Each year, charities must submit an annual return to the ACNC – the Annual Information Statement. Alongside their Annual Information Statements, medium and large charities must also submit an annual financial report (AFR), which must comply with the ACNC’s requirements for financial reports.

The ACNC also promotes the voluntary disclosure of information of interest to stakeholders in AFRs, for example through the ACNC’s annual financial report disclosures – best practice guide.

The Annual Information Statement asks charities for both financial and non-financial information. We use the information from the Annual Information Statement to:

- populate the ACNC Charity Register

- ensure charities are complying with their obligations

- add data to ACNC datasets at data.gov.au

- facilitate the use of the Charity Passport, which allows us to share necessary information with other government agencies.

The Charity Register is integral to maintaining and enhancing public trust and confidence in the sector by allowing the public to view information about registered charities. The Charity Register also promotes sector transparency and accountability.

We have reviewed the quality and accuracy of charities’ Annual Information Statements and AFRs since 2015. This review saw us also examine reporting of related party transactions and key management personnel compensation disclosures in AFRs, both of which have been identified by users of financial statements as an important aspect of demonstrating transparency and accountability.

Our examination of these disclosures aimed to understand compliance levels where they are mandatory; and identify the level of voluntary disclosure where they are not mandatory.

In reporting review findings we aim to:

- improve the quality and accuracy of information published on the Charity Register

- improve future iterations of the Annual Information Statement

- identify trends and errors in financial reporting, and

- improve guidance on financial reporting.

Our reviews also inform us when we consider changes to the financial reporting framework.

Following our most recent review, we:

- updated our annual financial report checklist to help charities meet financial reporting requirements,

- updated our Standards and Financial Reporting guidance

- held additional webinars on financial reporting

- shared findings in relevant forums, podcasts and presentations to promote reporting compliance.

| Acronym | Full term |

|---|---|

| AASB | Australian Accounting Standards Board |

| ACNC Act | Australian Charities and Not-for-profits Commission Act 2012 (Cth) |

| ACNC Regulation | Australian Charities and Not-for-profits Commission Regulation 2013 (Cth) |

| AFR | Annual financial report |

| GPFS | General Purpose Financial Statements |

| GPFS-RDR | General Purpose Financial Statements – Reduced Disclosure Requirement |

| GPFS-SDR | General Purpose Financial Statements – Simplified Disclosure Requirement |

| SPFS | Special Purpose Financial Statements |

Selection methodology

We selected a random sample of 250 Annual Information Statements and AFRs submitted for the 2021 reporting period for full review.

Charities have different reporting dates depending on their financial year end date and the 2021 reporting period refers to 2021 Annual Information Statements submitted between July 2021 and December 2022.

What we checked for

Our review aimed to ensure:

- each AFR contained a complete set of financial statements:

- statement of profit or loss and other comprehensive income

- statement of financial position

- statement of cash flows

- statement of changes in equity (where required)

- notes to the financial statements

- a signed audit or review report

- a signed Responsible Persons’ declaration.

- charities had not made a material financial error when completing the financial information section of their 2021 Annual Information Statements. We specifically focused on revenue from government, donations and bequests, total revenue, employee expenses, total expenses and net assets.

- charities correctly reported the type of financial report they prepared in their Annual Information Statements.

- charities complied with the minimum accounting standards as set out in the Australian Charities and Not-for-profits Commission Regulation 2013 (Cth) (the ACNC Regulation), including the recognition and measurement disclosure requirements for SPFS in AASB 1054 Australian Additional Disclosures; and the disclosure of the nature of expenses required in AASB 101 Presentation of Financial Statements.

- Annual Information Statements did not include any financial information for non-registered entities in consolidated groups. The ACNC does allow parent entity charities that are reporting individually to the ACNC to submit consolidated financial statements (in accordance with AASB 10). However, the financial information in an individual charity’s Annual Information Statement must relate only to the parent entity.

We also recorded compliance with AASB 124 Related Party Disclosures, mandatory for charities preparing General Purpose Financial Statements (GPFS) (if relevant); and voluntary disclosures under this Australian Accounting Standard by preparers of Special Purpose Financial Statements (SPFS).

Of the Annual Information Statements and AFRs we selected for full review; we made the following observations:

Improvements compared to the previous year

- 79% of the AFRs reviewed correctly identified the Australian Charities and Not-for-profits Commission Act 2012 (Cth) (the ACNC Act) as the relevant reporting framework, an increase of 8% compared to the previous year.

- 86% of auditor’s or reviewer’s reports made the required reference to the ACNC Act compared to 79% in 2020 and 70% in 2019.

- 97% of charities attached a Responsible Persons' declaration with their AFR, a percentage that mirrored 2020 levels.

- 74% of 2021 AFR’s reviewed contained a complete set of financial statements, an improvement from 66% in 2020.

- 91% of Responsible Persons' declarations attached to AFRs in the 2021 reporting year were correctly signed and dated, compared to 89% in 2020. Of these attached reports, 81% of charities mentioned compliance with the ACNC Act, reflecting significant improvement from 66% in 2020.

- In the 2021 review, less than 1% of the Responsible Persons’ declarations did not contain the solvency declaration – which states that a charity is able to pay all its debts when due and payable. This was an improvement on the 2020 figure of 5%.

Observations across years

- The accuracy of the type of financial report selected in the Annual Information Statement continues to decrease. Only 57% of charities correctly selected the type of AFR in 2021, down from 65% in 2020.

- In the 2021 Annual Information Statement, 97% of charities correctly identified whether they had provided a consolidated financial report for multiple entities, a slight drop from 98% in the previous year.

- 15% of charities incorrectly reported expenses using a mixture of nature and function in 2021, compared to 23% in 2020 and 16% in 2019.

- Similar to the figures in last year’s reviews, only a small number of charities provided incorrect financial information in their Annual Information Statement from their AFR. In 2021 the largest errors were for ‘revenue from government’ and ‘employee expenses’ which were both incorrectly transposed from the AFR to the Annual Information Statement in 4% of reviews completed.

- In the 2021 reporting year, 98% of charities attached an auditor’s or reviewer’s report, compared to 91% in the previous year. This figure represents the strongest result since the AFR review process commenced.

- Of these reports, 94% were signed and dated, and 89% complied with the new auditing standards, both slightly lower results than 2020.

- Most of the common disclosure issues identified in 2020 were also present in the 2021 review, including insufficient or no disclosure of:

- whether the entity was a for-profit or not-for-profit for financial reporting purposes

- the accounting estimates and judgements management had made in the application of the charity’s accounting policies, and

- the fees paid to the auditor/reviewer of the financial statements.

- 10% of assurance reports provided contained a modified opinion. Of these, 54% did not accurately report that modification in their Annual Information Statement.

New observations

- Of the charities required to disclose related party transactions, only 3% of those reviewed failed to do so. However, disclosure of key management personnel compensation was not provided in 14% of the applicable charities’ GPFS.

- 5% of charities in our sample had prepared General Purpose Financial Statements – Simplified Disclosure Requirements (GPFS-SDR), adopting AASB 1060 General Purpose Financial Statements – Simplified Disclosures for For-Profit and Not-for-Profit Tier 2 Entities before it officially replaced the General Purpose Financial Statements – Reduced Disclosure Requirements (GPFS-RDR) framework for reporting periods from 1 July 2021.

- Audit reports were provided in a greater number of AFRs examined (98%) indicating a trend away from review reports being provided as a form of assurance.

We reviewed 250 AFRs submitted by medium and large charities, with three of those from charities that report to the ACNC as part of reporting groups.

A breakdown of sampled charities by size:

| Charity size | Percentage |

|---|---|

| Large (total revenue $1 million or more) | 72% |

| Medium (total revenue $250,000 to $999,999) | 28% |

The average total revenue and assets of the AFRs we reviewed:

| Average total revenue | Average total assets | |

|---|---|---|

| Medium | $733,175 | $3,042,965 |

| Large | $25,234,009 | $54,192,434 |

A breakdown of the types of financial statements submitted by medium and large charities that we reviewed:

| Type of financial report reviewed | Medium charity | Large charity |

|---|---|---|

| SPFS | 67% | 59% |

| GPFS-RDR | 20% | 29% |

| GPFS-SDR | 3% | 5% |

| GPFS | 10% | 7% |

Overall, 61% of the financial statements we reviewed were SPFS. 27% were GPFS-RDR; 5% were GPFS-SDR and 7% were GPFS.

Breakdown of financial reports reviewed by charity location:

| State or territory | Percentage |

|---|---|

| New South Wales | 32% |

| Victoria | 27% |

| Queensland | 15% |

| Western Australia | 11% |

| South Australia | 9% |

| Australian Capital Territory | 2% |

| Tasmania | 3% |

| Northern Territory | 1% |

Breakdown of financial reports reviewed by charity legal structure:

| Charity legal structure | Percentage |

|---|---|

| Incorporated association | 46% |

| Company limited by guarantee | 38% |

| Other unincorporated association | 2% |

| Trust | 10% |

| Company limited by shares | 1% |

| Other | 3% |

Selecting the correct type of financial statements

57% of charities correctly selected the type of financial statements they had prepared in their Annual Information Statement, compared with 65% the previous year.

Of the charities that selected the incorrect type of financial statements, 53% prepared SPFS but stated they had prepared GPFS, GPFS-RDR or GPFS-SDR. The next most common type of financial statement incorrectly selected was from preparers of GFPS-RDR.

Transposing financial information from AFRs to Annual Information Statements

The Annual Information Statement requires charities to complete a summary income statement and balance sheet to cover specific financial data elements. We compared the financial information in charities’ AFRs with the financial information in their Annual Information Statements to check the accuracy of data transposition.

These comparisons covered:

- revenue from government including grants

- revenue from donations/bequests

- total revenue

- employee expenses

- total expenses

- net assets/liabilities.

Comparison of information in charities’ Annual Information Statements and AFRs:

| Annual Information Statement matched to AFR | Revenue from government | Revenue from donations / bequests | Total revenue | Employee expenses | Total expenses | Net assets / liabilities |

|---|---|---|---|---|---|---|

| Correctly transposed | 78% | 85% | 84% | 78% | 85% | 91% |

| Immaterial error | 18% | 12% | 13% | 18% | 12% | 8% |

| Incorrectly transposed | 4% | 3% | 3% | 4% | 3% | 1% |

These results reflect an improvement in the accuracy of information transposed from the AFR to the Annual Information Statement since the ACNC first started reviewing charities’ AFRs.

Identifying consolidated financial statements

- Charities that control one or more other entities (as a parent charity with at least one subsidiary) may be required to present consolidated financial statements in accordance with AASB 10 Consolidated Financial Statements.

For parent charities reporting to the ACNC as a single charity, we will accept a consolidated AFR. However, the financial information the charity provides in its Annual Information Statement must relate only to that single charity, not the financial information of its consolidated group.

- Charities may also be approved to report to the ACNC as a group, and to do so they provide the ACNC with a consolidated group AFR. These consolidated or combined financial statements can include information relating to non-ACNC registered entities. However, the financial information provided in the Annual Information Statement must only relate to registered charities who are approved to report as an ACNC group.

Of all the AFRs we reviewed, 6% (16) were consolidated AFRs and 94% were single-charity AFRs.

Our reviews found that 97% of charities correctly answered the consolidated question in their Annual Information Statement. Of the seven charities who incorrectly answered this question:

- 29% provided consolidated reports but answered that they had not (two charities).

- 71% had not provided consolidated reports but answered that they had (five charities).

We identified errors in the Annual Information Statement figures for 25% of charities that did submit a consolidated AFR. In these cases, the charities incorrectly provided income statement and balance sheet figures for the entire consolidated group rather than financial information for the single charity submitting the Annual Information Statement.

Providing complete sets of financial statements

Charities’ 2021 AFRs had to comply with AASB 101 Presentation of Financial Statements, unless they were eligible to participate in an ACNC transitional reporting or streamlined transitional reporting relief arrangement.

AASB 101 specifies that a complete set of financial statements comprises:

- a statement of profit or loss statement and other comprehensive income (this can be presented as a single statement or in separate statements)

- a statement of financial position

- a statement of changes in equity

- a statement of cash flows, and

- the notes to the financial statements.

Of the charities required to comply with all ACNC reporting requirements, 74% submitted a complete set of financial statements.

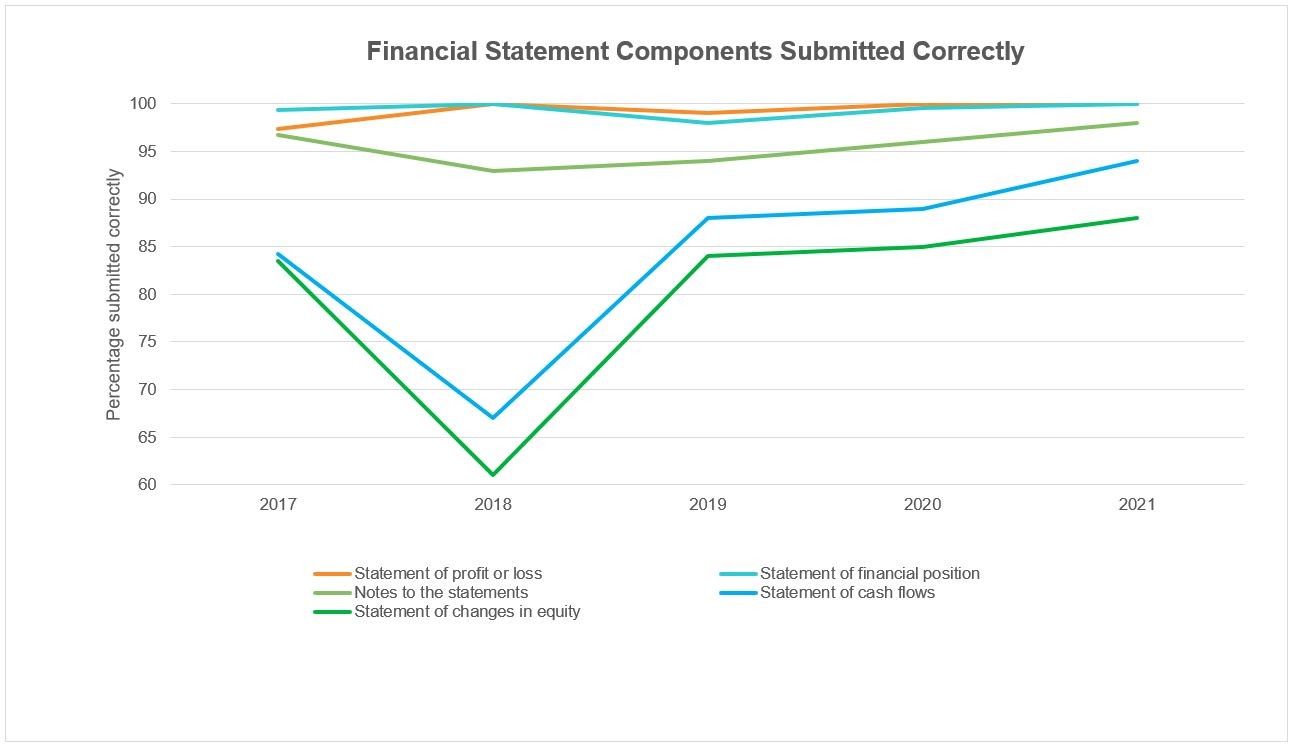

This represents an increase from the 66% that submitted a complete and correct set of financial statements in 2020, and helps arrest a decline for this review item that had occurred since 2017.

This trend towards improvement can also be seen in relation to the percentage of charities that correctly submitted each of the required statements and the notes.

| Financial statement component | Percentage submitted correctly in 2021 |

|---|---|

| Statement of profit or loss | 100% |

| Statement of financial position | 100% |

| Notes to the statements | 98% |

| Statement of cash flows | 94% |

| Statement of changes in equity | 88% |

| Statement of other comprehensive income | 76% |

We noted that if the notes to the financial statements stated that the ACNC Act was the relevant reporting framework, the required statements were also much more likely to be included.

For example, 94% of all financial reports that referenced the ACNC Act included a statement of changes in equity compared to 88% of all financial statements reviewed.

Streamlined reporting arrangements

One of the ways we reduce red tape across the sector is by working to allow charities previously required to report to state and territory regulators to only report to the ACNC.

This occurs through streamlined reporting arrangements.

Previously, where no streamlined arrangement was in place, many incorporated associations and charitable fundraisers that were required to submit financial reports to other state or territory regulators were instead able to submit the same financial report to the ACNC.

We would then accept those reports as meeting ACNC requirements.

However, most of these charities are now able to utilise streamlined reporting arrangements and report directly to the ACNC. The ACNC then shares the information it collects through the Annual Information Statement with other charity regulators.

The financial reports of charities eligible for streamlined reporting arrangements must meet ACNC financial report requirements, including the provision of a full set of financial statements and notes.

Where we have new streamlined reporting arrangements, we provide charities with two years of ‘transitional reporting relief’ before they are required to meet all of our financial reporting requirements.

As part of our review, we examined the financial reports of charities in the sample now eligible for streamlined reporting to determine whether they were meeting ACNC financial report requirements.

Charitable fundraisers

For the 2021 reporting period, charitable fundraisers in Victoria and Western Australia both entered the second year of their transitional relief period. Only two of the charities sampled fell into this category and it was found one of these did not comply with ACNC requirements, failing to provide a statement of other comprehensive income.

Incorporated associations

Charities incorporated in all states of Australia, except Queensland, were required to meet all ACNC reporting requirements for the 2021 AFR.

The table below shows a state and territory breakdown of the percentage of each financial statement included in AFRs by incorporated associations now required to meet ACNC reporting requirements. This analysis is for states and territories where the sample size was two or more.

| Financial statement | % of submission in SA | % of submission in TAS | % of submission in NSW | % of submission in VIC | % of submission in NT | % of submission in WA |

|---|---|---|---|---|---|---|

| Statement of financial position | 100% | 100% | 100% | 100% | 100% | 100% |

| Statement of profit or loss | 100% | 100% | 100% | 100% | 100% | 100% |

| Statement of other comprehensive income | 50% | 100% | 57% | 71% | 0% | 61% |

| Statement of changes in equity | 75% | 100% | 70% | 93% | 50% | 94% |

| Statement of cash flows | 81% | 100% | 80% | 96% | 50% | 94% |

| Notes to the statements | 100% | 100% | 97% | 96% | 100% | 100% |

Note: Submissions from the ACT were not included in this analysis as there was a sample size of one.

Presenting expenses

The accounting standards require a charity to present expenses recognised in its profit or loss statement using a classification based on either:

- their nature, or

- their function within the charity.

Presenting expenses by both nature and function is not permitted, and a charity’s decision on how it presents expenses – either by nature or function – may depend on historical and industry factors, as well as the nature of the charity itself.

Of the charities that submitted an AFR, 46% reported expenses using the nature of expense method, while 39% used the function of expense method. The remaining 15% of charities incorrectly reported using a mixture of nature and function of expenses.

Where charities did present expenses by function in their AFRs, 96% made the required separate disclosure regarding depreciation, amortisation and employee expenses (or did not need to do so). This compared favourably to the 83% that did so in 2020.

Types of AFRs prepared by charities

The type of AFRs medium and large charities prepare depends on whether the charity is a reporting entity.

Charities that are reporting entities

If a charity is a reporting entity, it must submit GPFS that comply with all applicable Australian Accounting Standards. The accounting standards issued by the AASB include standards for recognition, measurement and disclosure requirements.

When preparing GPFS for the 2021 reporting period, charities could choose to prepare either:

- full GFPS

- GPFS – Reduced Disclosure Requirements (RDR), or

- GPFS – Simplified Disclosure Requirements (SDR) (applying AASB 1060 General Purpose Financial Statements – Simplified Disclosures for For-Profit and Not-for-Profit Tier 2 Entities).

Our review found that 5% of charities reviewed prepared a GPFS-SDR. Of these, 83% incorrectly selected their financial statement type in their Annual Information Statement.

Charities that are not reporting entities

If a charity is not a reporting entity, it may prepare Special Purpose Financial Statements (SPFS). These statements must meet the minimum reporting requirements set out in the ACNC Regulation. In this year’s sample, we found that 61% of the financial statements provided by charities were SPFS.

Observations of whether financial statements included in our reviews met selected GPFS and SPFS disclosure requirements are provided in the table below:

| Financial report checks | Applicable Australian Accounting Standard | GPFS | GPFS-RDR | GPFS – SDR | |||

|---|---|---|---|---|---|---|---|

| Yes | No | Yes | No | Yes | No | ||

| Disclosure of significant accounting policies | AASB 101.117 | 89% | 11% | 100% | 0% | 100% | 0% |

| Disclosure of appropriate accounting estimates and judgements management made in the process of applying the charity’s accounting policies | AASB 101.22 and 125 | 74% | 26% | 88% | 12% | 100% | 0% |

| Disclosure for the purpose of preparing the financial statements, whether it is a for-profit or not-for-profit entity | AASB 1054.8(b) | 79% | 21% | 88% | 12% | 100% | 0% |

| The statutory basis under which the financial reports were prepared referenced the ACNC Act | AASB 1054.8 | 68% | 32% | 88% | 12% | 91% | 9% |

| Disclosure of fees to each auditor or reviewer of the financial statements (optional for those who prepare of GPFS-RDR) | AASB 1054.10 | 68% | 32% | 59% | Not mandatory | 91% | 9% |

| Disclosure note on related party disclosures (mandatory for GPFS) | AASB 124 | 89% | 11% | 100% | 0% | 100% | 0% |

| Disclosure of key management personnel compensation (mandatory for GPFS) | AASB 124.17 | 89% | 11% | 89% | 11% | 82% | 18% |

| Detailed disclosure of related party transactions (mandatory for GPFS) | AASB 124.18 and 19 | 73% | 27% | 54% | 46% | 80% | 20% |

| Financial report checks | Applicable Australian Accounting Standard | SPFS | All financial statement types | ||

|---|---|---|---|---|---|

| Yes | No | Yes | No | ||

| Disclosure of significant accounting policies | AASB 101.117 | 95% | 5% | 96% | 4% |

| Disclosure of appropriate accounting estimates and judgements management made in the process of applying the charity’s accounting policies | AASB 101.22 and 125 | 45% | 55% | 61% | 39% |

| Disclosure for the purpose of preparing the financial statements, whether it is a for-profit or not-for-profit entity | AASB 1054.8(b) | 60% | 40% | 71% | 29% |

| The statutory basis under which the financial reports were prepared referenced the ACNC Act | AASB 1054.8 | 75% | 25% | 79% | 21% |

| Disclosure of fees to each auditor or reviewer of the financial statements (optional for those who prepare of GPFS-RDR) | AASB 1054.10 | 57% | 43% | 71% | 29% |

| Disclosure note on related party disclosures (mandatory for GPFS) | AASB 124 | 24% | Not mandatory | 99% | 1% |

| Disclosure of key management personnel compensation (mandatory for GPFS) | AASB 124.17 | 8% | Not mandatory | 90% | 10% |

| Detailed disclosure of related party transactions (mandatory for GPFS) | AASB 124.18 and 19 | 65% | Not mandatory | 61% | 1% |

A significant percentage of charities that prepared GPFS (26%) and SPFS (55%) did not clearly provide disclosures of appropriate accounting estimates and judgements made when applying the charity’s accounting policies.

Similarly, a high number of the charities that prepared GPFS (21%) and SPFS (40%) also lacked a disclosure about the charity being a for-profit or not-for-profit entity for the purposes of preparing financial statements. However, these figures were an improvement on the corresponding figures (50% and 54% respectively) recorded in 2020.

11% of GPFS did not include disclosures of key management personnel remuneration or related party transactions as required by AASB 124. This was a reduction from 29% and 20% respectively in 2020.

In addition, we found that the notes for the basis of preparation often did not disclose that the statutory basis for the financial report was the ACNC Act. However, our review shows improvement in relation to this disclosure compared to last year (79% in 2021 compared to 71% in 2020).

While it is not mandatory for SPFS to provide related party disclosures, our review found that 24% provided a disclosure note of some kind regarding related party transactions. This figure was largely consistent with 2020 (23%).

Further, of those who prepared SPFS:

- 8% voluntarily reported remuneration to key management personnel, and

- 65% who disclosed related party transactions in their AFR also provided a disclosure note disclosing the nature of relationship, amount of transactions and any outstanding balances within the charity.

The accounting standard AASB 1054 requires charities to provide a disclosure note disclosing fees to their auditor or reviewer of the financial statements (optional for those who prepared GPFS-RDR).

Only 68% of GPFS disclosed their fees to their auditor or reviewer, while only 57% of charities who prepared SPFS did so.

Application of new recognition and measurement requirements of AASB 1054

New disclosure requirements regarding compliance with the recognition and measurement requirements under AASB 1054 Additional Australian Disclosures applied from the 2020 reporting period for charities preparing SPFS.

We noted that 54% of charities preparing SPFS included some sort of disclosure note regarding compliance with the recognition and measurement requirements.

Disclosure notes confirming compliance with the recognition and measurement requirements of all relevant accounting standards were the most observed note of this type.

Auditor/reviewer report requirements

Medium-sized charities can have their financial report either reviewed or audited. Large charities must have their financial report audited.

98% of the AFRs we examined had an auditor’s or reviewer’s report attached. Of the AFRs with an auditor or reviewer report attached:

- 98% had an auditor's report attached, and

- 2% had a reviewer’s report attached (91% of medium charities in the sample had their financial report audited, 9% had it reviewed).

Of the audit reports examined, 89% complied with the new auditing standards and 94% of them were signed.

Excluding charities using transitional reporting arrangements, 86% of auditor/reviewer reports reviewed provided an opinion about whether the AFR complied with the ACNC Act.

10% of charities’ auditor/reviewer reports contained a modified opinion/conclusion. The most common modification to the opinion related to cash donations received. This is common in the not-for-profit sector due to difficulties for auditors and reviewers in gathering sufficient evidence about the completeness of the income received from cash donations; that is, an impracticability to establish control over the collection of cash donations.

Only 8% of charities’ auditor/reviewer reports contained an emphasis of matter other than the basis of accounting being SPFS.

A common emphasis of matter observed continued to be uncertainties and impacts from the COVID-19 pandemic.

Responsible People’s declaration

Of the AFRs we reviewed, 97% included a Responsible People’s declaration.

Of the Responsible People’s declarations provided, 91% were signed and more than 99% included the required statement about whether the charity was able to pay all its debts when they became due and payable.

For the charities that did not use transitional reporting arrangements, 81% included the required statement about whether the financial statements and notes satisfy the requirements of the ACNC Act, which represents a significant improvement from 2020 (66%).

The ACNC will continue to review charities’ AFRs to ensure compliance with ACNC reporting requirements and to confirm the financial information charities provide in their Annual Information Statements matches the information in their AFRs.

We will enhance monitoring of related party transactions and key management personnel disclosures as this reporting is set to become mandatory in the Annual Information Statement for all reporters from 2022 (key management personnel) and 2023 (related party transactions).

We will continue to update ACNC reporting guidance and our AFR checklist to help charities meet their reporting obligations, particularly the new key management personnel remuneration and related party transactions reporting requirements which apply from the 2022 and 2023 Annual Information Statement respectively.

We will also continue to conduct webinars on financial reporting matters.

In past AFR reviews, the sample of charities each year was not a random sample because it included specifically selected charities (for example, charities who had previously been subject to compliance action, had a transitional reporting arrangement in place, or had previous material errors).

For 2020 and 2021, the charities selected were a random sample of 250 medium and large charities. A random sample was chosen so that conclusions could be drawn about financial reports from the wider population of medium and large charities.

Due to the alternative sampling approach, caution is recommended before attempting to draw some conclusions based on results over time.