This checklist and guide outline the information your organisation needs to apply for charity registration.

You should read this guide before starting your application – you may need to gather more information or make changes to your organisation prior to registering. Your application may be delayed if required information is incorrect or not provided.

Before you start your application, please read our guidance to understand if your organisation is likely to be eligible for charity registration. When you are ready to start your application, follow our instructions on applying for charity registration in the Charity Portal.

Checklist

You will need the following information to complete your application:

organisation information (including ABN, name, contact details)

legal structure

governing document

details of all Responsible People

date of establishment and requested date of registration

operating locations

activities

charity subtypes

financial and governance information

tax concessions and deductible gift recipient (DGR) endorsement

Registration application guide

For more information about the details you need to provide in your organisation's application, click on the headings below.

In addition to the questions in the application, you can also upload supporting documents, such as a business or strategic plan, agreements with third parties, or other relevant documents you would like the ACNC to consider with your application.

If there is information in your application that should not be made public, you can apply for withholding.

Some questions are only applicable for certain charities, so you may not be asked every question.

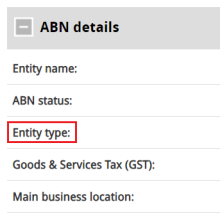

An Australian Business Number (ABN) is a unique 11-digit number that identifies your organisation. You can apply for an ABN on the Australian Business Register (ABR) website.

Each ABN has an associated ‘entity type’.

What you need to provide

- Your organisation's ABN

You need to have an active ABN to apply for charity registration. You cannot apply with a cancelled or inactive ABN.

You cannot apply for charity registration with an ABN that has an ineligible entity type (this includes ‘individual/sole trader’), or with an ABN that is already registered as a charity with the ACNC. Generally, government entities or entities with governmental purposes are not eligible to register as charities.

The entity type associated with your ABN must be consistent with your organisation’s legal structure. You will not be able to complete the application until you correct any differences.

If your organisation had a different ABN in the past, provide it in your application.

More information

You can search your organisation’s ABN on the ACNC Charity Register to see if it is already registered, and check the ABR’s ABN Lookup to see the organisation name and entity type.

If you need to update the name or entity type associated with the ABN, or apply for a new ABN, contact the ABR first, then apply for charity registration once the ABN is active and showing the correct information.

To work out your organisation’s legal structure, you should review its governing document (for example, its constitution, rules or deed). If your organisation is registered with another regulator, you can find out its legal structure by contacting that body.

You may need to seek professional advice if you are still unsure, or if you need help correcting your organisation’s governing document so that it is consistent with your organisation’s legal structure.

Our guidance on legal structures outlines which legal structure corresponds to which ABN entity type.

If the legal structure and entity type are not consistent, you should contact the ABR to correct the entity type before applying to register as a charity. Note that in some circumstances, the ABR may issue your organisation with a new ABN when its entity type is updated. You should apply with the new ABN.

Your organisation’s ‘legal name’ is its formal name as it appears on legal documents, such as a certificate of incorporation, trust deed, or in legislation that establishes the organisation.

What you need to provide

- Your organisation’s legal name (this will prepopulate based on the entity name associated with your organisation’s ABN)

- Other names your organisation is known by

- Previous names of your organisation

More information

Your organisation’s legal name needs to be the same as the name:

- listed for your organisation’s ABN on the Australian Business Register

- shown in your organisation’s governing documents

- registered with other regulators (such as ASIC), if applicable.

If your organisation’s legal name does not prepopulate correctly, please check you have provided the correct ABN. If the ABN is correct, provide the correct legal name for your organisation. Contact the ABR to update the name associated with your organisation’s ABN.

Address For Service

The Address For Service is the address that the ACNC will use to send correspondence to your organisation after it is registered as a charity.

What you need to provide

- Your organisation’s Address For Service email

- Your organisation’s physical Address For Service (optional, unless registered with ASIC)

More information

Because your organisation's Address For Service will appear on the Charity Register, you may not want to use a personal address.

Organisations registered with the Australian Securities and Investments Commission (ASIC) as a company or registrable body must provide its physical address and not a PO Box or Private Bag. Other organisations can choose to provide a physical address.

Organisation contact information

For ACNC purposes, your organisation’s contact information is not the same as its Address For Service.

Your organisation’s contact information is how members of the public can contact your organisation. These details are likely to be the same as those listed on the organisation’s website, or those used in other communications.

What you need to provide

It is optional to provide your organisation’s:

- physical address

- phone number

- email address

- website

- social media pages.

More information

Your organisation’s contact email or physical address can be the same or different to its Address For Service.

Your organisation’s contact details and its Address For Service will appear on its ACNC Charity Register page when registered.

Application contact

This is the person the ACNC will contact if we have queries about this registration application.

You can provide a contact individual or organisation (for example, a law or accountant firm that is submitting on behalf of the organisation).

What you need to provide

For an individual contact person, provide:

- full name

- date of birth

- address

- phone number

- personal email address.

For a contact organisation, provide:

- organisation name and ABN

- contact person at the organisation (provide full name, phone, email).

More information

This information will allow the ACNC to verify the identity of your organisation’s contact person if they contact us.

If you do not provide this information, we may not be able to verify the identity of the contact person and will be unable to discuss the application with them.

If you provide a contact organisation, this information will allow the ACNC to discuss the application with people representing the contact organisation.

All charities have a legal structure – it can be incorporated or unincorporated, and the best structure will depend on several factors, including how the organisation operates.

Your organisation’s legal structure must match the entity type associated with its ABN.

What you need to provide

Select your organisation’s legal structure. You may need to provide extra information depending on the structure of your organisation.

Association incorporated under state or territory law (for example, an incorporated association or some Parents & Citizens associations)

- If your organisation is an incorporated association (meaning it is incorporated under certain legislation, listed below):

- State or territory of incorporation

- Incorporated association number. Your organisation’s incorporation number can be found on its certificate of incorporation.

- If your organisation is not an incorporated association (meaning it is not incorporated under certain legislation, listed below, such as some Parents & Citizens associations):

- Describe how it is incorporated. This may include providing the governing legislation under which your organisation is incorporated.

- Where your organisation was established (Australia or overseas)

- Australian Registered Body Number (ARBN), if applicable

Company (including public or private companies)

- Australian Company Number (ACN)

Trust or fund (including private or public ancillary funds)

- Select the type of trust (private ancillary fund / public ancillary fund / neither)

- If the trustee of the trust or fund is a corporation, provide the ABN of the corporation.

ORIC registered corporations

- Indigenous Corporation Number (ICN). Only entities incorporated under the Corporations (Aboriginal and Torres Strait Islander) Act 2006 (CATSI Act) will have this number.

Co-operative

- Co-operative or organisation number. This is the number that your organisation received once it was registered as a co-operative with the relevant regulator.

Incorporated under another authority (for example, an Act of Parliament, Royal Charter, Letters Patent or foreign corporation)

- Select how your organisation was established:

- Established under an Act of Parliament – provide the full name of the Act

- Established under Royal Charter

- Established under letters patent

- Other – provide further information

- Australian Registered Body Number (ARBN), if applicable

Other

- Provide details of your organisation’s legal structure.

Select ‘Other’ if your organisation’s legal structure does not fall within any of the other options. This includes organisations that are established overseas.

More information

Legal structure and entity type

If the legal structure you select does not match the entity type associated with your organisation’s ABN, you will not be able to continue your application.

If they do not match, ensure that the legal structure you have selected is correct. If the legal structure is correct, you should contact the Australian Business Register (ABR) to correct the entity type before continuing with your application.

You must correct the entity type first, then you can re-apply to the ACNC for charity registration. The ABR may issue you with a new ABN when it updates your organisation’s entity type. If this occurs, you should apply for charity registration with the new ABN.

Entering an incorrect legal structure here will result in delays to your application.

Incorporated associations

Your organisation is an incorporated association if it is incorporated under any of the following statutes. This includes all statutes, subordinate legislation, regulations or instruments amending, re-enacting or replacing them:

- the Associations Incorporation Act 2009 of New South Wales

- the Associations Incorporation Reform Act 2012 of Victoria

- the Associations Incorporation Act 1981 of Queensland

- the Associations Incorporation Act 2015 of Western Australia

- the Associations Incorporation Act 1985 of South Australia

- the Associations Incorporation Act 1964 of Tasmania

- the Associations Incorporation Act 1991 of the Australian Capital Territory

- the Associations Act 2003 of the Northern Territory

- the Associations Incorporation Act 2005 of Norfolk Island.

If your organisation is not registered under one of these Acts, for example, a Parents & Citizens (P&C) association, it is not considered an incorporated association.

Your organisation's governing document is the formal document that sets out its name, its objects and the rules under which it operates.

This document may have different names depending on the type of organisation, but it is commonly called a constitution, rules, articles of association or trust deed.

What you need to provide

- Upload your organisation’s governing document

- Statement of purpose, objects or aims, if not included in the governing document

More information

The governing document should not be a draft, incomplete or redacted version or have unrelated documents attached.

The unredacted version of your organisation’s governing document will be published on the ACNC Charity Register, unless we have approved to withhold it, or it is appropriate to publish a redacted version.

Ensure that your organisation’s governing document includes:

- its legal name

- a statement of purposes, objects or aims

- suitable not-for-profit and winding up clauses, which requires surplus assets to be used for charitable purposes or distributed to another charity

- definitions of the duties and responsibilities of Responsible People and members

- rules and processes that outline how your organisation is governed

If your organisation’s legal structure is a proprietary company (Pty Ltd), ensure its governing document does not permit private benefits to its shareholders or members – such as the sale or transfer of shares for value other than the issue price, or the distribution of profits or dividends.

A Responsible Person is someone who is responsible for governing an organisation (for example, a board member, a committee member or a director of a trustee corporation).

What you need to provide

- Number of Responsible People that your organisation's governing document requires your organisation to have

- Details of all Responsible People:

- full name

- date of birth

- position in organisation and start date

- residential address

- phone number

- email address

- cultural and language diversity (optional)

- Confirmation that Responsible People are not disqualified – for each person, check if they have been disqualified by the ACNC from being a Responsible Person for a charity or disqualified by ASIC from managing a corporation. To search the ASIC register, click ‘Search the banned and disqualified register’. Under the heading ‘Search ASIC Registers’, search within ‘Banned & Disqualified’ for the person’s name.

- If your organisation is applying to backdate its charity registration, confirm that past Responsible People were not disqualified

- If there are any personal relationships between Responsible People and other Responsible People, paid staff, contractors or third parties, or the organisation’s beneficiaries, describe the relationship. For example, two of the Responsible People (provide their names) are family members.

More information

Only the name of each Responsible Person and the position that person holds in your organisation will appear on the ACNC Charity Register, and will be made available to other government agencies through the Charity Passport.

We also request a date of birth and other contact details to identify a Responsible Person if they contact us about the organisation. Providing responses to non-mandatory questions is helpful but optional. The ACNC uses this information to confirm a Responsible Person’s identity for the purposes of administering the ACNC Act, and to continually improve our services.

You can check that your organisation has the appropriate number of Responsible People by checking its governing document or governing legislation, or see our summary of the required minimum number of Responsible People.

If your organisation only has one Responsible Person, your organisation may not be able to meet the ACNC Governance Standards. This may delay your application. You should ensure that the number of Responsible People your organisation has is appropriate to manage its governance. For more information read our Commissioner’s Policy Statement: Number of Responsible People in a registered charity.

Ensure the names of your organisation’s Responsible People are correct and match the names provided to other regulators.

If your organisation is a trust and the trustee is a corporation, provide the names of all the trustee corporation’s directors.

If your organisation’s structure is a co-operative or public company, it must have at least two directors that ordinarily live in Australia.

If your organisation’s structure is a proprietary company, it must have at least one director that ordinarily lives in Australia.

In your application, you choose the date from which you are requesting charity registration.

Registration can only be backdated to the latest of:

- the date your organisation was established

- the date your organisation's ABN became active, or

- 3 December 2012.

What you need to provide

- Date organisation was established

- Requested date of registration

- If backdating registration:

- upload previous copies of your organisation’s governing document (if it has changed)

- upload financial reports for each year from the requested registration date.

More information

The date your organisation was established is:

- incorporated association or company: the date of incorporation or registration as a company

- unincorporated association or trust: the date the organisation's governing document came into effect

- organisations established under legislation: the date the legislation was enacted.

Your organisation’s date of registration with the ACNC will determine when it is entitled to receive Commonwealth tax concessions. If your organisation wants Commonwealth tax concessions from before 3 December 2012, you need to apply for charity registration from 3 December 2012. You can request endorsement for Commonwealth tax concessions from an earlier date in your application.

Your organisation’s operating locations includes the places it:

- undertakes activities (including administrative activities, fundraising, and activities in collaboration with third parties)

- sends funds or other resources (including to third parties).

Charities that operate overseas must comply with the ACNC External Conduct Standards.

What you need to provide

- Operating locations – include all operating locations from the requested date of registration up to intended locations for the next 12 months

- If operating overseas, confirm your organisation’s proposed overseas activities comply with Australian laws on international sanctions

- If your organisation is required to obtain a sanctions permit, upload a copy

- If fundraising, list the locations and provide fundraising licence numbers (if applicable)

More information

Operating locations will be included on the ACNC Charity Register and may be used to identify any regulatory requirements your organisation may have based on the states and territories in which it operates.

Operating overseas is not restricted to activities on the ground in another country – it can include:

- sending funds or other resources overseas

- activities that are only a minor part of your charity's overall work, or involve only a small amount of money (such as sponsoring a child overseas or supporting missionary work)

- working with, or helping, another organisation located overseas.

See our guidance about operating overseas for more information.

Organisations operating in some countries may require a sanctions permit to undertake an activity that would otherwise be prohibited by an Australian sanctions law. See the Department of Foreign Affairs and Trade’s (DFAT) guidance on sanctions permits and sanctions regimes for more information.

See our guidance on External Conduct Standard 1: Activities and control of resources for more information about compliance with Australian laws when operating overseas.

Not all fundraising activities require a fundraising licence. If your organisation doesn’t have a licence or if you are unsure if your organisation needs one, check with your state or territory regulator.

Charity activities are the programs and services that an organisation runs to pursue its charitable purposes for its beneficiaries. Activities can be ongoing or temporary, small or large.

What you need to provide

- List all current activities, and planned activities for the next 12 months. For each activity, provide:

- activity or service name

- explanation of how the activity furthers the organisation’s charitable purpose

- description of the activity

- criteria used to select the beneficiaries for this activity or service

- estimate of time allocated to the activity, as a percentage of time spent on all activities

- estimate of money allocated.

- Select the main group of beneficiaries (who your charity helps)

- If operating overseas:

- select the groups of people your organisation works with overseas

- select how your organisation sends, or will send, money overseas (if applicable)

- provide the names and ABNs of all the organisations that your organisation works with overseas and describe its work with them (if applicable).

Charity subtypes are categories that reflect a charity’s charitable purpose. A charity’s purpose is the reason it has been set up, or what the charity’s activities work towards achieving.

Only apply for subtypes that reflect the purposes of your organisation. Do not apply for subtypes that your organisation does not actively pursue or that are not included as objects or purposes in your organisation's governing document. Choosing subtypes that do not reflect your organisation's purposes will delay your application.

What you need to provide

- Select your organisation’s charity subtypes

More information

Most organisations choose one to three subtypes. You may select more, but it may delay the assessment of your application.

See our guidance about charity subtypes for a definition of each subtype, and examples of the types of charities that can be registered under each one.

For certain charity subtypes, you need to provide additional information to explain how your organisation fits the subtype.

Revenue is what your organisation earns in a year from carrying out its ordinary activities. Your organisation’s annual revenue will determine its charity size once registered.

What you need to provide

- Provide an estimate of your organisation’s revenue for the current financial year

- Describe your organisation's revenue sources for the current financial year

- Describe your organisation's intended revenue sources for the next 24 months

- Provide your organisation's financial year end date

More information

The standard financial year for ACNC reporting ends on 30 June. If your organisation has a different financial year end date, provide the date and the reason why your organisation wants to apply for a reporting period other than 1 July to 30 June.

If your organisation is required to report its financial information to the Commonwealth Department of Education, provide your organisation’s Australian Government Education ID number.

Charities must ensure that they comply with the ACNC Governance Standards and, if operating overseas, the ACNC External Conduct Standards at all times. Basic Religious Charities (BRCs) are exempt from the ACNC Governance Standards.

You can read more in Governance for Good, the ACNC’s guide for charity board members.

What you need to provide

- Information about how your organisation manages conflicts of interest, for example:

- provide the conflict of interest clause number in your governing document

- upload your conflict of interest policy

- explain how your organisation defines and identifies a conflicts of interest, and how it ensures conflicts are disclosed and managed appropriately.

- Information about how your organisation safeguards vulnerable people (if applicable), for example:

- explain how your organisation assesses the suitability of staff, volunteers, contractors, etc. who work with vulnerable people

- list the steps your organisation takes to comply with the laws and reporting requirements for safeguarding vulnerable people

- list other steps your organisation takes to ensure it and other individuals or organisations engaged on its behalf keep vulnerable people safe

- upload your policy on the protection of vulnerable people.

- Information about how your organisation manages its resources, for example:

- upload your policies or procedures for managing financial affairs

- explain how your organisation ensures its Responsible People manage the financial affairs of the organisation in a responsible manner.

- If working with other organisations, describe any other steps your organisation takes to ensure its resources provided to third parties are used for the purpose provided.

- Describe how your organisation is accountable to its members and how members can raise concerns.

If your organisation’s information suggests it may be a Basic Religious Charity, you will be asked questions to determine its eligibility to report as a BRC.

More information

Visit our Governance Hub for more resources, including:

- Governance for good: A guide for Responsible People

- ACNC Governance Standards

- Managing conflicts of interest

- Governance Toolkit: Safeguarding vulnerable people

- Managing charity money: A guide for Responsible People

Charities operating overseas may be exposed to more risk, depending on the nature of their activities, who they help, and where they operate. To better understand potential risks, see the Department of Foreign Affairs and Trade’s (DFAT) guidance about countries, economies and regions, and Transparency International’s corruption perceptions index. These charities also need to comply with the ACNC External Conduct Standards.

You can apply for charity tax concessions from the ATO in the ACNC charity registration application.

What you need to provide

- Select the charity tax concessions you want to apply for, and provide additional information if required

- Income tax exemption: confirm that your organisation complies with its governing document and operates as a not-for-profit; and provide the percentage of your organisation’s activities that are outside Australia

- Fringe benefits tax exemption

- Fringe benefits tax rebate: confirm if your organisation is an institution

- Goods and services tax concessions

- Provide the requested date of endorsement for these tax concessions

More information

The ATO still decides on charity tax concessions, but you can apply in the ACNC registration application. This means that you do not have to complete a separate application with the ATO. Instead, you just need to complete the tax concessions section contained in the ACNC application.

After the ACNC registers your organisation as a charity, we forward the application for tax concessions to the ATO. The ATO then assesses your eligibility for charity tax concessions, and will inform you of the decision.

If you don't apply for charity tax concessions through the ACNC charity registration application, you can apply directly through the ATO at a later date.

Usually, the requested endorsement date is the same as an organisation’s requested date for charity registration (or earlier if the organisation is applying for tax concessions from before the ACNC’s commencement on 3 December 2012).

Organisations that are endorsed as deductible gift recipients (DGRs) are entitled to receive donations that are deductible from the donor's income tax.

It is important to remember that not all charities are eligible for DGR endorsement.

What you need to provide

If your organisation is applying for DGR endorsement:

- Select the type of DGR (Whole Deductible Gift Recipient, or fund, authority or institution your organisation owns or includes)

- Select the DGR item number that applies to your organisation, or the fund, authority or institution

- Provide the requested date of DGR endorsement

- If required, upload your organisation’s DGR schedule

- Confirm if your organisation’s governing document contains a DGR revocation clause, and provide the clause number

- If seeking endorsement for a fund, authority or institution:

- provide its name

- provide its physical address, if different to your organisation’s address

- if it has its own governing document, upload it

- confirm if it maintains a gift fund for its principal purpose

- confirm if all gifts and deductible contributions and related income are deposited into the fund, if the fund receives any other money or property, and your organisation has a gift fund revocation clause (provide the clause number).

More information

If your organisation is already endorsed as a DGR or has submitted an application for DGR endorsement with the ATO or another government department, please do not apply for DGR endorsement in the ACNC application.

From 14 December 2021, all non-government DGRs are required to be a registered charity, or to be operated by a registered charity. This requirement does not apply to ancillary funds or DGRs specifically listed in the tax law. For more information, see the ATO’s guidance on DGR registration.

A charity can apply to have certain information withheld from the public Charity Register.

However, we can only approve applications to have information withheld in limited circumstances.

What you need to provide

- If you want to request information to be withheld from the ACNC Charity Register:

- select the reason for withholding

- select which information you want withheld

- explain how publishing the information fits into the reason for withholding

- describe the steps you have taken to conceal this information from the public

- upload supporting documents, if applicable.

More information

The ACNC Commissioner will agree to withhold details of your organisation from the Charity Register only in very limited circumstances.

You must explain how your request fits within one of the prescribed circumstances for having information withheld as listed in the ACNC Act. If it does not fit within one of these circumstances, your request will be refused.

If we refuse your request, the information will be published on the Charity Register.

The limited reasons for which we can approve an application include:

- publishing the information could endanger public safety

- the information is commercially sensitive and publishing it could cause harm to the charity or a person

- the information is inaccurate, or likely to confuse or mislead, or

- the information is offensive.

For private ancillary funds, there are additional reasons:

- the information is likely to identify an individual donor

- publishing contact details would create an unreasonable administrative burden for the charity.