The Australian Charities Report 2017 is the fifth annual analysis of the information we receive from charities in their Annual Information Statements.

Download Annual Information Statement data, and other ACNC data, by visiting our section on data.gov.au.

For previous editions of the Australian Charities Report, see ACNC Reports.

Key findings

- Total revenue of $146.1 billion

- Government grants as a revenue source increased by $7 billion

- Donations and bequests as a revenue source totalled $9.9 billion

- 3.3 million volunteers across Australia’s charities

- Most registered charities (36%) are ‘extra small’, a subset of small

- 30% of charities reported their main activity was religious activities

- 4,567 charities operate overseas

- The most common overseas operating locations include:

- India

- Philippines

- Papua New Guinea

- Indonesia

- New Zealand

I am pleased to present the Australian Charities Report 2017 — the ACNC’s analysis of the information we receive from charities in their Annual Information Statements.

This year’s report is a more succinct summary of the key facts and figures, including the total income and expenses of charities, where they operate, who they help and what they do.

If you are in search of more in-depth information, you can also explore the data on our website at acnc.gov.au/charitydata.

There are now more than 57,500 charities registered with the ACNC. The Australian Charities Report 2017 analyses the Annual Information Statements of approximately 47,000 charities — those that were submitted by 13 February 2019. While we are publishing the 2017 report in 2019, this is in fact the most up to date information available to the ACNC. The data analysed in this report is drawn from the 2017 Annual Information Statement; the 2018 Annual Information Statement, by comparison, is not yet due for many charities.

This edition of the Australian Charities Report supports many of the findings from previous years:

- Most charities are small — with annual revenue of less than $250,000 (65%)

- The most common activity is religion (30%)

- The geographic distribution of charities aligns with Australia’s population, with New South Wales, Victoria and Queensland, in that order, being home to the majority

- And just under half of all charities (49%) are operated solely by volunteers.

We have noted significant changes in some measures, for example:

- Donations and bequests made to registered charities were $9.9 billion, a decrease of $600 million

- Total combined revenue increased from $143 billion in 2016 to $146 billion

- Government funds to charities increased by $7 billion

- Total combined employee expenses decreased to $74.8 billion, down from $75.4 billion in 2016

- 400,000 more people volunteered for a registered charity.

This is the fifth annual Australian Charities Report the ACNC has published. All previous editions can be found on our website.

If you would like any further information about this report, or ACNC data in general, please contact us at research@acnc.gov.au.

Best wishes

The Hon Dr Gary Johns

ACNC Commissioner

As part of their mandatory reporting requirements, registered charities must submit an Annual Information Statement to the ACNC every year. The only exception is corporations registered with the Office of the Registrar of Indigenous Corporations.

This report is based on the data from approximately 47,000 2017 Annual Information Statements, including those withheld from the ACNC Charity Register, submitted before 13 February 2019.

This report follows the Australian Charities Report 20161 (Charities Report 2016), and highlights the breadth and diversity of Australia’s registered charities.

The Annual Information Statement involves questions for charities on a range of financial and non-financial information.

Generally, all charities must submit their Annual Information Statement within six months from the end of their reporting period. The two most common reporting periods are:

- a regular financial year (1 July to 30 June)

- a calendar year (1 January to 31 December).

A Basic Religious Charity is a registered charity with the subtype of advancing religion and which meets five other requirements. Basic Religious Charities do not have to answer financial questions in the Annual Information Statement, or submit annual financial reports to us, although they may do this voluntarily.

METHODOLOGY, DATA AND LIMITATIONS

This report only includes data from submitted 2017 Annual Information Statements. No estimated or proxy data is used. This is a different approach to the 2016 Charities Report, where other data or estimated data was used when the 2016 Annual Information Statement data was not available.

Although we have a comprehensive process for reviewing as much charity data as possible, there may be errors in the data used for this report.

Where possible, this report includes financial information:

- reported by Basic Religious Charities

- from charities that did not conduct activities (for example, the charity may still have received revenue from investments for the 2017 reporting period).

In this report, we will indicate when we have excluded information from Basic Religious Charities or charities that were not operating.

There may be slight rounding errors in this report (for example, totals that add up to 99.9% rather than 100%).

CHARITIES THAT REPORT AS A GROUP

In some situations, such as when one charity controls one or more charities, we can allow a group of registered charities to submit one Annual Information Statement. These are referred to as group Annual Information Statements.

We received 241 group 2017 Annual Information Statements on behalf of 1,195 registered charities. For the purposes of this report, each reporting group is treated as a single charity.

ACCESSING 2017 ANNUAL INFORMATION STATEMENT DATA

Our interactive datacube

We have published a datacube for the 2017 Annual Information Statement. This datacube only includes publicly available information. It allows you to filter the data based on a range of different criteria.

You can access the datacube at acnc.gov.au/charitydata.

Additionally, the 2017 Annual Information Statement dataset (which excludes charities that have information withheld from the Charity Register) is available at data.gov.au.

Questions

If you have any questions about this report, please contact us at research@acnc.gov.au.

Australian charities

A charity’s financial reporting obligations to the ACNC depend on whether it is a small, medium or large charity.

The size of a charity is based on its total annual revenue for the relevant reporting period:

Small charities have annual revenue of under $250,000

Medium charities have annual revenue of $250,000 or more but under $1 million

Large charities have annual revenue of $1 million or more

Based on 2017 Annual Information Statement submissions (excluding charities that did not operate in the 2017 reporting period):

|

65% of charities are small |

|---|---|

|

16% of charities are medium |

|

19% of charities are large |

In this report, we will use the six size categories outlined in Figure 1. These categories are based on total revenue reported by charities and were also used in the Charities Report 2016.

Figure 1 shows the number of charities in each of the six size categories, excluding both charities that did not operate in the 2017 reporting period, and Basic Religious Charities. The figures to the left exclude charities that did not operate in the 2017 reporting period, but include Basic Religious Charities.

Figure 1. Australian charities by size

|

Size |

Total revenue |

% |

|---|---|---|

|

Extra small |

Less than $50,000 |

36.3 |

|

Small |

More than $50,000 but less than $250,000 |

25.2 |

|

Medium |

$250,000 or more but under $1 million |

16.8 |

|

Large |

More than $1 million but less than $10 million |

16.5 |

|

Very large |

More than $10 million but less than $100 million |

4.8 |

|

Extra large |

More than $100 million |

0.4 |

HOW MANY CHARITIES WERE OPERATING?

More than 97.5% of charities were operating in the 2017 reporting period.

Some charities that were not operating were still in their planning phases, others conducted activities under the name of another registered charity.

|

98% of charities were operating in 2017 |

|---|

WHERE ARE THE STREET ADDRESSES FOR CHARITIES?

Where charities provided a postcode for their business address (excluding PO Boxes), nearly 69% were located within the major cities in Australia based on the Australian Statistical Geography Standard (ASGS): Volume 5 — Remoteness Structure, July 20162 .

The remaining 31% of charity street addresses are located outside of major cities, including 2.6% in remote (or very remote) Australia.

Figure 2. Charity street address

|

Location (Remoteness structure) |

% |

|---|---|

|

Major Cities of Australia |

68.9 |

|

Inner Regional Australia |

19.2 |

|

Outer Regional Australia |

9.3 |

|

Remote Australia |

1.8 |

|

Very Remote Australia |

0.8 |

WHERE DO CHARITIES OPERATE IN AUSTRALIA?

Nearly 20% of charities operate in more than one state, territory or country. Nearly 28% of charities operate only in NSW. Only 0.3% of charities operate exclusively overseas.

Figure 3. Where charities operate

|

Jurisdiction |

% |

|---|---|

|

Only ACT |

1.2 |

|

Only NSW |

27.6 |

|

Only NT |

0.8 |

|

Only QLD |

12.5 |

|

Only SA |

6.3 |

|

Only TAS |

2.3 |

|

Only VIC |

20.5 |

|

Only WA |

8.6 |

|

Only international |

0.3 |

|

More than one of the above |

19 |

CHARITIES THAT OPERATE OVERSEAS

Almost 10% of charities (4,567) reported operating in an overseas location. The most common overseas locations include India, Philippines, Papua New Guinea, Indonesia and New Zealand.

|

4,567 charities operated internationally |

|---|

It is important to understand the difference between a charity’s purpose and its activities. All registered charities must have a charitable purpose. This purpose is what the charity has been set up to achieve. A charity’s activities are the things it does to achieve its purpose.

MAIN ACTIVITY

In the Annual Information Statement, charities are asked to select their main activity. By far, the most common main activity selected by charities that operated in the 2017 reporting period was religious activities.

The three most common activities in extra-large charities were higher education, aged care and social services.

By comparison, the three most common activities in extra-small charities were religious activities, social services and grant-making activities.

Figure 4. Most common activities

Figure 5. Least common activities |

Note: These activities are not charitable in isolation, but charities conduct them to help achieve their charitable purpose. |

|---|---|

|

Sports 0.5% |

|

Income support and maintenance 0.5% |

|

Law and legal services 0.4% |

BY SECTOR

Using the categories (or sectors) listed in the International Classification of Not-for-profit organisations, religion is the most common sector for Australian charities. Nearly 20% of charities are in the education and research sector, while almost 11% are in the social services sector.

It is important to note that a charity’s sector is not the same as its activities. For example, a charity that manages a scholarship fund may report that it is in the education sector and that its main activity is grant-making.

Figure 6. Charities by sector

NUMBER OF ACTIVITIES

In addition to reporting their main activity, charities can select other activities that make up a significant part of their work.

Larger charities were more likely to select more activities than smaller charities.

Figure 7. Average number of activities

|

Size |

Average |

|---|---|

|

Extra small |

1.8 |

|

Small |

2.2 |

|

Medium |

2.4 |

|

Large |

2.6 |

|

Very large |

2.7 |

|

Extra large |

3.8 |

|

Average across all charities |

2.1 |

MAIN BENEFICIARIES

In the Annual Information Statement, we asked charities that operated in 2017 to nominate their main beneficiary.

Forty eight per cent of charities reported their main beneficiary as the general community in Australia.

While this was still the most common beneficiary across all charity sizes, the figure represented a significant decrease from the number of charities that reported ‘the general community in Australia’ as their main beneficiary in the Charities Report 2016 (59%). In the 2017 Annual Information Statement, we changed the way that this question was asked in order to get more accurate responses. This likely explains the change.

For charities that did nominate a specific group of beneficiaries as a main activity, the most common were: children, other charities, families and adults.

Figure 8. Most common* beneficiaries of all charities |

|

|---|---|

|

10% Children aged 6 to under 15 |

|

|

5% Other charities |

|

|

4% Families |

|

|

4% Early childhood — children aged under 6 |

|

|

3% Adults aged 65 and over |

|

Figure 9. Most common* beneficiaries of very large charities |

|

|---|---|

| 22% - Children aged 6 to under 15 |

|

| 8% - Adults aged 65 and over |

|

| 8% - People with disabilities |

|

Figure 10. Most common* beneficiaries of extra small charities |

|

|---|---|

| 8% - Children aged 6 to under 15 |

|

| 6% - Other charities |

|

| 4% - Veterans and their families |

|

*Excluding ‘the general community in Australia’

AVERAGE NUMBER OF BENEFICIARIES

After reporting their main beneficiary, charities can select other groups that benefit directly from their work.

Larger charities reported more beneficiary groups than smaller charities.

Figure 11. Average number of beneficiary groups per charity

|

Size |

Average |

|---|---|

|

Extra small |

2.4 |

|

Small |

2.9 |

|

Medium |

3.2 |

|

Large |

3.3 |

|

Very large |

3.6 |

|

Extra large |

3.7 |

|

Average across all charities |

2.8 |

IMPACT OF THE NATIONAL DISABILITY INSURANCE SCHEME (NDIS)

The NDIS will have a large impact on charities that help people with a disability. Already we can see that the number of charities providing NDIS funded support is increasing.

In the 2016 and 2017 Annual Information Statement, charities that selected ‘people with a disability’ as a beneficiary were asked whether:

- the charity provided support and/or services funded by the NDIS

- the charity intended to provide funded support and/or services to participants of the NDIS in the next reporting period.

Figure 12. NDIS funded support provided by charities

Charities that intended to provide services and support funded by the NDIS in the next reporting period

Charities that reported they had provided support and/or services funded by the NDIS

- Almost 20% of charities that selected people with a disability as a beneficiary in the 2016 Annual Information Statement intended to provide NDIS support in the 2017 reporting period.

- Approximately 17% of charities that help people with a disability provided services funded by the NDIS in the 2017 reporting period. A further increase is expected as the NDIS continues to roll out across the country.

Charities were asked to report the number of paid full-time, part-time, and casual employees that worked for the charity during the last pay cycle of the 2017 reporting period. This data represents a snapshot of employment figures at a single time.

Charities employed 1.26 million staff. This figure is slightly lower than the 1.3 million paid staff reported in the Charities Report 2016.

Figure 13. Charity staff employment |

|---|

|

VOLUNTEERS |

|

|---|---|

million |

Volunteer numbers across Australia’s charities increased to 3.3 million people (compared to 2.9 million in the previous year).

It should be noted that this number does not necessarily reflect the total number of volunteers across Australia, as people may volunteer for more than one charity or may volunteer for not-for-profits that are not registered charities.

Large charities reported the most volunteers (1.2 million), followed by extra small charities (around 624,000) and medium charities (approximately 450,000).

CHARITIES THAT OPERATE WITH NO EMPLOYEES

49% of charities operate without any paid staff

For charities engaging in activities, 48.9% of charities operate without any paid staff. This compares with 49.6% in the Charities Report 2016.

Financial status of Australian charities

The information in this section provides a basis for understanding charities in greater detail. This information should not be used in isolation to measure the effectiveness of Australia’s charities.

TOTAL REVENUE FOR THE 2017 REPORTING PERIOD

Revenue forms part of a charity’s income, and relates to the funds received by a charity undertaking its ordinary activities.

These figures include revenue from those Basic Religious Charities that reported financial information. The figures also include charities that did not engage in activities but provided financial information — for example, charities that are not operating may still receive revenue from investments.

Total revenue for the charity sector is $146.1 billion, up from the $142.8 billion cited in the Charities Report 2016.

Figure 14. Revenue |

|

|---|---|

|

Size |

Total revenue |

| Extra small | $218 million |

| Small | $1.3 billion |

| Medium | $3.5 billion |

| Large | $21.4 billion |

| Very large | $48.8 billion |

| Extra large | $70.9 billion |

CHARITIES BY REVENUE

- The top 10 charities by revenue (including reporting groups) accounted for 13.6% of the sector’s entire revenue.

- The top 50 charities accounted for 34.4% of the sector’s revenue.

TOTAL INCOME

A charity’s total income is made up of its total revenue and other income.

Other income relates to funds received that are not part of a charity’s ordinary activities.

Total revenue + other income = total income

Total income for the sector is $149.9 billion, down slightly from the $150.6 billion recorded in 2016.

|

|---|

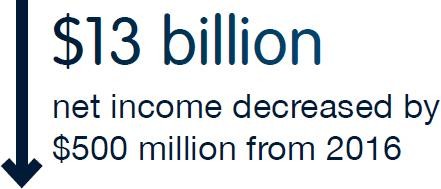

NET INCOME

Net income represents total income minus total expenses.

For the charity sector, total income exceeded total expenses by $13 billion in 2017. In the Charities Report 2016 this figure was $13.5 billion.

|

|---|

Figure 15. Total income

|

Size |

Total income |

|---|---|

|

Extra small |

$288 million |

|

Small |

$1.4 billion |

|

Medium |

$3.7 billion |

|

Large |

$22 billion |

|

Very large |

$49.9 billion |

|

Extra large |

$72.7 billion |

TOTAL EXPENSES

Total expenses remained relatively consistent between 2017 ($136.9 billion) and 2016 ($137.1 billion).

|

|---|

Figure 16. Total expenses

|

Size |

Total expenses |

|---|---|

|

Extra small |

$365 million |

|

Small |

$1.2 billion |

|

Medium |

$3.3 billion |

|

Large |

$20 billion |

|

Very large |

$45 billion |

|

Extra large |

$67 billion |

TOTAL ASSETS

Assets provide future benefits to a charity and include anything of commercial value that is controlled by a charity — examples of assets include stock, buildings and trademarks.

Total assets were $304.6 billion, an increase of $19.8 billion on the figure in the Charities Report 2016.

|

|---|

Figure 17. Total assets

|

Size |

Total assets |

|---|---|

|

Extra small |

$2.8 billion |

|

Small |

$6.9 billion |

|

Medium |

$13.9 billion |

|

Large |

$47.3 billion |

|

Very large |

$103.6 billion |

|

Extra large |

$130 billion |

TOTAL LIABILITIES

Liabilities are generally defined as what a charity owes. They include anything of commercial value that is owed by a charity — such as loans, employee entitlements and bank overdrafts.

Total liabilities were $92 billion, an increase of $4.8 billion compared to the Charities Report 2016.

|

|---|

NET ASSETS/LIABILITIES

Net assets/liabilities represent total assets minus total liabilities.

For the charity sector, net assets were $212.6 billion, a $15 billion increase on the figure recorded in the Charities Report 2016.

|

|---|

Figure 18. Liabilities

|

Size |

Total liabilities |

|---|---|

|

Extra small |

$311 million |

|

Small |

$745 million |

|

Medium |

$1.9 billion |

|

Large |

$11.3 billion |

|

Very large |

$32.8 billion |

|

Extra large |

$44.9 billion |

The revenue elements on which a charity must report are based on its ACNC charity size.

Figure 19. Revenue reporting requirements

|

Are charities required to provide this information? |

||

|

Revenue element |

Extra small and small charities (revenue under $250,000) |

Medium to extra large charities (revenue $250,000 or more) |

|

Revenue from government (including grants) |

Yes |

Yes |

|

Revenue from donations and bequests |

Yes |

Yes |

|

Revenue from goods or services |

No — optional |

Yes |

|

Revenue from investments |

No — optional |

Yes |

|

Other revenue |

Yes |

Yes |

- $68 billion Government funds to charities in 2017

- $61 billion Government funds to charities in 2016

Excluding Basic Religious Charities, and charities that did not operate in the 2017 reporting period:

-

92% of extra large charities receive revenue from government

-

14% of extra small charities receive revenue from government

-

66% of charities receive revenue from donations or bequests

-

46% of charities receive revenue from goods or services

-

52% of charities received revenue from investments

Figure 20 displays a breakdown of each revenue element by amount (where charities have provided revenue.)

Figure 20. Charity revenue sources

Figure 21. Charity revenue sources by percentage

|

Revenue source |

|||||

|

Size |

Government (including grants) |

Donations and bequests |

Goods or services |

Investments |

Other revenue |

|

Extra small |

7.8 |

36.9 |

17.2 |

14.9 |

23.2 |

|

Small |

12.8 |

36.8 |

20.7 |

9.4 |

20.3 |

|

Medium |

29.3 |

25.0 |

25.0 |

8.0 |

12.7 |

|

Large |

47.0 |

12.4 |

26.1 |

4.2 |

10.2 |

|

Very large |

46.0 |

8.2 |

34.3 |

2.5 |

8.9 |

|

Extra large |

48.4 |

2.6 |

33.5 |

3.1 |

12.3 |

- Donations and bequests to charities have decreased by $600 million, from $10.5 billion in the 2016 reporting period to $9.9 billion in the 2017 reporting period.

-

Donations and bequests represent 37% of revenue for small and extra small but only 2.6% of revenue for extra large charities.

EMPLOYEE EXPENSES

Charities spent $74.8 billion on employee expenses, slightly less than the $75.4 billion figure recorded in the Charities Report 2016.

Figure 22. Employee expenses

|

Size |

Employee expenses |

|---|---|

|

Extra small |

$32.3 million |

|

Small |

$314 million |

|

Medium |

$1.4 billion |

|

Large |

$10.9 billion |

|

Very large |

$25.6 billion |

|

Extra large |

$36.6 billion |

GRANTS AND DONATIONS

Grants and donations within Australia decreased by approximately $200 million compared to figures recorded in the Charities Report 2016. Grants and donations outside Australia remained stable.

Approximately 75% of grants and donations were spent within Australia during the 2017 reporting period, a slight decrease on the Charities Report 2016 (76%).

Figure 23. Grants and donations

|

Size |

Within Australia |

Outside Australia |

|---|---|---|

|

Extra small |

$112 million |

$15 million |

|

Small |

$233 million |

$45 million |

|

Medium |

$384 million |

$78 million |

|

Large |

$1.1 billion |

$332 million |

|

Very large |

$1.4 billion |

$723 million |

|

Extra large |

$1.6 billion |

$379 million |

|

Total |

$4.8 billion |

$1.6 billion |