---|

Number | % change from previous year | % change over 3 years | Number | % change from previous year | % change over 3 years | Ratio | % change | % change over 3 years | |

| Extra small | 227,661 | -0.4 | -6.4 | 12,010 | 8.8 | 29 | 19 | -8.4 | -27.4 |

| Small | 386,895 | 11.5 | 9.9 | 14,411 | -1.7 | -2.5 | 26.8 | 13.4 | 12.8 |

| Medium | 421,186 | 5.6 | -15.6 | 42,763 | 4.7 | -0.9 | 9.8 | 0.9 | -15.1 |

| Large | 1,510,117 | 23.2 | 10.2 | 207,766 | -6 | -11 | 7.3 | 31 | 23.2 |

| Very large | 516,794 | -5.6 | -15 | 480,901 | 2 | 5.8 | 1.1 | -7.4 | -17.3 |

| Extra large | 155,648 | 1.8 | -19.8 | 695,343 | 7.6 | 15.1 | 0.2 | -5.4 | -25.4 |

| Unknown – BRC | 278,816 | 1 | -11 | 15,775 | -4.6 | -12.2 | 17.7 | 5.9 | 1.6 |

| All charities | 3,497,117 | 10.1 | -2.3 | 1,468,969 | 3.3 | 6.6 | 2.4 | 6.6 | -8.4 |

Note: Charities report employee numbers based on their last pay period before submitting the Annual Information Statement. Volunteer numbers are based on the entire reporting period.

Table 14: Operating charities with no employees by charity size

Extra small charities, small charities, and Basic Religious Charities were the most likely to operate without any paid staff. The proportion of entirely volunteer-operated charities decreased as charity size increased.

| Charity size | % of operating charities with no employees | % Change |

|---|---|---|

| Extra Small | 88 | -0.3 |

| Small | 57.8 | 3.9 |

| Medium | 25.1 | 2.2 |

| Large | 12.2 | 1 |

| Very large | 5.6 | 0.9 |

| Extra large | 3.1 | -0.6 |

| Size unknown – BRC | 48.5 | 1.4 |

| Total | 51 | 1 |

Largest employee totals

Depending on the circumstances, the ACNC can allow a group of registered charities to submit one Annual Information Statement and financial report.

The Melbourne Archdiocese Catholic Schools Ltd Group reported the largest number of employees of 18,608. This includes information for 294 schools based on their financial report.

Table 15: Australian charities with the most employees

| Charity name | Registered state | Subtypes | Staff – full time | Staff – part time | Staff – casual | Total employees |

|---|---|---|---|---|---|---|

| Melbourne Archdiocese Catholic Schools Ltd Group | VIC |

| 8,497 | 8,458 | 1,653 | 18,608 |

| Little Company of Mary Health Care Limited Group | NSW |

| 3,963 | 10,192 | 3,697 | 17,852 |

| UnitingCare QLD Group | QLD |

| 3,790 | 9,193 | 2,981 | 15,964 |

| Goodstart Early Learning Group | QLD |

| 8,274 | 4,915 | 2,049 | 15,238 |

| St John Of God Health Care Inc | WA |

| 2,481 | 7,494 | 3,205 | 13,180 |

| Catholic Education Western Australia Limited | WA |

| 5,484 | 4,343 | 2,860 | 12,687 |

| University of Melbourne Group | VIC |

| 6,754 | 3,148 | 2,530 | 12,432 |

| The Corporation of The Trustees of The Roman Catholic Archdiocese of Brisbane | QLD |

| 5,856 | 4,254 | 2,277 | 12,387 |

| University of NSW Group | NSW |

| 6,104 | 1,378 | 4,368 | 11,850 |

| Queensland University of Technology | QLD |

| 3,114 | 1,561 | 6,711 | 11,386 |

Note: Some charities have permission from the ACNC to report as part of a group. For these groups, we have included the subtypes of the charities involved in the group.

Largest volunteer totals

Table 16: Australian charities with the most volunteers

| Charity name | Registered state | Subtype categories | Total volunteers |

|---|---|---|---|

| Clean Up Australia Limited | NSW |

| 908,437 |

| Surf Life Saving New South Wales Group | NSW |

| 76,000 |

| The Duke of Edinburgh’s International Award – Australia | NSW |

| 59,501 |

| Surf Life Saving Australia Limited | NSW |

| 44,272 |

| Surf Life Saving Queensland | QLD |

| 36,267 |

| Padi Aware Group | NSW |

| 28,000 |

| MATES in Construction (Aust) Limited | QLD |

| 26,026 |

| Life Saving Victoria Limited | VIC |

| 25,000 |

| Surf Life Saving Western Australia Inc | WA |

| 24,000 |

| Surf Life Saving Sydney Northern Beaches Inc | NSW |

| 19,000 |

Cost of living issues that affected the broader Australian economy during 2022 also impacted charity finances.

Total revenue increased by $11 billion to a record $200 billion, but at the same time expenses increased by $21 billion.

Charities’ net income remained positive, showing that income exceeded expenses. However, the net income figure recorded across the sector – $5.7 billion – was the lowest figure the ACNC has ever reported.

While the sector’s assets grew by 8.3% to $457 billion during 2022, total liabilities increased by 11.5% to reach $158 billion.

Key financial terms

The following sections of the Australian Charities Report use a number of financial terms with specific meanings as detailed below.

- Revenue = funds a charity receives when undertaking its ordinary activities (for example, donations and bequests).

- Other income = income (or loss) from transactions that, while not part of a charity’s ordinary activities, affect the charity’s bottom line. They can include a realised gain or loss on the sale of assets (for example, the sale of a building) or a change in the value of the charity’s investments.

- Total income = total revenue + other income

- Expenses = costs incurred by the charity (for example, employee expenses)

- Net income = total income – total expenses

- Assets = resources controlled by a charity such as cash, shares, property, equipment and trademarks.

- Liabilities = amounts that a charity owes such as bank overdrafts, amounts owed to suppliers or creditors, loans and employee entitlements.

- Net assets = total assets – total liabilities

Understanding the financial information of charities

The key terms listed are a good starting point for understanding the charity sector and its diversity. There is so much variety in the charity sector that it can be difficult and misleading to try to compare or evaluate charities based on their revenue and expenses.

The asset ratio can help to assess financial sustainability: Asset ratio = total assets/total liabilities

A ratio of more than one indicates that a charity’s assets exceed its liabilities. A higher asset ratio can indicate that a charity has set aside funds – known as reserves – to help ensure its financial stability and sustainability.

Income and expenses

Revenue and income

A charity’s total income is made up of its total revenue and what is known as other income.

Revenue relates to the funds a charity receives when undertaking its ordinary activities. Other income comprises income (or loss) from transactions that, while not part of a charity’s ordinary activities, affect the charity’s bottom line.

For the first time, the charity sector’s total revenue exceeded $200 billion. This was an increase of nearly $11 billion (5.6%) when compared to the previous year.

This 5.6% growth outpaced the wider Australian economy, with the Australian Bureau of Statistics reporting that the Australian economy grew by 3.0% in the 2022–23 financial year.

Unlike 2021, all charity sizes experienced revenue growth in 2022. Extra small charities reported the smallest growth (3.8%), with medium charities showing the largest growth (7.3%).

The largest charities continue to account for most of the sector’s total revenue.

Only 0.5% of Australia’s charities are classed as extra large (with total revenue of $100 million or more), yet these charities accounted for more than 54% of the sector’s aggregate revenue.

Extra small charities, despite making up about one-third of the sector, contributed only 0.1% of the sector’s aggregate revenue.

The 30 largest charities by revenue (which includes charities that report collectively to the ACNC as part of reporting groups) accounted for 24% of the sector’s revenue, and the 50 largest charities accounted for 32%.

A list of Australia’s 30 largest charities by revenue can be found in Appendix 1.

Table 17: Total revenue by charity size with changes from previous reporting periods

| Size | Total revenue ($ million) | Contribution to the sector’s total revenue (%) | Change from previous period ($ million) | % change from previous period | Change over three years ($ million) | % change over 3 years |

|---|---|---|---|---|---|---|

| Extra small | 224 | 0.1 | 8 | 3.8 | 3 | 1.4 |

| Small | 1,348 | 0.7 | 67 | 5.2 | 38 | 2.9 |

| Medium | 3,898 | 1.9 | 264 | 7.3 | 325 | 9.1 |

| Large | 23,147 | 11.5 | 1,264 | 5.8 | 579 | 2.6 |

| Very large | 63,117 | 31.5 | 2,949 | 4.9 | 8,497 | 15.6 |

| Extra large | 108,948 | 54.3 | 6,150 | 6 | 25,280 | 30.2 |

| All charities | 200,682 | 100 | 10,702 | 5.6 | 34,721 | 20.9 |

Total income in the 2022 reporting period increased by more than $5 billion – or 2.8% – on the previous year, and now stands at $201 billion.

However, this increase in income was not felt by all charities in the sector. Charities across the extra small, small, medium and large categories reported decreases in total income.

The increase in the sector’s total income was predominately driven by very large and extra large charities.

Table 18: Total income by charity size with changes from previous reporting periods

| Size | Total income ($ million) | Change from previous period ($ million) | Change over three years ($ million) | % change from previous period | % change over 3 years |

|---|---|---|---|---|---|

| Extra small | 283 | -15 | 25 | -5 | -9.6 |

| Small | 1,322 | -149 | -43 | -10.1 | -3.1 |

| Medium | 3,761 | -331 | 77 | -8.1 | 2.1 |

| Large | 23,028 | -152 | -419 | -0.7 | -1.8 |

| Very large | 63,884 | 1,806 | 8,437 | 2.9 | 15.2 |

| Extra large | 109,167 | 4,326 | 24,850 | 4.1 | 29.1 |

| All charities | 201,445 | 5,485 | 32,657 | 2.8 | 19.3 |

Expenses

Charities must use their funds to further their charitable purpose or purposes. For some charities, part of their income and/or assets may need to be applied to specific charitable outcomes (such as a particular bequest, for example).

In 2022, the charity sector’s total expenses increased by $22 billion (12.6%) to $195.8 billion.

The increase of 12.6% was twice the rate of inflation. The cost of running a charity was also impacted by inflation, with the Consumer Price Index rising 6.0% over the 12 months to the June 2023 quarter.

Only extra small charities reported a decrease (4.5%) in total expenses. Extra large charities reported a 15% increase in total expenses.

Table 19: Total expenses by charity size with changes from the previous reporting period

| Size | Total expenses ($ million) | Change from previous period ($ million) | Change from previous period (%) | Change over 3 years ($ million) | Change over 3 years (%) |

|---|---|---|---|---|---|

| Extra small | 368 | -17 | -4.5 | 50 | 15.6 |

| Small | 1,319 | 90 | 7.3 | 36 | 2.8 |

| Medium | 3,715 | 439* | 13.4 | 357 | 10.6 |

| Large | 21,992 | 2,117 | 10.7 | 688 | 3.2 |

| Very large | 60,038 | 5,090 | 9.3 | 8,604 | 16.7 |

| Extra large | 108,348 | 14,134 | 15 | 28,403 | 35.5 |

| All charities | 195,780 | 21,853 | +12.6 | 38,138 | 24.2 |

* As part of our quality assurance when analysing data for this edition of the Charities Report, we identified a reporting error made by a charity. We have removed this outlier when comparing 2022 data with 2021.

Net income

Net income is measured by subtracting a charity’s total expenses from its total income (not total revenue).

The sector reported positive net income of $5.7 billion in 2022. This means that income (revenue plus transactions not a part of a charity’s ordinary activities) continued to exceed expenses. There was a 74% decrease in net income when comparing 2022 to 2021 due to a significant increase in total expenses.

Table 20: Net income by charity size with changes from the previous reporting period

| Size | Net income ($ million) | Change from previous period ($ million) | Change from previous period (%) | Change over 3 years ($ million) | Change from over 3 years (%) |

|---|---|---|---|---|---|

| Extra small | -85 | 2 | -2.6 | -25 | 41.4 |

| Small | 3 | -239 | -98.9 | -79 | -96.7 |

| Medium | 46 | -771* | -94.4 | -279 | -85.9 |

| Large | 1,036 | -2,269 | -68.7 | -1,106 | -51.6 |

| Very large | 3,846 | -3,284 | -46.1 | -168 | -4.2 |

| Extra large | 819 | -9,701 | -92.2 | -3,823 | -82.4 |

| All charities | 5,701 | -16,261 | -74.2 | -5,445 | -48.9 |

* As part of our quality assurance when analysing data for this edition of the Charities Report, we identified a reporting error made by a charity. We have removed this outlier when comparing 2022 data with 2021.

Assets and liabilities

Total assets

Assets are any resources controlled by a charity – for example: cash, shares, property, equipment and trademarks.

Charity assets continue to grow, with the sector’s total assets at approximately $457 billion. This represented an increase of $35 billion (8.3%) compared to the previous year.

Medium charities reported a decrease in total assets (down by 4% to $17.3 billion). Charities across all other size categories reported an increase in assets, with extra large charities accounting for 80% of the total increase.

Table 21: Total assets by charity size with changes from previous reporting periods

| Charity size | Total assets ($ million) | Change from previous period ($ million) | Change from previous period (%) | Change over 3 years ($ million) | Change over 3 years (%) |

|---|---|---|---|---|---|

| Extra small | 4,300 | 34 | 0.8 | 1,498 | 53.5 |

| Small | 9,446 | 1,145 | 13.8 | 1,678 | 21.6 |

| Medium | 17,261 | -712 | -4 | 2,626 | 17.9 |

| Large | 61,310 | 2,535 | 4.3 | 2,327 | 3.9 |

| Very large | 135,080 | 3,662 | 2.8 | 21,622 | 19.1 |

| Extra large | 229,608 | 28,219 | 14 | 73,465 | 47.1 |

| All charities | 457,003 | 34,884 | 8.3 | 103,216 | 29.2 |

Total liabilities

Liabilities represent amounts that a charity owes such as amounts owed to suppliers or creditors and loans.

In 2022, total liabilities increased by 11.5% (or $16.3 billion) to $158 billion. This compared to a growth of 3% in 2021.

The total percentage growth in liabilities (11.5%), outpaced the percentage growth in total assets (8.3%).

Large charities were the only size category to report a decrease in total liabilities. Smaller charities reported the highest percentage increase in total liabilities.

Table 22: Total liabilities by charity size

| Size | Total liabilities ($ million) | Change from previous period ($ million) | Change from previous period (%) | Change over 3 years ($ million) | Change over 3 years (%) |

|---|---|---|---|---|---|

| Extra small | 628 | 124 | 24.6 | 196 | 45.3 |

| Small | 1,281 | 301 | 30.8 | 309 | 31.8 |

| Medium | 2,497 | 341 | 15.8 | 577 | 30.1 |

| Large | 13,574 | -314 | -2.3 | 684 | 5.3 |

| Very large | 46,917 | 1,199 | 2.6 | 7,697 | 19.6 |

| Extra large | 93,125 | 14,672 | 18.7 | 34,804 | 59.7 |

| All charities | 158,022 | 16,323 | 11.5 | 44,268 | 38.9 |

Net assets/liabilities and the asset ratio

Australia’s charity sector reported net assets of approximately $299 billion, an increase of just under $18 billion (6.6%) when compared to the previous year.

The asset ratio is a useful tool to understand net assets: Asset ratio = total assets/total liabilities

A higher asset ratio can indicate that a charity has set aside funds – known as reserves – to help ensure its financial stability and sustainability.

On average, charities continued to hold more assets than liabilities in the 2022 reporting period based on the asset ratio. The Australian charity sector’s overall asset ratio decreased slightly from 3 in 2021 to 2.9 in 2022.

While smaller charities continued to maintain the highest asset ratios, these charities also reported a significant decrease in their asset ratios in comparison to the previous year due to increases in their total liabilities.

For example, the 24.6% increase in extra small charities’ total liabilities between 2021 and 2022 (outlined in Table 22) contributed to a 1.5 point decrease in these charities’ 2022 asset ratio (see Table 23).

Table 23: Net asset/liabilities by charity size

| Charity size | Net assets/ liabilities ($ million) | Change from previous period (%) | Change over 3 years (%) | Asset ratio (average) | Change from previous period asset ratio | Change to asset ratio over 3 years |

|---|---|---|---|---|---|---|

| Extra small | 3,671 | -4 | 55 | 6.8 | -1.5 | 0.4 |

| Small | 8,165 | 11.5 | 20.1 | 7.4 | -1.1 | -0.6 |

| Medium | 14,764 | -6.7 | 16.1 | 6.9 | -1.4 | -0.7 |

| Large | 47,736 | 6.3 | 3.6 | 4.5 | 0.3 | -0.1 |

| Very large | 88,162 | 2.9 | 18.8 | 2.9 | Unchanged | Unchanged |

| Extra large | 136,483 | 11 | 39.5 | 2.5 | -0.1 | -0.2 |

| All charities | 298,982 | 6.6 | 24.6 | 2.9 | -0.1 | -0.2 |

Charities generate revenue from a range of sources, with those sources varying based on charity size and purposes.

Revenue sources

A charity’s size determines the revenue sources it must report on in the Annual Information Statement.

Table 24: Revenue reporting requirements

Information on revenue sources charities must provide in the Annual Information Statement

| Revenue source | Revenue under $500,000 | Revenue of $500,000 or more |

|---|---|---|

| Revenue from government (including grants) | Yes | Yes |

| Revenue from donations and bequests | Yes | Yes |

| Revenue from goods or services | Not mandatory to provide – optional | Yes |

| Revenue from investments | Not mandatory to provide – optional | Yes |

| Other revenue | Yes | Yes |

Note: Revenue from government also includes revenue received under a contract with government to provide specified services.

Small charities had the option to provide information about revenue from investments, and from goods or services, in the 2022 Annual Information Statement.

Some medium sized charities in 2021 may have become small in 2022 due to the revised thresholds that came into force in 2022. To ensure accuracy, some statistics in this section do not have comparative analysis.

Breakdown of charity revenue sources

For the first time since we started recording these figures, revenue from government to charities exceeded $100 billion, growing by 5.6% over the previous year and now totalling $103 billion.

However, the proportion of revenue from government to the sector’s total revenue remained unchanged. In 2022, revenue from government continued to represent 51% of the sector’s revenue.

Larger charities are more reliant than other charities on the government when it comes to funding their purposes.

Revenue from donations and bequests also increased in 2022, reaching $13.9 billion (an increase of $584 million from 2021). Except for extra large charities, charities of all sizes reported an increase in donations and bequests.

The 30 charities (including those that report collectively as groups) that attracted the largest donations and bequests amounts received nearly 20% of all the donations and bequests received by all Australian charities.

A list of these charities has been provided in Appendix 2.

Table 25: Revenue sources by charity size with changes from previous reporting periods

| Charity size | Extra small | Small | Medium | Large | Very large | Extra large | All charities | ||

|---|---|---|---|---|---|---|---|---|---|

| Government (including grants) | $ million | 22 | 177 | 1,115 | 10,095 | 29,828 | 61,443 | 102,680 | |

| % change | -6.6 | -16.5 | -5.8 | 2.4 | 2 | 8.3 | 5.6 | ||

| % change over 3 years | 11.8 | 8.4 | 10.7 | -3.7 | 16.7 | 50.3 | 31.5 | ||

| Donations and bequests | $ million | 90 | 553 | 1,179 | 3,828 | 5,209 | 3,085 | 13,944 | |

| % change | 6.4 | 7.8 | 15.3 | 17.2 | 12.6 | -19.8 | 4.4 | ||

| % change over 3 years | 5.8 | 10 | 24 | 32.6 | 15.5 | 9.2 | 18.6 | ||

| Goods or services | $ million | 50 | 317 | 972 | 6,717 | 23,287 | 34,578 | 65,920 | |

| % change | 9 | 13.5 | See note | 8.1 | 9.5 | 13 | 11.3 | ||

| % change over 3 years | 2.9 | 0.7 | See note | 3.4 | 18.5 | 18.2 | 16.2 | ||

| Investments | $ million | 32 | 153 | 326 | 1,138 | 1,654 | 1,940 | 5,243 | |

| % change | -0.8 | 22.8 | See note | 5.4 | -8 | -37 | -18.1 | ||

| % change over 3 years | -5.3 | 3.5 | See note | -5.6 | -1 | 22.7 | -10.9 | ||

| Other revenue | $ million | 30 | 149 | 306 | 1,369 | 3,140 | 7,902 | 12,896 | |

| % change | 1.6 | -2.8 | See note | -6.7 | -3.6 | -7.3 | -6.2 | ||

| % change over 3 years | -11.6 | -18.6 | See note | -8.8 | -2.6 | -3.8 | -4.4 |

Note: Due to changes in the charity size thresholds in 2022, accurate comparisons for goods or services, investments and other revenue for medium charities cannot be made.

Extra small charities continued to be least reliant on revenue from government. The percentage of charities’ total revenue that came from government generally increased with charity size.

Smaller charities remained most reliant on donations and bequests. For these charities, 40% of their revenue was generated from donations and bequests. In comparison, donations and bequests made up less 3% of extra large charities’ total revenue.

Table 26: Revenue sources as a percentage of total revenue by charity size with changes from previous reporting periods

| Charity size | Extra small | Small | Medium | Large | Very large | Extra large | All charities | ||

|---|---|---|---|---|---|---|---|---|---|

| Government (including grants) | % of total | 10.0 | 13.1 | 28.6 | 43.6 | 47.3 | 56.4 | 51.2 | |

| % change | -1.1 | -3.4 | -3.9 | -1.4 | -1.3 | 1.2 | Unchanged | ||

| % change over 3 years | 0.9 | 0.7 | 0.4 | -2.8 | 0.5 | 7.6 | 4.1 | ||

| Donations and bequests | % of total | 40.1 | 41.1 | 30.2 | 16.5 | 8.3 | 2.8 | 6.9 | |

| % change | 1 | 1 | 2.1 | 1.6 | 0.6 | -0.9 | -0.1 | ||

| % change over 3 years | 1.7 | 2.7 | 3.6 | 3.7 | Unchanged | -0.5 | -0.1 | ||

| Goods or services | % of total | 22.3 | 23.5 | 24.9 | 29 | 36.9 | 31.7 | 32.8 | |

| % change | 1.1 | 1.7 | See note | 0.6 | 1.6 | 2 | 1.7 | ||

| % change over 3 years | 0.3 | -0.5 | See note | 0.2 | 0.9 | -3.2 | -1.3 | ||

| Investments | % of total | 14.3 | 11.3 | 8.4 | 4.9 | 2.6 | 1.8 | 2.6 | |

| % change | -0.7 | 1.6 | See note | Unchanged | -0.4 | -1.2 | -0.8 | ||

| % change over 3 years | -1 | 0.1 | See note | -0.4 | -0.4 | -1.2 | -0.9 | ||

| Other revenue | % of total | 13.3 | 11.0 | 7.9 | 5.9 | 5 | 7.3 | 6.4 | |

| % change | -0.3 | -0.9 | See note | -0.8 | -0.4 | -1 | -0.8 | ||

| % change over 3 years | -1.9 | -2.9 | See note | -0.7 | -0.9 | -2.6 | -1.7 |

Note: Due to changes in the charity size thresholds in 2022, accurate comparisons for goods or services, investments and other revenue for medium charities cannot be made.

Charity revenue sources

In 2022, about 41% of charities reported receiving revenue from government, a decrease of 4.2% from the previous period.

More than 70% of charities reported receiving donations and bequests. Nearly 66% of extra small charities reported receiving this type of revenue – a near 11% increase on the previous year.

The proportion of charities that reported receiving revenue from goods or services increased in line with charity size – whereas 36% of extra small charities reported receiving this type of revenue, 88% of extra large charities reported receiving revenue from goods or services.

Table 27: Percentage of charities that reported revenue from different sources by size

| Charity size | Extra small | Small | Medium | Large | Very large | Extra large | All charities | ||

|---|---|---|---|---|---|---|---|---|---|

| Government (including grants) | % of total | 17.2 | 31.3 | 54.6 | 71 | 87.4 | 93.8 | 41.2 | |

| % change | 1.8 | -11.1 | -12.9 | -9.1 | -3.8 | -0.5 | -4.2 | ||

| % change over 3 years | 2.4 | 4.3 | 3.1 | 0.1 | 0.2 | 2.9 | 3.9 | ||

| Donations and bequests | % of total | 65.7 | 74.9 | 74.2 | 69.9 | 67.9 | 78.7 | 70.6 | |

| % change | 10.9 | 0.1 | 0.4 | -0.7 | -1.8 | -0.4 | 4.4 | ||

| % change over 3 years | 9 | 1.1 | 2.3 | -1.7 | -2.0 | -5.6 | 3.8 | ||

| Goods or services | % of total | 36.3 | 49.1 | 63.7 | 76 | 86.1 | 88.4 | 54.4 | |

| % change | 5.6 | 0.4 | See note | -1.1 | -0.7 | 1.5 | 3 | ||

| % change over 3 years | 5.3 | 0.7 | See note | -2.1 | 0.1 | 0.1 | 2.5 | ||

| Investments | % of total | 41.5 | 48.3 | 60.3 | 73.4 | 81.9 | 86.0 | 54.6 | |

| % change | 1.4 | -2 | See note | -2.9 | -3 | -4.9 | -0.4 | ||

| % change over 3 years | 0.7 | -6.2 | See note | -6.6 | -4.9 | -3.8 | -3.4 | ||

| Other revenue | % of total | 39.7 | 46.3 | 56.9 | 70.5 | 81.4 | 86.4 | 52.3 | |

| % change | 3.9 | -1.9 | See note | -3.2 | -2.8 | -0.9 | 0.4 | ||

| % change over 3 years | -0.4 | -5.7 | See note | -4.4 | -2.4 | -1.9 | -2.2 |

Note: Due to changes in the charity size thresholds in 2022, accurate comparisons for goods or services, investments and other revenue for medium charities cannot be made.

Charities use funds to further their charitable purposes. Some assets held by charities may have additional conditions on how they can be used – for example, some grants or gifts must be used for specific purposes.

Charities are a significant employer in Australia. More than half the sector’s expenses are employee-related.

Charities also distributed nearly $12 billion in grants and donations in the 2022 reporting period.

Types of expenses

The type of expenses a charity must report to the ACNC are based on its size.

In the Annual Information Statement, all charities must report the following expenses:

- employee

- grants and donations within Australia

- grants and donations outside Australia

- other (for example, rental expenses, bank charges, utilities).

Charities with revenue in excess of $3 million must also report interest expenses (interest paid by charities on any money they have borrowed).

Employee expenses

In 2022, employee expenses increased by 9.8% to $108 billion. This compared to a 5.4% increase in the previous year. Larger charities experienced a bigger increase in employee expenses – for example, extra large charities reported a 12.7% increase in expenses.

This is likely due to the tight labour market and the 47,000 increase in total employees reported by charities in 2022.

Table 28: Employee expenses by charity size

| Charity size | $ million | Change over previous year ($ million) | % change | Change over 3 years ($ million) | % change over 3 years |

|---|---|---|---|---|---|

| Extra small | 34 | 2 | 4.8 | 2 | 6.1 |

| Small | 304 | -1 | -0.2 | Unchanged | -0.2 |

| Medium | 1,536 | 78* | 5.3 | 108 | 7.6 |

| Large | 11,545 | 694 | 6.4 | 77 | 0.7 |

| Very large | 34,140 | 2,021 | 6.3 | 4,918 | 16.8 |

| Extra large | 60,466 | 6,834 | 12.7 | 17,034 | 39.2 |

| All charities | 108,025 | 9,628 | 9.8 | 22,138 | 25.8 |

* As part of our quality assurance when analysing data for this edition of the Charities Report, we identified a reporting error made by a charity. We have removed this outlier when comparing 2022 data with 2021.

Grants and donations

Some charities, such as ancillary funds and trusts, are primarily established to deliver structured philanthropy and focus solely on distributing grants and donations to other charities and charitable causes. For other charities, distributing grants and donations is only one element of their operations.

In the 2022 reporting period, charities reported spending $11.7 billion on grants and donations, an increase of 21% on the previous reporting period.

The increase was largely driven by grants and donations within Australia. Grants and donations within Australia increased by about $2 billion (26%) to $9.5 billion. In comparison, grants and donations outside Australia increased by 2.8% to $2.3 billion.

While the overall sector reported an increase in total grants and donations within or outside Australia, extra small charities reported a decrease in grants and donations within Australia. Similarly, extra small, large and extra large charities reported a decrease in grants and donations outside Australia.

Charities reported spending an average of $217,000 on grants to others within Australia compared to an average of $51,000 for grants to others outside Australia.

Table 29: Expenses on grants and donations by charity size

| Charity size | Within Australia | Outside Australia | Total | ||||||

|---|---|---|---|---|---|---|---|---|---|

$ million | % change | % change over 3 years | $ million | % change | % change over 3 years | $ million | % change | % change over 3 years | |

| Extra small | 130 | -11.3 | 37.0 | 16 | -8.1 | 20 | 146 | -11 | 34.8 |

| Small | 257 | 5.4 | 7.4 | 63 | 9.2 | 23.2 | 320 | 6.1 | 10.1 |

| Medium | 470 | 14 | 10 | 121 | 13 | 34.9 | 591 | 13.8 | 14.4 |

| Large | 1,711 | 17.1 | 20.6 | 538 | -10.7 | 56.6 | 2,249 | 9 | 27.7 |

| Very large | 2,618 | 8.5 | 34.6 | 907 | 15.7 | 22.1 | 3,524 | 10.3 | 31.1 |

| Extra large | 4,303 | 51.3 | 41.3 | 607 | -2.3 | 7.8 | 4,910 | 41.7 | 36 |

| All charities | 9,489 | 26.2 | 32.3 | 2,252 | 2.8 | 24.9 | 11,741 | 20.9 | 30.8 |

Table 30: Average expenses on grants and donations by charity size

| Charity size | Within Australia | Outside Australia | Total | ||||||

|---|---|---|---|---|---|---|---|---|---|

$ | % change | % change over 3 years | $ | % change | % change over 3 years | $ | % change | % change over 3 years | |

| Extra small | 8,135 | -13.3 | 25.9 | 1,024 | -10.1 | 10.3 | 9,159 | -11 | 34.8 |

| Small | 23,771 | -2.4 | 3 | 5,784 | 1.1 | 18.1 | 29,555 | -1.7 | 5.6 |

| Medium | 62,290 | 5.2 | -0.2 | 16,078 | 4.3 | 22.4 | 78,368 | 13.8 | 14.4 |

| Large | 245,409 | 11.5 | 15.6 | 77,232 | -15 | 50 | 322,641 | 9 | 27.7 |

| Very large | 1,143,659 | 4.5 | 20.5 | 396,093 | 11.5 | 9.4 | 1,539,752 | 10.3 | 31.1 |

| Extra large | 16,679,599 | 43.1 | 7.9 | 2,352,282 | -7.6 | 17.7 | 19,031,811 | 41.7 | 36 |

| All charities | 216,533 | 19.9 | 23.2 | 51,394 | -2.2 | 16.3 | 267,927 | 20.9 | 30.8 |

Interest and other expenses

‘Interest expenses’ details the interest paid by charities on any money they have borrowed. Charities with revenue in excess of $3 million (some large and all very large and extra large charities) are required to report on interest expenses. Extra small, small and medium charities do not report interest expenses in the Annual Information Statement.

‘Other expenses’ includes all expenses other than employee expenses, and grants and donations, made in and outside Australia. For extra small, small and medium charities, interest expenses are included within ‘other expenses’.

Other expenses includes expenses such as rent, insurance, bank charges, consultancy fees, cost of goods sold, equipment hire, depreciation, fundraising expenses, utilities and other administration.

In 2022, interest expenses soared by around 16% to $1.7 billion.

Table 31: Interest and other expenses by charity size

| Charity size | Interest expenses | Other expenses | ||||

|---|---|---|---|---|---|---|

$ million | % change | % change over 3 years | $ million | % change | % change over 3 years | |

| Extra small | – | – | – | 188 | -0.1 | 6.0 |

| Small | – | – | – | 695 | 11.7 | 1.1 |

| Medium | – | – | – | 1,589* | 22.5 | 12.5 |

| Large | 90 | See note | See note | 8,184 | 19.6 | 3.3 |

| Very large | 494 | 9.1 | 2.3 | 21,879 | 14.1 | 14.9 |

| Extra large | 1,128 | 24.2 | 130.2 | 41,844 | 15.6 | 29.2 |

| All charities | 1,711 | 15.8 | 52.4 | 74,380 | 15.6 | 20.7 |

* As part of our quality assurance when analysing data for this edition of the Charities Report, we identified a reporting error made by a charity in 2021. We have removed this outlier when comparing 2022 data with 2021.

Note: Due to changes in the charity size thresholds in 2022, accurate comparisons for large charities cannot be made.

Breakdown of types of charity expenses

Extra small, small and medium charities do not report interest expenses separately in the Annual Information Statement. For these charities, interest expenses should be reported as part of other expenses.

Employee-related expenses were the largest charity expense reported, accounting for 55.2% of total expenses.

The percentage of employee expenses to overall expenses were greatest for larger charities.

Extra small charities reported only 9% of expenses going towards covering employee costs, which is unsurprising given that 88% of these charities are volunteer-based.

For extra small charities, ‘other expenses’ (which can include interest expenses) represented the largest expense type as a proportion of their overall expenses.

Table 32: Charity expenses as a percentage of total expenses by charity size

Extra small | Small | Medium | Large | Very large | Extra large | All charities | ||

|---|---|---|---|---|---|---|---|---|

| Employee expenses | % | 9.3 | 23.1 | 41.4 | 52.5 | 56.9 | 55.8 | 55.2 |

| % change | 0.8 | -1.8 | -2.8 | -2.1 | -1.6 | -1.1 | -1.3 | |

| % change over 3 years | -0.8 | -0.7 | -1.2 | -1.3 | Unchanged | 1.5 | 0.7 | |

| Interest expenses | % | – | – | – | 0.4 | 0.8 | 1 | 0.9 |

| % change | – | – | – | See note | Unchanged | 0.1 | Unchanged | |

| % change over 3 years | – | – | – | See note | -0.1 | 0.4 | 0.2 | |

| Grants and donations within Australia | % | 35.2 | 19.5 | 12.6 | 7.8 | 4.4 | 4 | 4.8 |

| % change | -2.7 | -0.4 | 2.9 | 0.4 | Unchanged | 1 | 0.6 | |

| % change over 3 years | 5.5 | 0.8 | -0.1 | 1.1 | 0.6 | 0.2 | 0.3 | |

| Grants and donations outside Australia | % | 4.4 | 4.7 | 3.3 | 2.4 | 1.5 | 0.6 | 1.2 |

| % change | -0.2 | 0.1 | 0.7 | -0.6 | 0.1 | -0.1 | -0.1 | |

| % change over 3 years | 0.2 | 0.8 | 0.6 | 0.8 | 0.1 | -0.1 | Unchanged | |

| Other expenses | % | 51.1 | 52.7 | 42.8 | 37.2 | 36.4 | 38.6 | 38 |

| % change | 2.1 | 2.0 | -0.8 | 2.8 | 1.5 | 0.2 | 0.9 | |

| % change over 3 years | -4.8 | -0.9 | 0.7 | Unchanged | -0.6 | -1.9 | -1.1 | |

Note: Due to changes in the charity size thresholds in 2022, accurate comparisons for large charities cannot be made.

To find out more about charity revenue and expenditure visit our Charity Data Explorer.

A charity subtype is a category of registration that reflects a charity’s particular purposes. A charity’s purpose is the reason it has been set up, or what its activities work towards achieving.

Our analysis of charity subtypes provides an insight into the subsectors that make up the charity sector. We can learn more about the composition of these subsectors, the financial patterns within them, and how they compare with other subsectors.

The Australian Charities and Not-for-profits Commission Act 2012 (Cth) sets out 14 charity subtypes. These include the 12 charitable purposes set out in the Charities Act 2013 (Cth), as well as the categories of Public Benevolent Institution and Health Promotion Charity.

- Advancing health (health)

- Advancing education (education)

- Advancing social or public welfare (social welfare)

- Advancing religion (religion)

- Advancing culture (culture)

- Promoting reconciliation, mutual respect and tolerance between groups of individuals that are in Australia (reconciliation)

- Promoting or protecting human rights (human rights)

- Advancing the security or safety of Australia or the Australian public (security)

- Preventing or relieving the suffering of animals (animals)

- Advancing the natural environment (environment)

- Any other purpose beneficial to the general public that may reasonably be regarded as analogous to, or within the spirit of, any of the purposes mentioned in the subtypes above (other)

- Promoting or opposing a change to any matter established by law, policy or practice in the Commonwealth, a state, a territory or another country (law)

- Public Benevolent Institution (PBI)

- Health Promotion Charity (HPC)

Charities can either be registered with multiple subtypes or can choose not to be registered with any subtype.

In addition to the 14 charity subtypes, our analysis includes two extra categories:

- charities registered with more than one subtype – for example, a charity with two subtypes is included in this category rather than in the two separate categories of its two subtypes

- charities with no registered subtype.

Basic Religious Charities that did not provide financial information were not included in this analysis, as were charities that reported as a group.

The analysis of each subtype in this report is limited to charities registered solely with that single subtype.

If a charity has more than one subtype, analysis will only be included in the ‘Multiple’ category. Because of this, each subtype analysis in this report is not a complete picture of the subtype as a whole.

About 30% of charities that submitted a 2022 Annual Information Statement were registered with more than one subtype.

Table 33: Number of charities registered by subtype and charity size

| Subtype category | Extra small | Small | Medium | Large | Very large | Extra large | Total | ||

|---|---|---|---|---|---|---|---|---|---|

Number | Change from previous year | Change from 3 years earlier | |||||||

| Health | 403 | 172 | 72 | 66 | 17 | 1 | 731 | 45 | 53 |

| Education | 2,065 | 1,296 | 1,196 | 1,056 | 492 | 53 | 6,158 | 95 | 1 |

| Social welfare | 762 | 368 | 240 | 182 | 21 | – | 1,573 | 74 | 119 |

| Religion | 2,009 | 2,481 | 1,216 | 423 | 42 | 7 | 6,178 | 314 | 611 |

| Culture | 764 | 383 | 261 | 169 | 33 | – | 1,610 | 174 | 327 |

| Reconciliation | 26 | 16 | 14 | 6 | – | – | 62 | 2 | 4 |

| Human rights | 17 | 12 | 5 | 5 | 1 | – | 40 | 2 | 2 |

| Security | 79 | 34 | 14 | 16 | – | – | 143 | 19 | -15 |

| Animals | 259 | 251 | 72 | 24 | 12 | – | 618 | 39 | 105 |